i INP-WEALTHPK

Muhammad Asad Tahir Bhawana

Natural gas production in Pakistan declined by approximately 6 percent in FY22, contributing around 33 percent to the country's primary energy supply mix compared to 35 percent in the previous year. To compensate for this decrease, Pakistan has increased its reliance on imported Regasified Liquified Natural Gas (RLNG), reports WealthPK. According to a report issued by the Pakistan Credit Rating Agency (PACRA), Pakistan's proven natural gas reserves have been steadily declining due to a lack of significant discoveries.

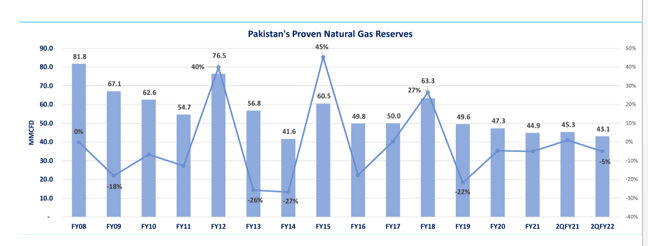

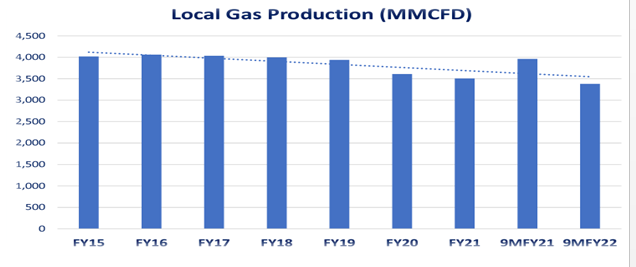

From FY08 to FY21, these reserves have decreased by approximately 45 percent. From 2QFY21 to 2QFY22 alone, the decline in reserves was around 5 percent. The reserves are currently estimated to be around 43.1 million cubic feet per day (MMCFD) as of 2QFY22. Local gas production has also suffered, with a significant reduction during 9MFY22 to approximately 3,376 MMCFD compared to the previous year's 3,960 MMCFD, resulting in a year-on-year decline of approximately 15 percent.

Furthermore, no major discoveries have been announced by local gas exploration firms in the past two years. The largest gas producer in the country is the Oil and Gas Development Company (OGDC), accounting for approximately 25 percent of total gas production, followed by the Pakistan Petroleum Limited (PPL) and Mari Petroleum (Mari) with shares of approximately 22 percent and 19 percent respectively.

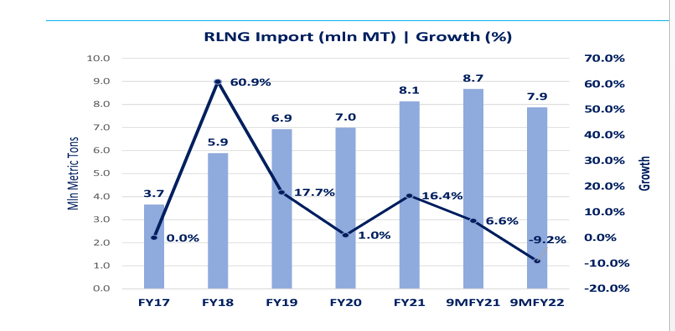

To address the growing energy demand and insufficient local production, Pakistan initiated RLNG imports in FY15. In 9MFY22, RLNG imports decreased by approximately 9.2 percent compared to the previous year. As the demand for energy continues to rise, RLNG imports play a crucial role, compensating for the shortfall caused by the limited domestic capacity. Both PSO and Pakistan LNG hold nearly equal market shares in this context.

Pakistan witnessed a decline of approximately 4.5 percent during 9MFY22 in overall gas consumption compared to the previous year. The transport sector experienced the greatest decline of around 34.3 percent, followed by the general industry sector with a decrease of about 6.5 percent, and the power sector with a decline of approximately 5.8 percent. The power sector remained the highest gas consumer, followed by the household sector. However, the fertilizer sector was an exception, with a rise in consumption of around 1.9 percent due to its inclusion in the gas supply priority list by the federal government. Household consumers resorted to using expensive LPG during gas supply curtailments by the national gas utility corporations.

Moreover, the rising gas circular debt poses a significant threat to the fragile distribution gas sector, with both natural gas and RLNG contributing to the debt. As of March 2022, OGDC and PPL faced receivables of approximately PKR513 billion from the gas utility companies, hindering exploration efforts. Factors such as differential margins, UFG, and gas theft further contribute to the debt. Additionally, the increasing price of LPG, a vital fuel for the poor, is driven by decreasing local production and costly imports due to a devaluing PKR, making sustained price reductions challenging. Forecasts indicate a rise of about 37 percent in LNG imports and a decline of approximately 38 percent in indigenous gas production from FY20 to FY27, suggesting an increased reliance on LNG to compensate for the declining domestic production.

Credit: INP-WealthPk