INP-WealthPk

Jawad Ahmed

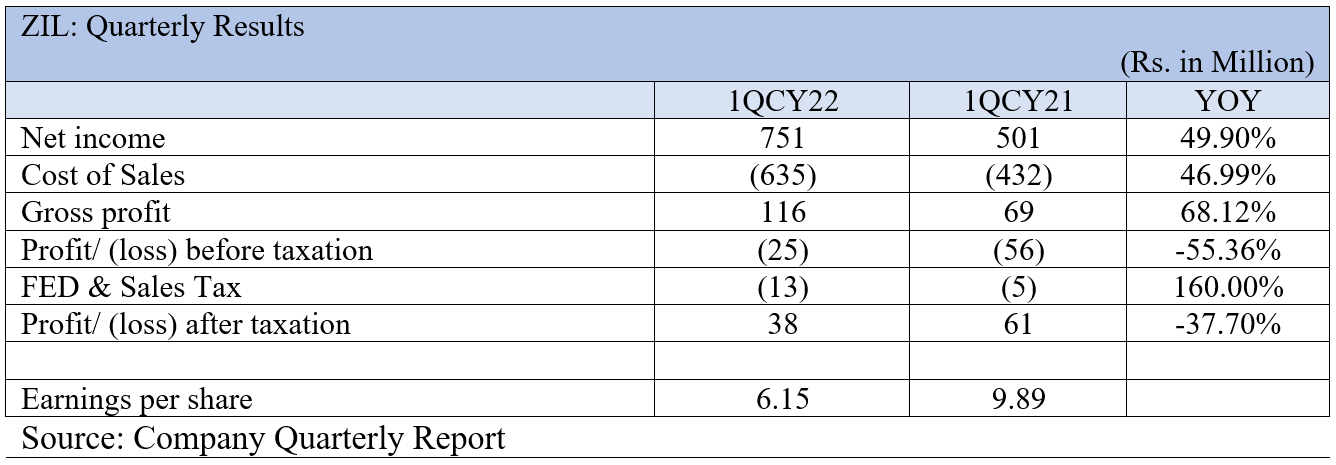

The net sales of ZIL Limited – the producer of food and personal care products – increased by 50% in the first quarter of calendar year 2022 to Rs751 million from Rs501 million in the same period of last year, according to the latest financials filed with the stock exchange.

Despite healthy growth in top-line, tremendous pressure on margins persisted as skyrocketing prices of raw material continued to reduce margins.

This caused the profit-after-tax to fall 37.7% to Rs38 million from Rs61 million in the same period of last year, reports WealthPK, quoting the company’s financial stats.

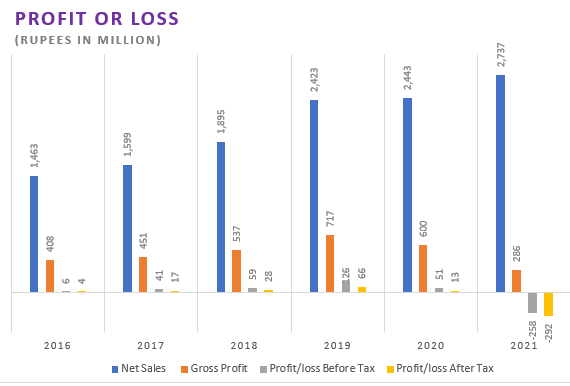

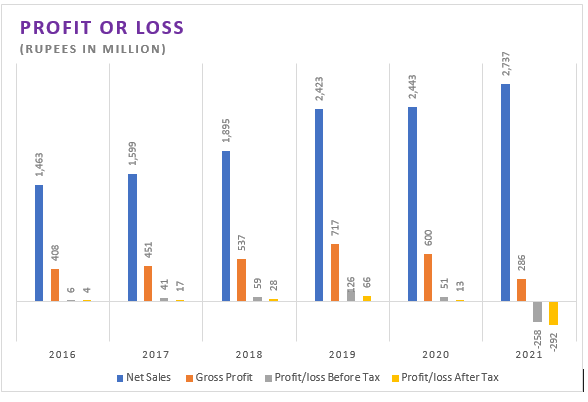

Historical Performance

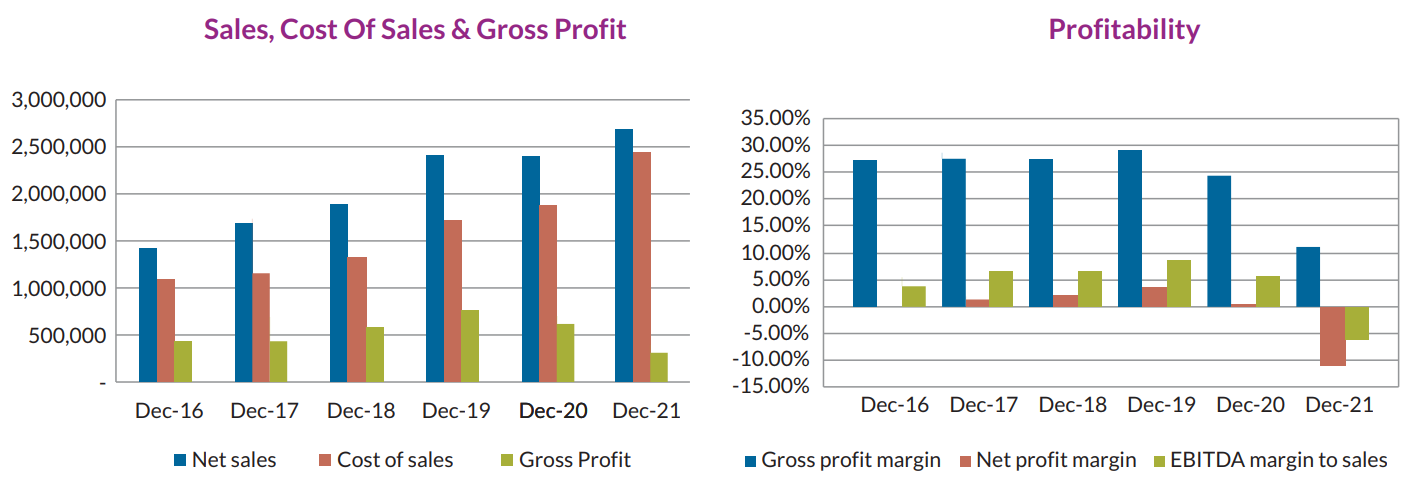

Since the calendar year 2016, the company’s sales revenue has increased, yet its profitability ratios have fluctuated.

In 2018, the company achieved sales of Rs1.89 billion, up 18.5%, from the previous year’s Rs1.6 billion. The increase was mainly caused by an improvement in sales operations and digital marketing.

During the year, gross profit grew by 19% to Rs537 million, and profit-after-tax registered a growth of 64.7% to Rs28 million compared to Rs17 million in 2017.

In 2019, the company’s sales increased by 27.9% to Rs2.42 billion from Rs1.89 billion in 2018, mainly attributable to strong volume growth and selling prices.

The gross profit increased by 33.5% to Rs717 million, and after-tax income increased by 136% to Rs66 million.

In 2020, despite the Covid-19 pandemic and the challenging economic climate, the company was able to maintain its sales revenue and even boosted it by 1% as sales rose to Rs2.44 billion from Rs2.42 billion in 2019.

However, the gross profit declined by 16.3% to Rs600 million, and the net income after payment of taxes fell by 80% to Rs13 million.

In 2021, sales revenue grew by 12% to Rs2.74 billion from Rs2.44 billion in the previous year. Despite the topline growth, the year remained extremely challenging with respect to financial performance.

Due to an unprecedented increase in input costs, gross profit declined to Rs286 million as compared to last year’s Rs600 million.

As the profitability remained under tremendous pressure during the year, the company bore a net loss of Rs292 million compared to a net profit of Rs13 million the year before.