INP-WealthPk

Jawad Ahmed

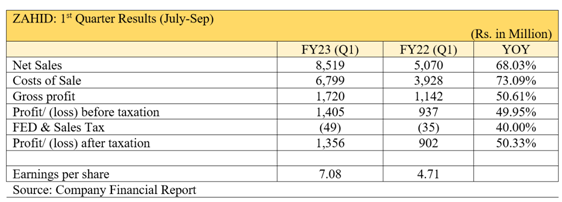

Net sales of Zahidjee Textile Mills Limited increased 68% to Rs8.51 billion in the first quarter (July-Sept) of the ongoing financial year 2022-23 compared with Rs5 billion in the same period of the last fiscal. Despite the economic downturn, the company has been able to achieve considerable growth in terms of sales and profitability compared to previous period, reports WealthPK quoting the company’s financial stats.

Zahidjee Textile Mills Limited was incorporated in Pakistan on July 17, 1990 as a public limited company under the Companies Ordinance, 1984. The principal business of the company is export of all kinds of value-added fabrics and textile made-ups. The company is also engaged in the business of manufacturing and selling yarn.

During the quarter under review, the company reported a gross profit of Rs1.72 billion, up 50.6% from the previous year’s Rs1.14 billion. The profit-before-tax in the FY23’s first quarter stood at Rs1.40 billion compared to Rs937 million during the same period of previous year. The company’s net profitability rose 50.3% to Rs1.35 billion in the first quarter of FY23 from Rs902 million over the same period in FY22. This increase pushed the earnings per share (EPS) to Rs7.08 from Rs4.71 the previous year.

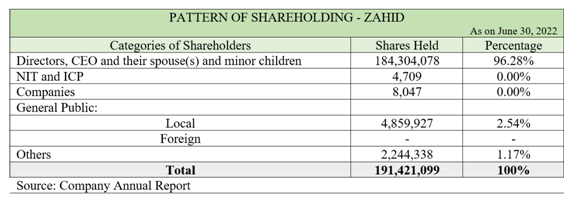

Shareholding pattern

As of June 30, 2022, the company’s directors, the CEO, their spouses and minor children owned 96.28% of the shares. The remaining shares were divided between local investors (2.54%) and ‘others’ (1.17%).

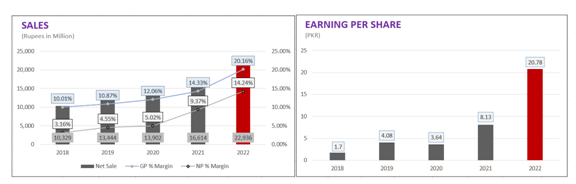

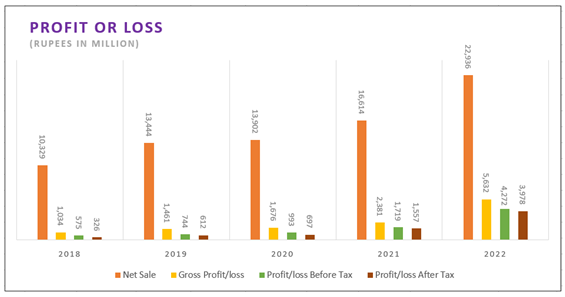

Company’s performance over the years

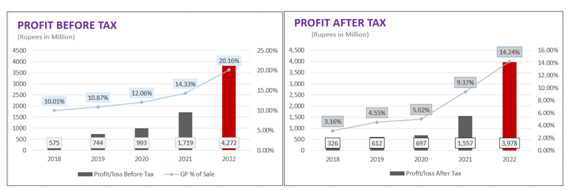

The company managed a slight increase in its revenue in 2020 due to the Covid-19 pandemic and the subsequent difficult economic climate. Sales revenue increased 3.4% to Rs13.9 billion from Rs13.4 billion in 2019. As a result, the business’s gross profit increased from Rs1.46 billion the previous year to Rs1.67 billion this year. During the year, the company reported a net profit of Rs697 million against Rs612 million in 2019. The EPS for the year declined to Rs3.64 from Rs4.08 the previous year.

In 2021, due to an increase in demand for products, the company’s top line increased to Rs16.61 billion from Rs13.90 billion in 2020. The gross profit jumped to Rs2.38 billion from Rs1.67 billion in the previous year, principally because of rising demand and the economy’s rebound after the Covid-19-induced restrictions were lifted. The net profit took a massive leap to Rs1.55 billion from Rs697 million the previous year. As a result, the EPS rose to Rs8.13 from the previous year’s Rs3.64.

In 2022, the company’s sales revenue increased to Rs22.9 billion from Rs16.61 billion in 2021. The company’s gross profit surged to Rs5.63 billion from Rs2.38 billion the previous year, registering a 136% increase year-over-year. The profit-after-tax for the year jumped to Rs3.97 billion, 155% higher than the previous year’s Rs1.55 billion. As a result, the EPS leapfrogged to Rs20.78 in 2021 from Rs8.13 a year before.

Credit: Independent News Pakistan-WealthPk