INP-WealthPk

Fakiha Tariq

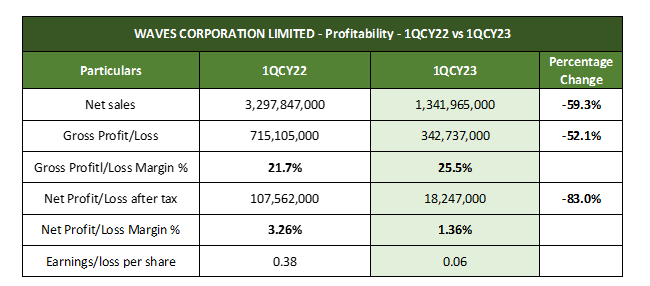

Waves Corporation Limited’s (WAVES) net profit plunged 83% in the first quarter (January-March) of the ongoing calendar year 2023 compared to the corresponding months of last year, reports WealthPK. WAVES’ sales dropped a substantial 59% and gross profit by 52% during the three-month period compared to the same quarter of the last year.

The company ended the 1QCY23 by making gross sales of Rs1.34 billion, earning a gross profit of Rs342 million on them, thus achieving the quarterly gross profit ratio of 25.5%. The home appliance maker’s net profit stood at a minimal Rs18 million and net profit ratio at 1.36% in 1QCY23. WAVES ended 1QCY23 with the earnings per share of Rs0.06 for its shareholders.

WAVES posted a revenue of Rs3.29 billion, a gross profit of Rs715 million, a net profit of Rs107 million and earnings per share of Rs0.38 in 1QCY22. The listed company is the fourth-largest firm registered in the cable and electrical goods sector with a market capitalisation of Rs1.9 billion.

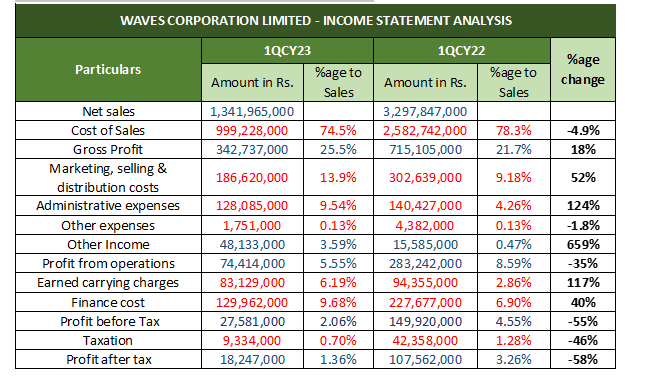

Income Statement Analysis – 1QCY23 vs 1QCY22

During the first quarter of 2023, the company sustained the highest cost of sales, which constituted 74.5%, or Rs999 million, of the total sales. In terms of operating expenses, the company bore the highest cost of marketing, selling and distribution of goods at Rs186 million, or 13.9% of the total sales. The administrative charges stood at Rs128 million, or 9.54% of total sales. The company bore Rs1.7 million, or 0.13%, of total sales under the head of ‘other’ expenses.

However, the company received Rs48 million as other income, adding up 3.59% to the total income, and translating into an operating profit of Rs74.4 million and an operating profit ratio of 5.55%. The company earned Rs83 million as carrying charges, contributing 6.19% to the total sales. However, the finance cost stood at Rs129 million, pushing the sales down by 9.68%. The company reported a profit-before-tax (PBT) of Rs27 million and a PBT ratio of merely 2.06% during 1QCY23. It paid corporate tax of Rs9.3 million, or 0.70% of sales, thus coming up with a net profit of Rs18 million.

An almost 60% decline in revenues year-on-year affected the overall profitability of the firm.

The impact of the cost of sales on the company’s overall revenue was reduced by 4.9% year-on-year. The gross profit margin of 21.7% in 1QCY22 cranked up by 18% in 1QCY23, indicating WAVES performed more efficiently at the gross profit level in the quarter under review. In terms of operating expenses, the company’s head of ‘other’ expenses went down by 1.8%, and reduced sales by 0.13% both in 1QCY23 and 1QCY22. However, the burden of marketing, selling and distribution expenses and administrative expenses increased by 52% and 124%, respectively, in 1QCY23.

The company’s ‘other income’ head grew by a massive 659% year-on-year. The increased operational expenses reduced the operating profit of WAVES by 35% in 1QCY23 compared to 1QCY22. The company’s sales were weighed down by a 117% increase in earned carrying charges and a 40% rise in finance cost in the first quarter of 2023. This reduced the profit-before-tax by 55%. The tax burden on sales was thus reduced by 46% due to low PBT, leading to a 58% reduction in net profit in 1QCY23.

Credit : Independent News Pakistan-WealthPk