INP-WealthPk

Hifsa Raja

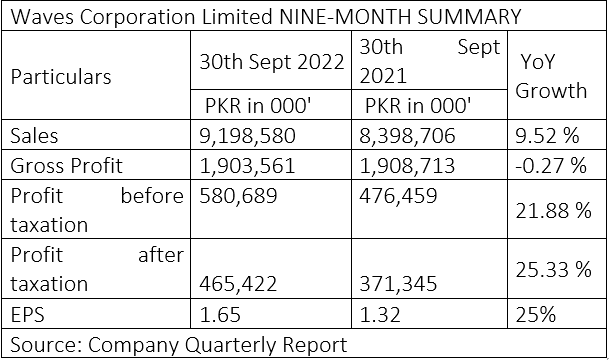

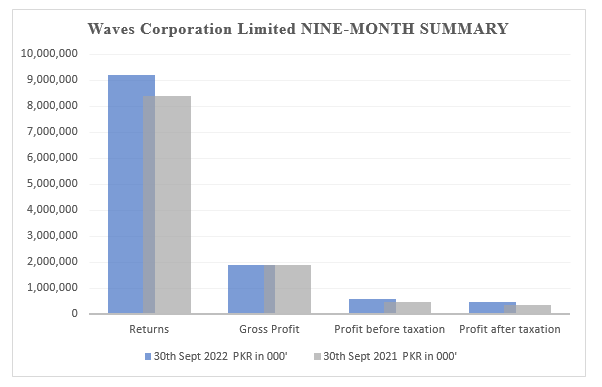

Waves Cooperation Limited’s sales increased 9.52% to Rs9.19 billion in the first nine months of the calendar year 2022 from Rs8.39 billion over the corresponding period of the previous year. The company’s before-tax profit increased 21.88% in 9MCY22 to Rs580 million from Rs476 million in 9MCY21. The post-tax profit also increased 25.33% to Rs465 million in 9MCY22 from Rs371 million over the corresponding period of CY21, reports WealthPK.

Waves Corporation maintains satisfactory inventory levels in view of the current volatile economic conditions in the country. The company is also constructing a new factory to ensure continuity of its operations during the difficult times. Despite rising costs due to rupee devaluation, Waves maintains net margins through strong demand and modest volume growth by passing on costs in selling prices.

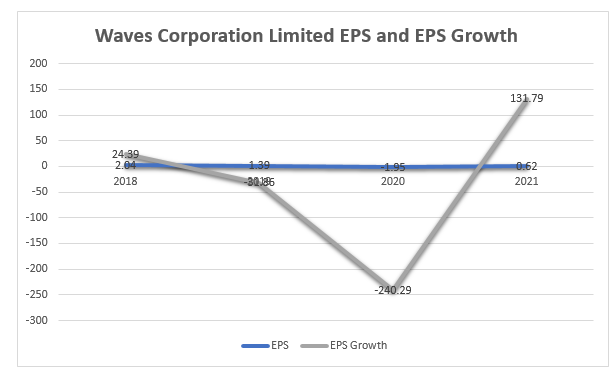

Earnings growth analysis

The company experienced a significant decline in earnings per share in 2020, posting a negative EPS of Rs1.95 compared to the previous two years when the EPS stayed positive, though it continued to decrease. However, the EPS rebounded in 2021 to Rs0.62. The company had a strong EPS growth rate of 24.39% in 2018, but then it declined to -31.86% in 2019, and further plunged to -240.29% in 2020. However, the company experienced a sharp increase in EPS growth as it stood at 131.79% in 2021.

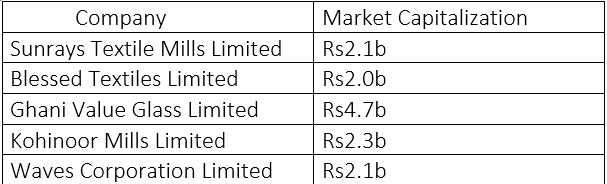

Industry comparison

Sunrays Textile Mills Limited, Blessed Textiles Limited, Ghani Value Glass Limited, and Kohinoor Mills Limited have all been regarded as rivals of Waves Corporation Limited. Market capitalization can be used by investors to compare one company's size to others as it indicates the cost investors are willing to pay for a company's stock. Ghani Value Glass Limited has the highest market capitalization of Rs4.7 billion. With a value of Rs2.1 billion, Waves Corporation Limited has the third-largest market capitalization among its rivals.

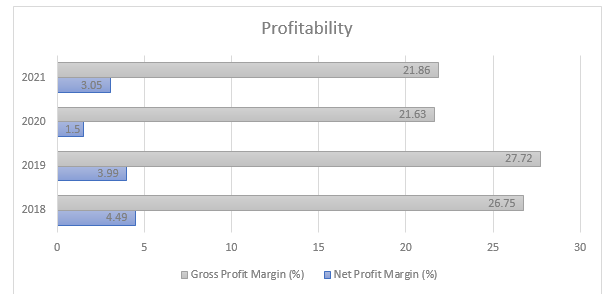

Profitability

Net profit margin has been fluctuating over the past four years, ranging from a high of 4.49% in 2018 to a low of 1.5% in 2020, before rebounding to 3.05% in 2021. This could indicate that the company is experiencing some challenges in managing its expenses or generating revenue, which could negatively impact its ability to grow and return value to shareholders.

On the other hand, the gross profit margin has remained relatively stable, with a range of 21.63% to 27.72% over the same period. This could suggest that the company has been successful in managing its direct costs and maintaining profitability in its sales.

Company profile

Waves Corporation Limited (formerly Waves Singer Pakistan Limited) was incorporated in Pakistan under the repealed Companies Ordinance, 1984 (now Companies Act, 2017) as a public company limited. The company manufactures and assembles consumer appliances and retails and trades them along with other light engineering products.

Credit: Independent News Pakistan-WealthPk