INP-WealthPk

Arsalan Ali

By incorporating value addition into the kaolin industry, Pakistan has a great opportunity to bolster exports and reduce dependence on imports. This, in turn, could lead to the accumulation of foreign reserves, creation of jobs opportunities, and positively impacting the trade account, according to a report of Trade Development Authority of Pakistan (TDAP). The report, a copy of which is available with WealthPK, highlights the presence of substantial reserves of kaolin, commonly known as China clay, in the regions of Nagarparkar, Thar, in Sindh province, Swat in Khyber Pakhtunkhwa province, Salt Range, and Mianwali in Punjab province. The report said that during FY22, Pakistan's kaolin extraction amounted to approximately 16,000 tons. Kaolin mined in Sindh is generally of superior quality when compared to that obtained from Punjab.

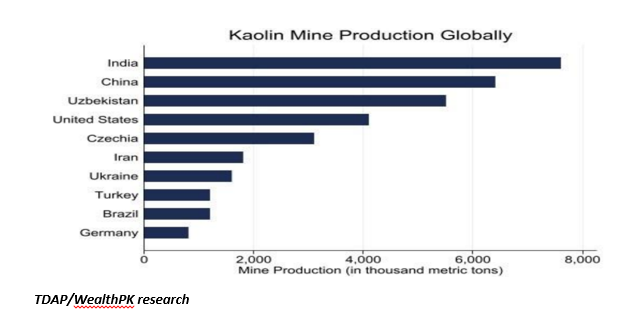

By increasing and implementing strategic investments, the mineral sector can undergo development, leading to value addition in minerals, including kaolin. This will play a pivotal role in boosting exports of kaolin which have extensive applications in industries such as paper, ceramics, paint, rubber, and fiberglass. The projected growth of the global kaolin market indicates that its size is expected to reach around $5.87 billion by 2030, with a forecasted compound annual growth rate (CAGR) of 3.47%. The market demand for kaolin is expected to reach 37.50 million tons in 2027 Pakistan imported kaolin and kaolinic clays worth $11.7 million in 2021, primarily from its largest suppliers, the United States and China. During the year 2022, India emerged as the leading global producer of kaolin, with China, Uzbekistan, the United States, and Czechia also contributing significantly to the production.

According to the report, the leading exporters of kaolin and kaolinic clays are the United States, the United Kingdom, China, and Brazil. On the other hand, Spain, China, Belgium, Germany, and Japan rank among top importers of these products. The current market price for kaolin ore stands at approximately $30 per ton, with a purity level of 60%. However, through value addition and conversion into refined white kaolin, Pakistan can generate significant revenue, as the final product can be sold for up to $350 per ton. Investing in the development and value addition of kaolin holds the potential to create employment opportunities, particularly in Thar and Swat. Furthermore, it is imperative to foster research and development (R&D) efforts aimed at enhancing the processing and refining methodologies of kaolin, thus augmenting its competitiveness in the global market.

Through the establishment of a robust kaolin industry, Pakistan can not only expand its export opportunities, but also make significant contributions to its economic growth. The report emphasises the importance of establishing essential infrastructure, such as roads, bridges, ports, and other facilities, to attract investment in mineral sector. Simplifying and streamlining the legal and regulatory framework is crucial to promote investment and enhance competitiveness within the mineral sector. Furthermore, the report highlights the necessity of investing in human capital development to expand the skilled labour force in the mineral sector. This involves providing training and education programs to workers and fostering R&D initiatives. In order to attract local and foreign investment in the mineral sector, the government should create an investment-friendly environment and provide incentives, said the report.

Credit: INP-WealthPk