INP-WealthPk

Qudsia Bano

Unilever Pakistan Foods, a leading consumer goods company in the country, has recorded strong earnings for the first three months of the ongoing calendar year 2023. The company attributed its success to strategic initiatives, strong brand equity, and effective cost management practices.

The company's ability to adapt to changing market dynamics, capitalise on consumer preferences, and drive growth across all key financial indicators positions it for continued success in the future. The results reflect the company's strong market presence and successful strategic initiatives.

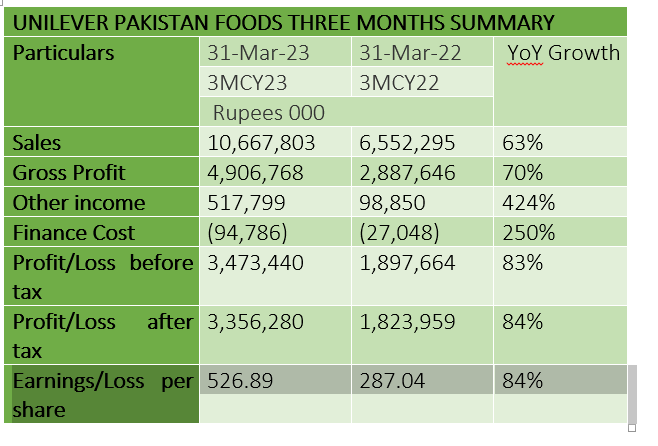

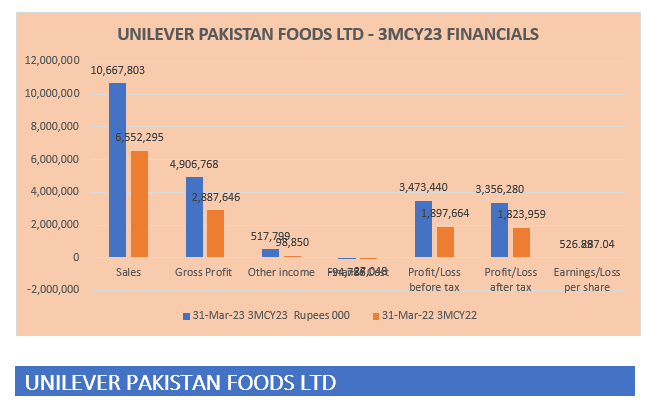

The company's sales for the three-month period ending on March 31, 2023, reached an impressive Rs10.67 billion, a remarkable 63% increase from the same quarter last year. This substantial surge in sales can be attributed to several factors, including increased consumer demand, effective marketing strategies, and successful product launches.

Unilever Pakistan Foods also reported a notable growth in gross profit, which amounted to Rs4.91 billion, showcasing a remarkable 70% increase compared to the first three months of 2022. This significant rise in gross profit reflects the company's ability to manage costs efficiently and optimise its supply chain operations.

In addition to the strong sales and gross profit growth, Unilever Pakistan Foods achieved a substantial boost in its other income, which skyrocketed to Rs517.8 million, representing an outstanding 424% surge compared to the corresponding period last year, highlighting the successful execution of additional revenue streams and diversification efforts.

Furthermore, the company's finance cost decreased by 250% to Rs94.8 million, showcasing a significant improvement in financial management and interest expenses. This reduction in finance costs positively impacted Unilever Pakistan Foods' overall profitability and contributed to its strong financial performance.

Unilever Pakistan Foods' profit-before-tax demonstrated remarkable growth, reaching an impressive Rs3.47 billion, representing an 83% increase compared to the same period in 2022. This significant improvement in pre-tax profit further reinforces the company's ability to generate value and optimise its operations.

Moreover, Unilever Pakistan Foods reported a net profit of Rs3.36 billion for the first three months of 2023, showcasing an exceptional 84% growth compared to the previous year’s same period. This substantial increase in net profit highlights the company's efficiency in managing costs, improving operational performance, and capitalising on favourable market conditions.

Consequently, the company's earnings per share (EPS) for the three-month period ending on March 31, 2023, stood at Rs526.89, reflecting an impressive 84% increase compared to the corresponding period of 2022. This robust growth in EPS signifies the company's ability to generate higher returns for its shareholders and solidifies its position as a market leader in the consumer goods sector.

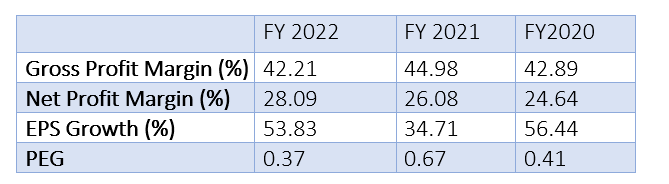

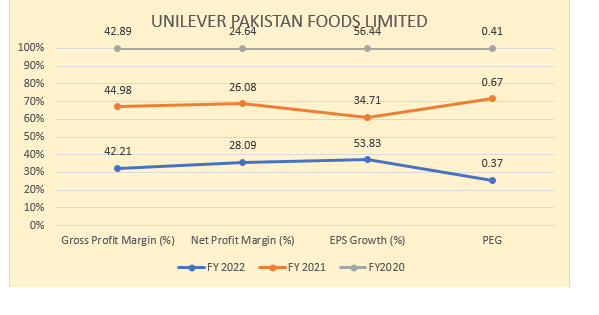

Unilever Pakistan Foods' gross profit margin witnessed a slight decline from 44.98% in FY21 to 42.21% in FY22. However, it remained relatively stable over the three-year period, reflecting the company's ability to maintain a healthy level of profitability in relation to its cost of goods sold. The company has managed to sustain its gross profit margin above 40%, indicating effective cost management and efficient utilisation of resources.

The net profit margin of Unilever Pakistan Foods exhibited a consistent growth trend over the three-year period. It increased from 24.64% in FY20 to 26.08% in FY21 and further rose to 28.09% in FY22. This upward trajectory signifies the company's ability to generate higher profits relative to its total revenue. The company has successfully implemented strategies to improve operational efficiency, control expenses, and maximise profitability.

The consumer goods maker achieved notable growth in EPS over the three-year period. The EPS growth rate rose from 34.71% in FY21 to 53.83% in FY22, indicating a substantial improvement in the company's profitability on a per-share basis. This positive trend reflects effective management of costs, revenue growth, and successful implementation of strategies to drive shareholder value.

The Price/Earnings to Growth (PEG) ratio provides insights into the valuation of a company's stock relative to its earnings growth. Unilever Pakistan Foods' PEG ratio decreased from 0.67 in FY21 to 0.37 in FY22, indicating an attractive valuation in relation to its EPS growth rate. A PEG ratio below 1 suggests that the stock may be undervalued relative to its growth prospects. This indicates that investors may perceive Unilever Pakistan Foods as an appealing investment opportunity, considering the company's strong earnings growth potential.

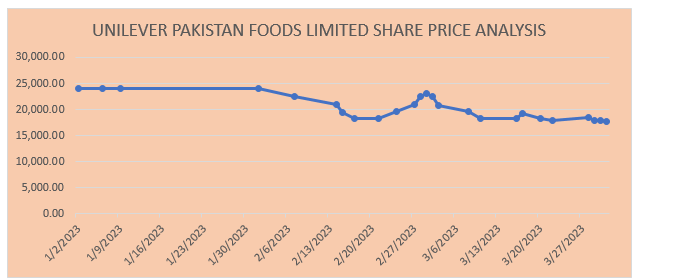

Share price analysis

During the three-month period from January to March 2023, the share price of Unilever Pakistan Foods exhibited a mixed pattern with both fluctuations and stability. Starting the year at Rs24,000, the share price remained relatively stable in January and early February. However, a decline occurred in mid-February, reaching its lowest point at Rs18,210.

Subsequently, the share price witnessed a notable increase on February 24, followed by further gains at the end of the month. March brought fluctuations, with occasional highs and lows, but the share price remained relatively stable overall. It ranged between Rs17,750 and Rs22,998. These fluctuations suggest the market sentiment surrounding Unilever Pakistan Foods' shares was influenced by various factors during the given period.

About the company

Listed on the Pakistan Stock Exchange, the company manufactures and sells consumer and commercial food products under the brand names Rafhan, Knorr, Energile, Glaxose-D and Food Solutions. The company is a subsidiary of Conopco Inc. USA, whereas its ultimate parent company is Unilever PLC United Kingdom.

Credit: INP-WealthPk