INP-WealthPk

Irfan Ahmed

The uncertainty about the International Monetary Fund (IMF) loan programme continued to shake the stock market though it picked slightly in the last week after the political situation in Pakistan started showing signs of normality, WealthPK reports.

The delay in releasing the amount of loan to Pakistan by the IMF also caused a continuous depreciation of the rupee. The disbursement of the $1.7 billion loan has been delayed as the IMF has raised doubts about Pakistan’s compliance with the deal. The situation put pressure on the stock market.

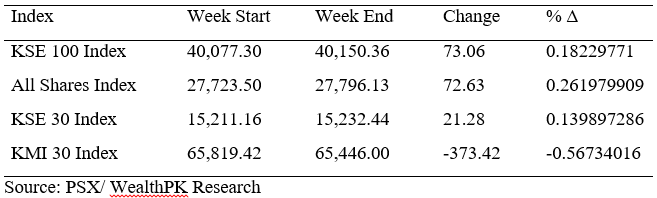

According to WealthPK analysis, the market gained 73.06 points throughout the week, closing at 40,150.36 points, up by 0.18 percent. The All-Share index also increased by 72.63 points, the KSE-30 index gained 21.28 points and the KMI-30 index decreased by 373.42 points on a weekly basis.

Source: PSX/ WealthPK Research

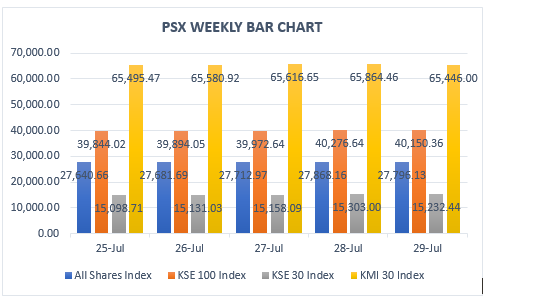

On July 25, the Karachi Stock Exchange (KSE) 100-index fell below the crucial threshold of 40,000 points after losing 233.28 points or 0.58 percent during the day to close at 39.844.02 points as a result of the nation’s political unpredictability, which has harmed investor confidence.

The rupee hit a record low of 232.93 against the US dollar on July 19 as investors were concerned about the continuous depreciation of the rupee. The benchmark KSE-100 index closed at 39,894.05 points, up 50.03 points or 0.13 percent.

The stock market on July 27 witnessed a volatile trading session as the main board volumes remained dry whereas decent volumes were observed in the third-tier stocks. At close, the KSE-100 settled with a marginal gain of 78.59 points or 0.20 percent to close at 39,972.64.

After some normality was witnessed on the political front in Punjab, the stock market saw a bullish trend on July 28. The benchmark KSE-100 index eventually settled at 40,276.64, showing an increase of 304 points or 0.76 percent.

Investors’ concerns over the country’s political and economic situation led to a rangebound session on July 22 at the Pakistan Stock Exchange. The KSE-100 index decreased to 40,150.36 points with a change of 126.28 negative points.

Source: PSX/ WealthPK Research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $0.57 million. Individuals made the most money by selling their shares for $2.04 million, followed by insurance companies with $1.78 million and Broker Proprietary Trading with $1.16 million. Banks purchased up to $3.26 million in shares, followed by companies, which purchased $2.38 million in stock. Foreign corporate Pakistanis purchased up to $0.42 million worth of stock.

According to Muhammad Ahmed, a financial analyst with Arif Habib Limited, the stock market is likely to stay positive during the next week. With the commencement of the result session next week, certain scrips are expected to remain in the limelight. Moreover, scrips are trading at cheap valuations, which may revive the momentum.

“We recommend that the investors cherry-pick the scrips because we expect the market to be positive next

week since valuation has opened up to attract levels,” Muhammad Ahmed told WealthPK.

Source: PSX/ WealthPK Research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $0.57 million. Individuals made the most money by selling their shares for $2.04 million, followed by insurance companies with $1.78 million and Broker Proprietary Trading with $1.16 million. Banks purchased up to $3.26 million in shares, followed by companies, which purchased $2.38 million in stock. Foreign corporate Pakistanis purchased up to $0.42 million worth of stock.

According to Muhammad Ahmed, a financial analyst with Arif Habib Limited, the stock market is likely to stay positive during the next week. With the commencement of the result session next week, certain scrips are expected to remain in the limelight. Moreover, scrips are trading at cheap valuations, which may revive the momentum.

“We recommend that the investors cherry-pick the scrips because we expect the market to be positive next week since valuation has opened up to attract levels,” Muhammad Ahmed told WealthPK.