INP-WealthPk

Qudsia Bano

Treet Corporation Limited, a leading maker of razors and razor blades, released its financial results for the three and nine-month periods ending March 31, 2023, showing remarkable growth and demonstrating its ability to capitalise on market opportunities and deliver solid financial performance.

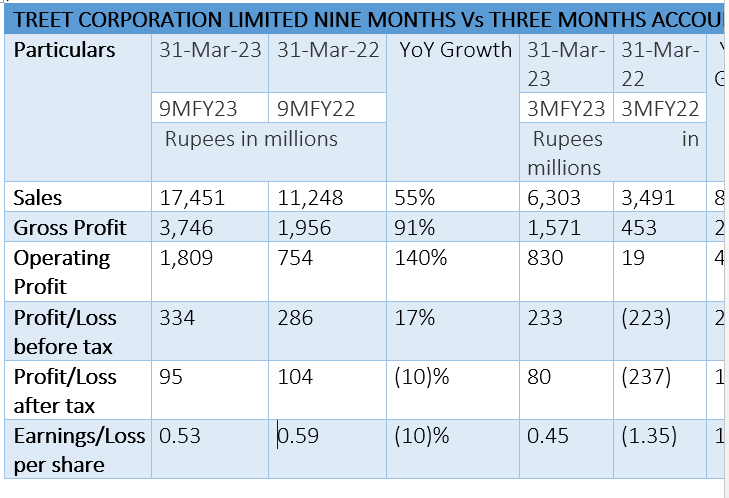

Nine-month accounts analysis

During the nine-month period of FY23, Treet Corporation Limited reported sales of Rs17.45 billion, reflecting a robust year-on-year (YoY) growth of 55%. This substantial increase in sales can be attributed to the company's successful strategic initiatives and strong demand for its products. The gross profit for the nine-month period soared to Rs3.75 billion, representing a remarkable YoY growth of 91%. This improvement in gross profit margin can be attributed to effective cost management and improved operational efficiency.

Treet Corporation Limited's operating profit also witnessed a significant boost during the nine-month period, reaching Rs1.81 billion, a YoY growth of 140%. This exceptional growth in operating profit highlights the company's ability to optimise its resources and enhance its operational performance. Despite facing certain challenges, such as increased taxes and expenses, Treet Corporation managed to report a profit-before-tax of Rs334 million, marking a modest YoY growth of 17%. This achievement showcases the company's ability to navigate through a complex business environment and deliver positive financial results.

However, the company reported a slight decline in profit-after-tax, amounting to Rs95 million, indicating a YoY decrease of 10%. This decline can be attributed to certain exceptional expenses or non-operational factors affecting the net profitability of the company. Earnings per share (EPS) for the nine-month period stood at Rs0.53, representing a YoY decrease of 10%. This decline is reflective of the challenges faced by the company during this period.

In the three-month period ending March 31, 2023, Treet Corporation witnessed exceptional growth in various financial metrics. The company reported sales of Rs6.3 billion, reflecting a remarkable YoY growth of 81%. This growth can be attributed to increased demand for its products and successful marketing strategies. The gross profit for the three-month period reached Rs1.57 billion, demonstrating a substantial YoY growth of 247%. This impressive increase in gross profit margin indicates improved cost management and operational efficiency.

Operating profit witnessed a remarkable surge, reaching Rs830 million, reflecting a staggering YoY growth of 4,252%. This extraordinary growth in operating profit signifies the company's ability to optimise its operations and achieve higher profitability. Profit-before-tax for the three-month period amounted to Rs233 million, marking a significant improvement from the loss of Rs223 million reported in the corresponding period of the previous year. This positive turnaround highlights Treet Corporation Limited's successful implementation of effective business strategies and cost management initiatives.

The company reported a profit-after-tax of Rs80 million for the three-month period, showing a substantial YoY increase of 134%. This positive growth in net profitability signifies the company's ability to generate sustainable returns for its shareholders. EPS for the three-month period stood at Rs0.45, indicating a remarkable YoY increase of 134%. This improvement in EPS reflects Treet Corporation’s commitment to enhancing shareholder value.

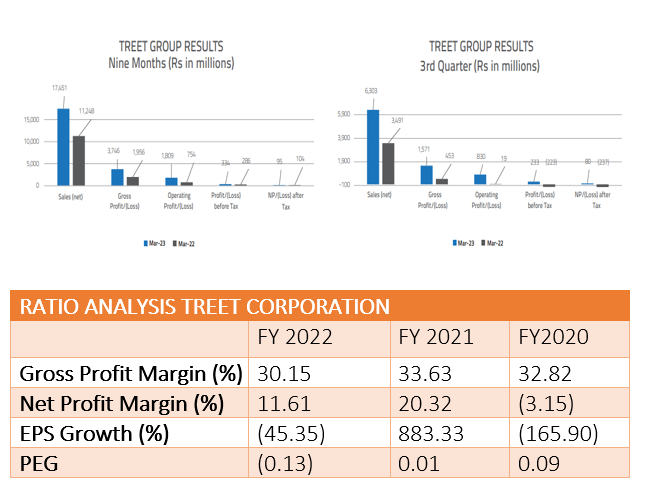

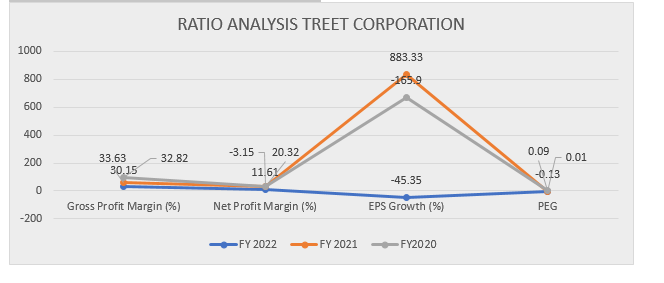

Treet Corporation’s financial performance can be further analysed by examining key ratios related to profitability and growth. The following ratio analysis highlights the company's performance over the past three fiscal years (FY20, FY21 and FY22).

Gross profit margin (%)

The gross profit margin measures the percentage of sales revenue that remains after deducting the cost of goods sold. Treet Corporation’s gross profit margin has remained relatively stable over the past three years, with percentages of 32.82% in FY20, 33.63% in FY21 and 30.15% in FY22. The slight decrease in FY22 indicates a possible increase in production costs or pricing pressures. Overall, the company has maintained a reasonably healthy gross profit margin.

Net profit margin (%)

The net profit margin reflects the percentage of sales revenue that translates into net profit after considering all expenses. Treet Corporation experienced a significant improvement in net profit margin, recording 20.32% in FY21, compared to a negative margin of 3.15% in FY20. However, the margin dropped to 11.61% in FY22. This decrease may be attributed to various factors, including increased operating expenses or non-recurring charges impacting profitability.

EPS growth (%)

The EPS growth ratio represents the annual percentage change in EPS. Treet Corporation had an impressive EPS growth of 883.33% in FY21, indicating a substantial improvement in profitability. However, the company witnessed a decline of 45.35% in FY22, suggesting a decrease in earnings. The negative growth could be a result of several factors, such as higher expenses or a decline in sales. It is important for the company to analyse and address the factors affecting its EPS growth to ensure long-term sustainable profitability.

PEG (price/earnings to growth) ratio

The PEG ratio provides insight into a company's valuation relative to its expected earnings growth rate. Treet Corporation Limited's PEG ratio has shown fluctuation over the three-year period. A PEG ratio of 0.01 in FY21 indicates that the company's stock was potentially undervalued relative to its EPS growth rate. In contrast, a PEG ratio of 0.13 in FY22 suggests an overvaluation of the company's stock relative to its earnings growth. The PEG ratio of 0.09 in FY20 indicates a moderate valuation.

About the company

Treet Corporation was incorporated in Pakistan on January 22, 1977 as a public limited company under the Companies Act 1913 (now Companies Act, 2017). The principal activity of the company is to manufacture and sell razors and razor blades along with other trading activities.

Credit: INP-WealthPk