INP-WealthPk

Hifsa Raja

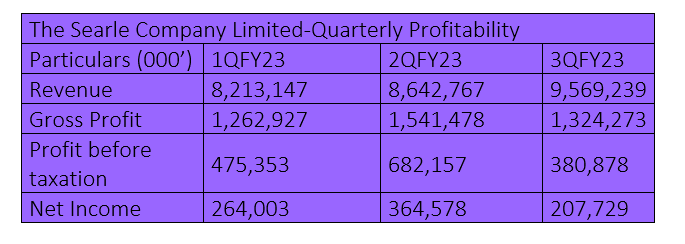

The Searle Company Limited – the maker of pharmaceutical and consumer products – recently released its quarterly profitability report, showcasing gradual increase in sales in the first three quarters of the last financial year 2022-23, but fluctuation in profits. In the first quarter (July-Sept) of FY23, the company posted a revenue of Rs8.2 billion, a gross profit of Rs1.2 billion and a net income of Rs264 million.

In the second quarter (Oct-Dec), the firm posted a revenue of Rs8.6 billion, a gross profit of Rs1.5 billion and a net income of Rs364 million. In the third quarter (Jan-March), sales stood at Rs9.5 billion, the gross profit at Rs1.3 billion and the net income at Rs207 million. The company's revenue demonstrated a positive trend, increasing in the three quarters, reflecting the company's ability to generate sales and meet customer demands. In terms of gross profit, The Searle Company Limited achieved steady progress. The gross profit figures rose in the second quarter, and then slightly declined in the third quarter. This indicates effective cost management and the ability to maintain a reasonable margin between revenue and the cost of goods sold.

Profit-before-taxation figures also showcased a mixed trend, increasing in the second quarter, but declining in the third quarter, probably because of factors such as changes in market conditions or operational expenses. Net income, reflecting the company's overall profitability, followed a similar pattern. The figures increased in the second quarter, but decreased in the third quarter. The decrease in net income in the third quarter may be a cause for concern, but overall, the financial performance of the company remained positive over the three quarters. The Searle Company Limited's quarterly profitability reflects a mix of positive growth and some challenges.

The company's ability to generate consistent revenue and maintain a reasonable gross profit margin showcases its market competitiveness. However, the slight decline in the profit before and after taxation in the third quarter may require further analysis and strategic decision-making to address any underlying issues. Moving forward, The Searle Company Limited aims to continue its growth trajectory, focusing on strengthening its market position and optimising operational efficiency. By identifying and addressing the factors impacting profitability, the company aims to overcome challenges and maintain a sustainable and profitable business in the industry.

The company's efforts to take advantage of new prospects in the consumer products sector and its sustained success is a factor stakeholders and investors should look forward to.

Performance in FY22

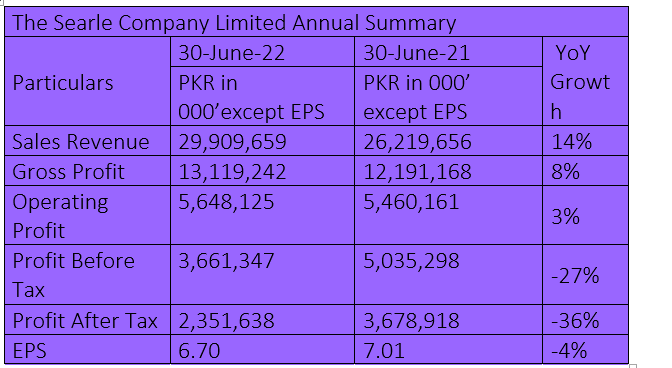

In the fiscal year 2021-22, the company reported a modest increase in net sales, reaching Rs29 billion compared to Rs26 billion of the previous year, indicating a growth of 14%. Likewise, the gross profit increased to Rs13 billion, up 8% from the previous year's figure of Rs12 billion.

The company’s operating profit increased by 3% to Rs5.6 billion in FY22 from the previous year's Rs5.4 billion. However, the company’s before-tax profit decreased by 27% to Rs3.6 billion in FY22 from the previous year's Rs5 billion. Moreover, the company’s profit-after-tax dwindled by 36% to Rs2.3 billion in FY22 from the previous year's Rs3.6 billion.

The earnings per share (EPS) also decreased by 4% year-on-year.

EPS and EPS growth over the years

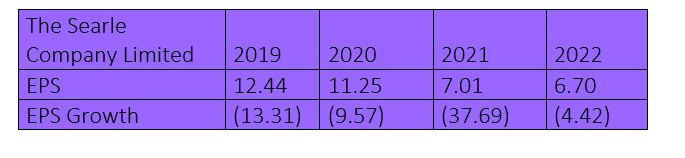

In FY19, the company reported a robust EPS of Rs12.44. However, EPS decreased in FY20 to Rs11.25, to Rs7.01 in FY21 and to Rs6.70 in FY22.

EPS growth over this period remained negative, suggesting the company may need to reassess its strategies and implement measures to enhance its profitability and boost EPS growth. This could involve exploring new market opportunities, optimising operational efficiency, or diversifying its product portfolio.

Ratio analysis

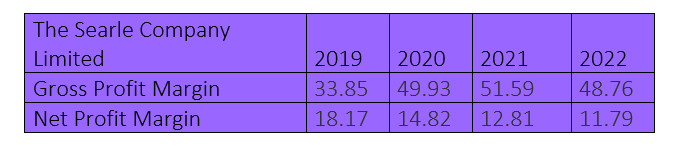

In 2019, the gross profit margin stood at 33.85%, and increased to 49.93% in 2020, and to 51.59% in 2021. However, the margin declined to 48.76% in 2022. In 2019, the net profit margin was 18.17%, but it kept declining in the later years.

Overall, The Searle Company Limited’s previous years have steady profitability. However, the decrease in 2022 in both the gross profit and net profit margins points to a challenging time for the business. To address the variables impacting its profitability and assure sustainable financial performance in the future, the company needs to take strategic initiatives. Investors and stakeholders should keep a close eye on the company's efforts to address the issues and strengthen its financial condition.

Price prediction using machine learning algorithms

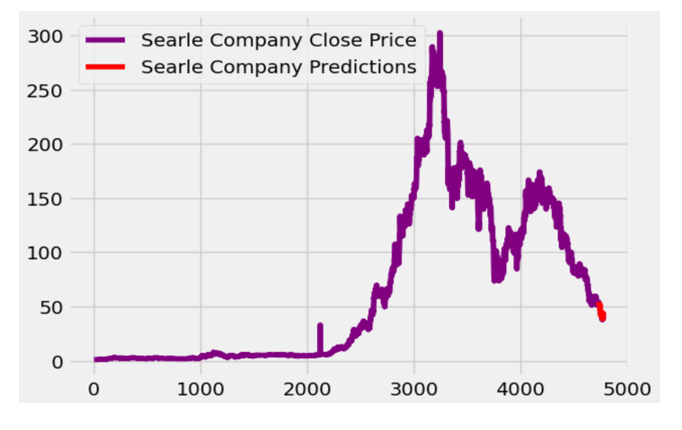

The future stock close prices of The Searle Company Limited were predicted in a ground-breaking analysis using a state-of-the-art machine learning approach. The model used 20 years of historical data, from 2003 to 2023, to make very precise forecasts. The model utilises the capabilities of a specialised recurrent neural network called Long Short-Term Memory (LSTM). This brings in a new era of financial forecasting and illustrates how machine learning has the power to fundamentally alter investing approaches.

Finally, the model plots the actual stock prices (labeled as "Searle Company Close Price") and overlays the predicted prices (labeled as " Searle Company Predictions") on the same graph. This visualisation allows for a visual comparison between the actual and predicted values, helps to assess the performance of the model. The model predicts that the prices of the stock will fall in the future.

Company profile

The Searle Company Limited was incorporated in Pakistan as a private limited company in October 1965. In November 1993, the company was converted into a public limited company under the now repealed Companies Ordinance, 1984 (now Companies Act, 2017). The firm is principally engaged in the manufacturing of pharmaceutical and other consumer products. Its parent company, International Brands (Private) Limited, owns 56.32% of its shares.

Credit: INP-WealthPk