INP-WealthPk

Fakiha Tariq

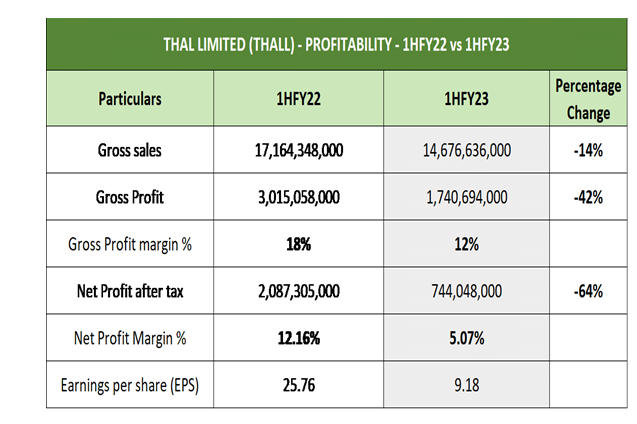

THALL Limited reported a 14 percent decrease in gross sales and 64 percent in net profit in the first six months (Jul to Dec) of the Fiscal Year 2023 compared to the corresponding period of the last fiscal year 2021, WealthPK reports. The company is listed on the Pakistan Stock Exchange (PSX) under the symbol of “THALL” in the automobile parts and accessories sector. With market capitalisation of Rs14 billion, THALL is the only large-cap company listed in the automobile parts and accessories sector. It was established as a public limited company in 1966 and is primarily engaged in production and sale of engineering and packaging products.

The sales dropped in 1HFY23 to Rs14 billion as compared to Rs17 billion in 1HFY22. The gross profit dropped to Rs1.7 billion in 1HFY23 against the gross profit of Rs3 billion posted in 1HFY22. Likewise, the net profit dropped massively from Rs2.0 billion in 1HF22 to Rs744 million in 1HFY23.

The gross profit and net profit ratios dropped from 18% to 12% and 12.16% to 5.07% in 1HFY22 versus 1HFY23. Therefore, THALL reported EPS value of Rs9.18 per share in 1HFY23 compared to Rs25.76 posted in 1HFY22.

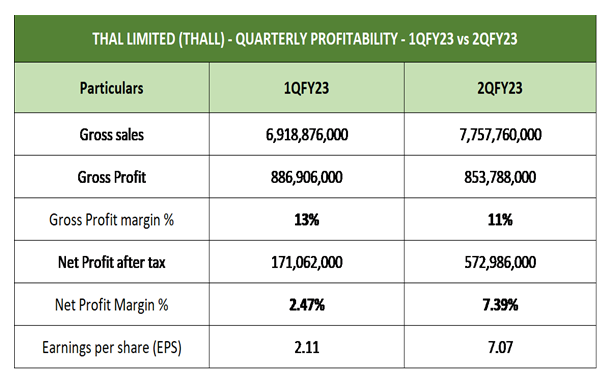

Quarterly Profitability Review – 1HFY23

In the first quarter (Jul to Sept) of FY23, the company posted gross sales of Rs6.9 billion. The gross profit and net profit were Rs886 million and Rs171 million, respectively. Therefore, the company posted gross profit ratio and net profit ratio of 13% and 2.47% in 1QFY23. The EPS value was reported to be Rs2.11 per share in 1QFY23.

In the second quarter (Oct to Dec) of FY23, gross sales moved up to Rs7.7 billion. The gross profit decreased in comparison to the first quarter of trade to Rs853 million. THALL reported an increase in net profit in comparison to 1QFY23 and declared a net profit of Rs572 million in 2QFY23. Thus, the GP ratio and NP ratio in 2QFY23 calculated to be 11% and 7.39%, respectively.

In 2QFY23, EPS value of Rs7.07 was reported.

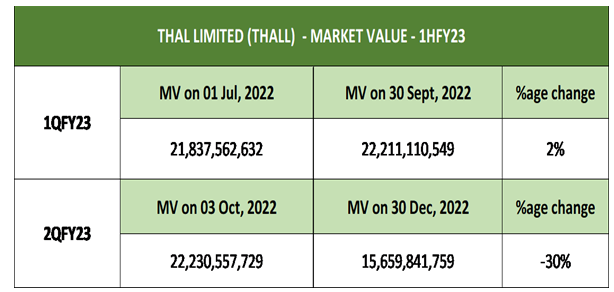

Market Value Review – 1HFY23

Overall, the market value dropped by 28% in 1HFY23. In quarterly review, it was revealed that in the first quarter of FY23, the market value increased by 2% from Rs21.8 billion to Rs22.2 billion.

Quarterly Profitability Review – 1HFY23

In the first quarter (Jul to Sept) of FY23, the company posted gross sales of Rs6.9 billion. The gross profit and net profit were Rs886 million and Rs171 million, respectively. Therefore, the company posted gross profit ratio and net profit ratio of 13% and 2.47%

However, the second quarter of FY23 proved to be disastrous in which the market value dropped by 30% from Rs22.2 billion to Rs15 billion.

Credit: Independent News Pakistan-WealthPk