INP-WealthPk

Jawad Ahmed

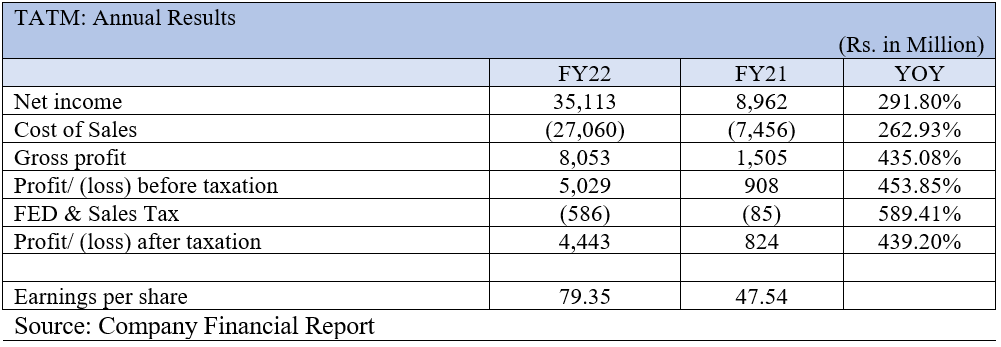

The revenues of Tata Textile Mills Limited – the producer and seller of yarn – shot to Rs35 billion in the financial year 2021-22, higher by a whopping 291.8% than the Rs8.96 billion in the fiscal 2020-21, reports WealthPK.

The company’s top line showed a significant increase in FY22, sending its profitability through the roof.

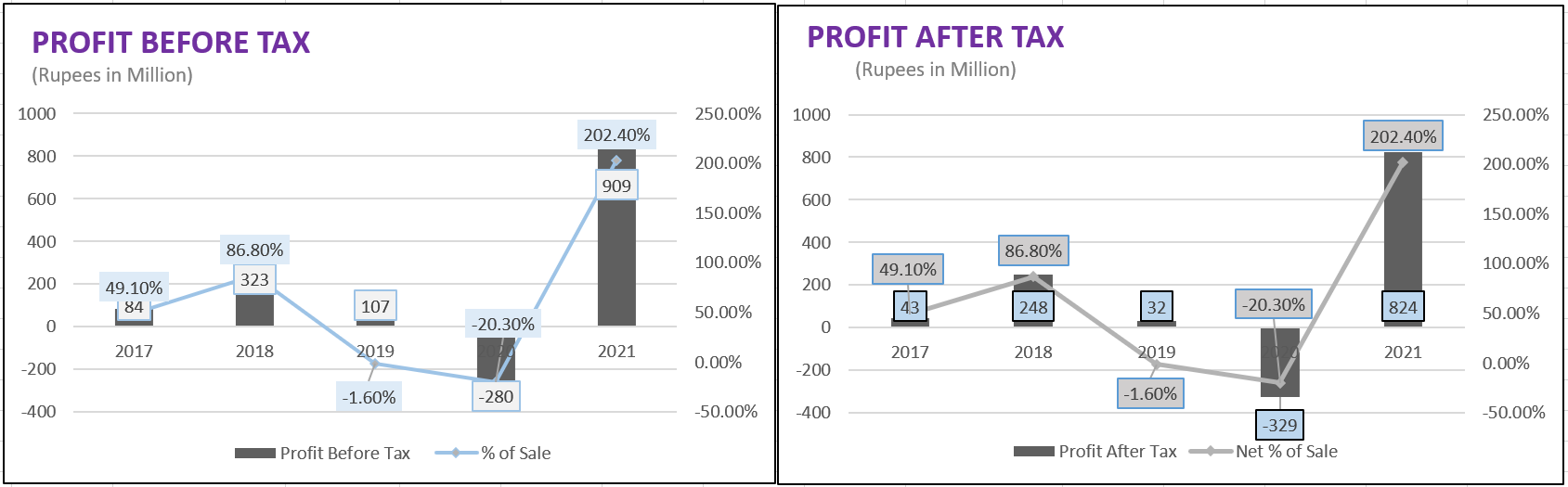

During FY22, the company also reported a monumental profit-before-tax of Rs5 billion, up 454% from Rs908 million the year before. The net profit for the fiscal year ending June 30, 2022, stood higher by a massive 439% at Rs4.44 billion than Rs824 million the previous year.

The earnings per share (EPS) shot up to Rs79.35 in FY22 from Rs47.54 in FY21.

Company’s performance over the years

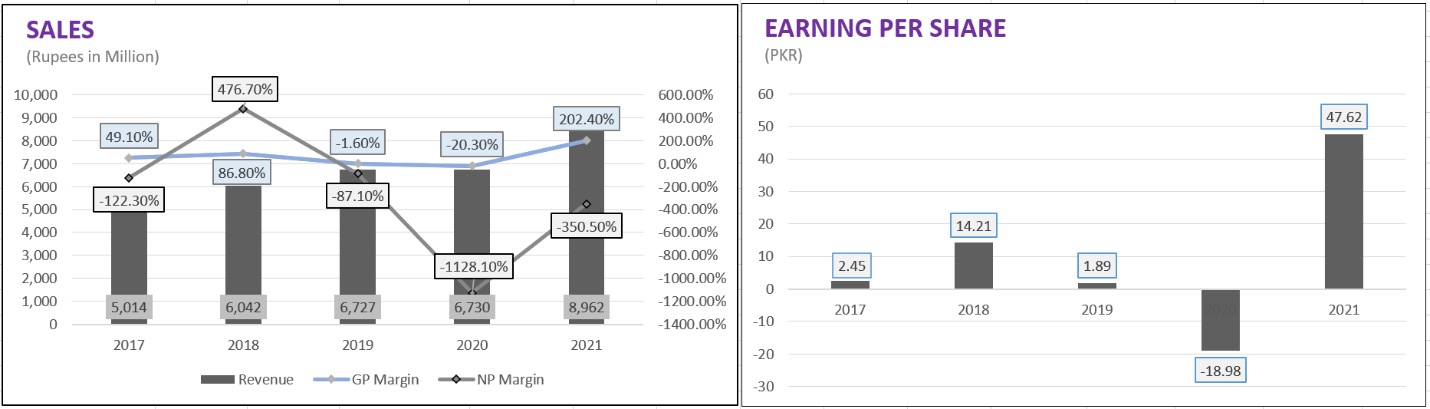

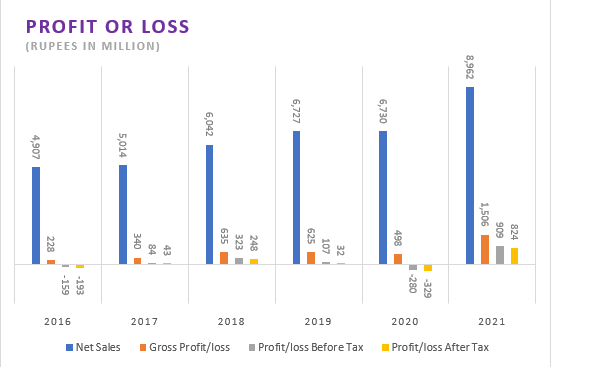

In 2019, the net sales of the company increased moderately to Rs6.727 billion compared to Rs6.042 billion in the preceding year, showing a growth of 11.34%.

However, the company’s gross profit marginally declined to Rs625 million from Rs635 million in 2018.

Due to an increase in the operating cost and taxation, the company’s net profitability massively decreased to Rs32 million from Rs248 million in 2018, which pushed the EPS down to Rs1.89 from the earlier Rs14.21.

In 2020, the ceasing of operations due to the Covid-19-induced lockdowns affected the company’s sales. The company posted net sales of Rs6.730 billion, with a modest increase of 0.03% over last year’s Rs6.727 billion.

The company posted a loss-before-tax of Rs280 million due to multiple factors, including the pandemic-related restrictions and forced shutdown of operations, US-China trade dispute, affecting yarn and cotton prices, devaluation of the Pakistani rupee and an increase in interest expense, leading to higher borrowing costs.

The corporation experienced a net loss of Rs329 million in 2020 as opposed to a net profit of Rs32 million in 2019. As a result, the loss per share galloped to Rs18.98 from EPS of Rs1.89 a year before.

The company saw a remarkable boost in its turnover in 2021, which increased by 33.22% to Rs8.96 billion from Rs6.73 billion the previous year. The gross margins increased by over 202% to Rs1.5 billion, up from Rs498 million the year before.

In comparison to the net loss of Rs329 million the year before, the profit-after-tax grew to Rs824 million. The EPS for 2021 stood at Rs47.62.

Credit : Independent News Pakistan-WealthPk