INP-WealthPk

By Irfan Ahmed

The Pakistan Stock Exchange (PSX) experienced a positive trend in October 2022 as Pakistan was removed from the Financial Action Task Force (FATF) Gray List, rupee strengthened, and the Asian Development Bank (ADB) provided a $1.5 billion loan.

The KSE-100 Index remained range-bound in October, with the bourse closing at 41,265 points (+0.3%/136 points MoM), reports WealthPK.

Initial excitement at the bourse was led by Pak rupee posting a noteworthy recovery (closing at PKR 220/USD in October against PKR 239/USD in the previous month) with the new finance minister vowing to tame inflation and controlling the parity, as well as expectations of additional funds for flood relief.

Although the market's momentum could not be sustained, Moody's downgraded Pakistan's sovereign credit rating from B3 to Caa1 due to increased liquidity risks and external vulnerability. Albeit, the announcement of Pakistan’s exit from the FATF Grey List after a four-year long stint, and the approval of a loan worth $1.5 billion from the ADB restored the confidence of the market.

Moreover, the World Bank is also expected to offer flood-related support of $1.7 billion. However, improvement in the market trajectory remained short-lived as depleting reserves continued to put pressure on the rupee.

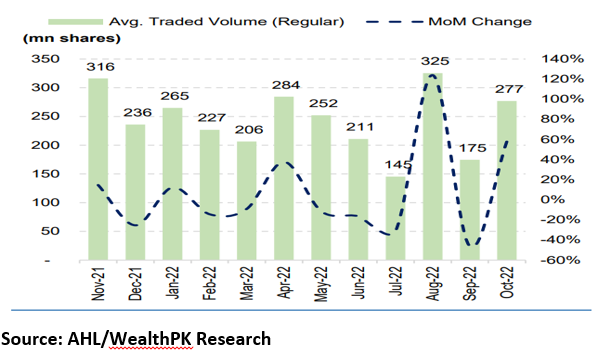

As per PSX data, the KSE-100 Index posted a negative return of -1% in three quarters of the current year 2022 (3Q CY22) against -7.5% in the prior quarter whereby political uncertainty and delay in the IMF program hammered the market returns. Average traded volume and value in October 2022 went up by 58% (277 million shares) and 25% ($36 million) on a month-on-month (MoM) basis, respectively.

Positive contributors to the stock market in October were power sector (278pts) given a dividend announcement by HUBC, fertilizer (250pts) amid healthy payouts, followed by technology (89pts). Negative index contribution was led by the auto sector (57pts), miscellaneous (49pts), and pharma (47pts).

Major gainers in the month under review were SYS, HUBC, RMPL, FABL and ATRL posting positive returns of 18%, 17%, 17%, 13%, and 13%, respectively. On the flip-side, BNWM, PGLC, PSMC, PPL and TRG posted negative returns (24%, 23%, 18%, 15% and 15%, respectively).

In terms of sectors, power was the best performing sector posting a return of 12% followed by fertilizer (4%), modaraba (3%), technology (3%), textile spinning (2%), food (2%) and leather (2%). Negative returns were led by woolen (24%), leasing (23%), vanaspati (13%), sugar (11%), and transport (8%).

According to a financial analyst at Arif Habib Private Limited (AHL), market returns will largely be dependent on a stable currency outlook volatility in the PKR-USD parity once again in recent weeks, amid debt obligation over the next 12 months in the backdrop of tough global conditions. In particular, effective negotiations with bilateral and multilateral partners, especially post floods will help stabilise the parity. The analyst added that Prime Minister Shehbaz Sharif’s visit to China and the next IMF meeting for the country’s ninth review and September-end performance criteria remain the key events to look out for.

"The profitability of the KSE-100 index posted a jump of 5% in 9M CY22 and 4% year-on-year (YoY) in 3Q CY22. We expect that this not only shows domestic businesses' resilience but also uncovers attractive valuations at the index,” said the analyst.

Credit : Independent News Pakistan-WealthPk