INP-WealthPk

Irfan Ahmed

The Pakistan Stock Exchange (PSX) posted a positive performance in October 2022 despite political uncertainty in the country as the rupee strengthened and friendly countries were expected to provide monetary support to Pakistan, WealthPK reports. The KSE-100 index posted a jump of 1,084 points on a month-on-month basis on November 22 to close at 43,349 points.

According to Arif Habib Limited, the finance minister assured markets that monetary support from friendly countries and multilateral partners would be reflected in the reserves position soon. The trade deficit also narrowed down by 26.59% to $11.469 billion during the first four months of the current fiscal as compared to $15.624 billion during the same period of the previous financial year. The Asian Development Bank (ADB) infused $1.5 billion into reserves, boosting the equity market.

However, the overarching focus of investors was pinned on political news. Pressure on the Pakistani rupee indicates falling of the State Bank of Pakistan (SBP) reserves as debt repayments continue to wash off any inflows, coupled with a surprise 100bps hike by the central bank in response to an overpowering rise in inflation, eroded earlier returns.

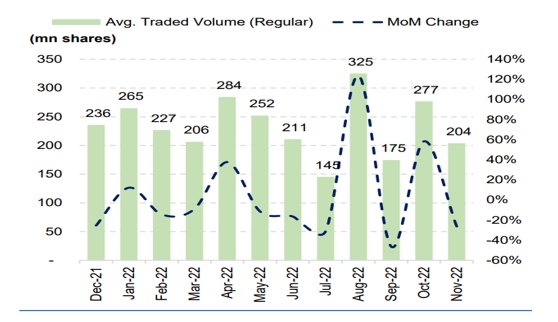

However, SBP remains confident of making the bond payment earlier than the due date in the first week of December, addressing another big concern that kept market participants wary in November. As per the AHL data, average traded volume and value during November went down by 26% and 21% on a month-on-month basis, respectively.

Source: AHL/WealthPK Research

Positive contributors during November were technology (580pts) given foreign buying, fertiliser (336pts) amid the commencement of Rabi season, followed by E&P’s (269ts) attributable to enticing valuations and banks (153pts) owed to rate hike by SBP. Whereas negative index contribution was led by miscellaneous (110pts), cement (95pts) and textile composite (42pts).

Scrip-wise performance chart during the month was led by PGLC, TRG, SYS, FABL, and ENGRO, each posting positive returns of 101%, 30%, 13%, 13%, and 12%, respectively. On the flipside, PSEL, AIRLINK, UNITY, POML and GATM posted negative returns of 20%, 16%, 12%, 12% and 10%, respectively.

In terms of sectors, leasing was the best performing sector that posted a return of 101%, followed by technology with a 17% return, textile spinning with 11%, woolen items with 8%, synthetic with 8%, oil marketing companies with 7% and tobacco with 7%. Negative returns were led by miscellaneous with 18%, flowed by Vanaspati with 12%, engineering with 6%, textile composite with 6% and mutual funds with 5%.

According to Arif Habib Pvt Limited (AHL), after some delay in the ninth review of the International Monetary Fund and September-end performance criteria, which was previously scheduled for November 3, 2022, the government and the IMF have begun virtual engagement. This remains critical for Pakistan as its reserves continue to deplete despite inflows from ADB, World Bank and AIIB in the last few weeks, given debt repayment obligations.

An analyst at AHL said that with a scheduled payment of $1 billion bonds in the current week and scheduled repayments of $26.3 billion till October 2023, IMF would invariably instill confidence in other bilateral and multilateral partners to provide Pakistan with the necessary monetary support.

The recent surprise hike of 100bps in SBP’s benchmark policy rate has once again taken the focus away from economic growth towards curbing inflation, and yet, a clear path has still not been established. The debate over the peak level of the policy rate is making the rounds, while KIBOR at nearly 17%, has spooked leveraged industries. However, commercial banks remain key beneficiaries of the policy.

“We also highlight that barring two out of the last 10 years, the stock market has posted positive returns for December. We believe a similar trend will be witnessed this year, given successful talks with IMF and timely payment of bonds,” the analyst told WealthPK.

Credit : Independent News Pakistan-WealthPk