INP-WealthPk

Hifsa Raja

The release of $500 million by the Asian Infrastructure Investment Bank (AIIB) has increased the reserves of the State Bank of Pakistan to some degree and infused a positive sentiment into the markets that the country will continue receiving the much-needed foreign exchange from multilateral and bilateral sources to be able to meet the external account requirements and finance the post-flood rehabilitation and settlement efforts. This was underscored by Iqra Khan, the compliance officer of Bridge Securities Private Limited, during a chat with WealthPK.

WealthPK: Do the AIIB inflows indicate that foreign donors and creditors have started looking at Pakistan with a positive lens? Will the inflows improve the market sentiment that Pakistan will likely come out of the economic morass it is currently in?

Iqra Khan: The stock market has reacted positively to the development as the benchmark KSE-100 index gained healthy points following the arrival of the much-needed inflows into the accounts of the central bank.

WealthPK: But the SBP’s unexpected policy rate hike by 100 basis points at a time when the economy was already slowing has taken the market by surprise. How does the market react to this?

Iqra Khan: Certainly, the rate hike led to a sharp decline in the stocks. However, the downward rally was short-lived as the index was soon driven by bulls after the $500 million tranche arrival from AIIB.

WealthPK: Which sectors responded favourably to the “good news”?

Iqra Khan: Sectors contributing positively to the performance of the market after the AIIB inflows came in included commercial banks (67.7 points), technology and communication (60.7 points), power generation & distribution (57.5 points), E&P (34.2 points) and cement (28.5 points).

WealthPK: Which stocks showed the most prominent impact?

Iqra Khan: Stocks that contributed significantly to the volumes were WorldCall Telecom Limited, UNITY, Kelt Exploration Ltd, Dewan Farooque Motors Limited, Bank Alfalah, Ghani Chemical Industries Limited and the Hub Power Company Limited.

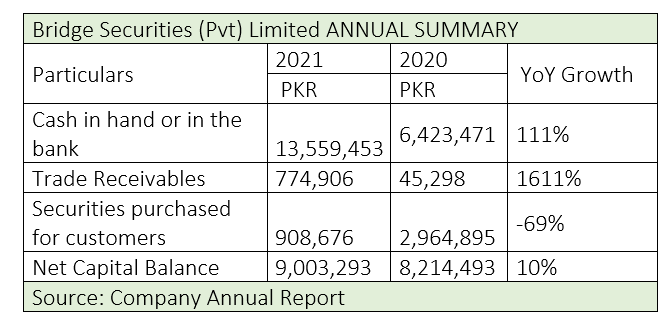

The company’s performance in FY21

Bridge Securities Private Limited’s cash-in-hand increased 111% to Rs13 million in fiscal year 2020-21 from Rs6.42 million in FY20.

The trade receivables, showing an increase of 1611%, stood at Rs774 million in FY21, rocketing from only Rs45,298 in FY20. Profit from securities purchased for customers decreased 69% to Rs908,676 in FY21 from Rs2.96 million in FY20. The net capital balance increased 10% to Rs9 million in FY21 from Rs8.21 million in FY20.

Fayaz Haider, the current CEO/Director of the Bridge Securities, started the stock brokerage business as an Individual Member of the erstwhile Lahore Stock Exchange in 2006. This business was converted into a corporate brokerage house under the name of M/s Bridge Securities (Pvt) Ltd in 2006. Since its inception, the company has successfully catered to the investment needs of its clients in the most transparent manner.

Well-trained and experienced staff is diligently serving with full regulatory compliance, recognising the prioritised status of clients and giving effect to their instructions at all times. The clients are assisted to make them aware of the market potential, related risks, sensitivities, etc.

Credit : Independent News Pakistan-WealthPk