INP-WealthPk

Hifsa Raja

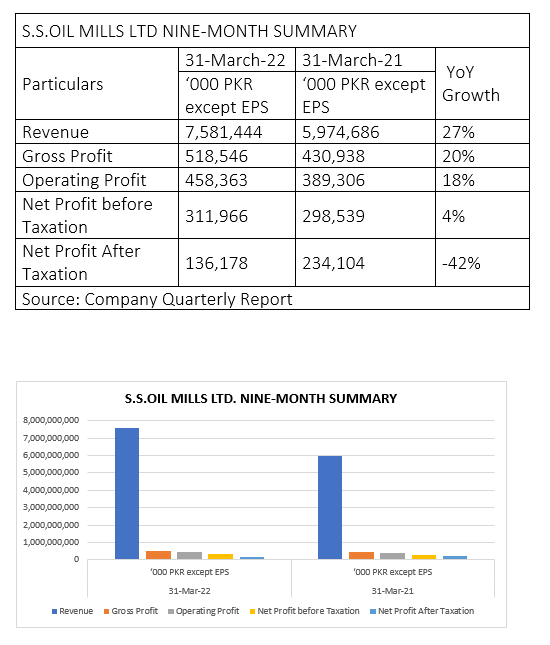

S.S Oil Mills Limited (SSOM) revenue jumped 27% to Rs7.58 billion in the first nine months of the fiscal year 2021-22 from Rs5.97 billion in the corresponding period of fiscal 2020-21. The company’s gross profit registered a growth of 20% in 9MFY22 to reach Rs518 million from Rs430 million in the corresponding period of FY21. The operating profit was up 18% to Rs458 million in 9MFY22 from Rs389 million in the same period of FY21. The increase in operating profit shows the operational efficiency of the company. The profit-before-taxation increased 4% to Rs311 million in 9MFY22 from Rs298 million in 9MFY21. The profit-after-taxation, however, decreased 42% to Rs136 million in 9MFY22 from Rs234 million over the corresponding period of FY21, reports WealthPK.

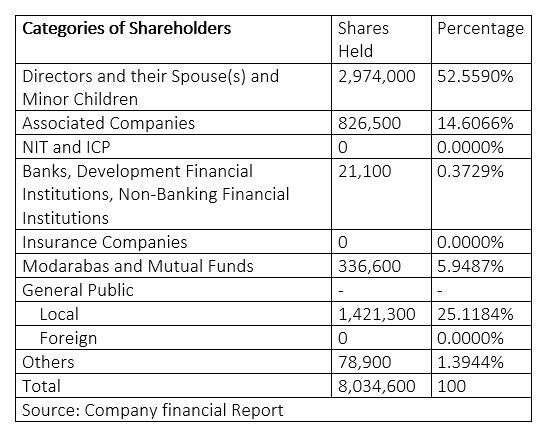

Shareholding

As of June 30, 2021, directors, their spouse(s) and minor children owned 52.55% of the shares of the company. Associated companies owned 14.60%, Banks, development financial institutions and non-banking financial institutions 0.37%, modarabas and mutual funds 5.94%, general public (local) 25.11% and ‘others’ category 1.39%, respectively.

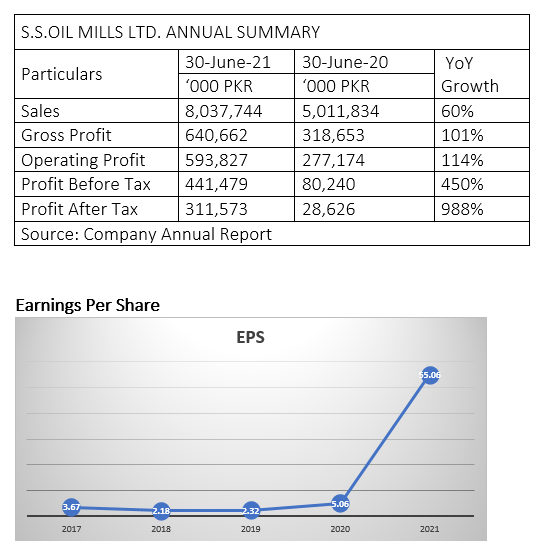

Financial Performance

During the fiscal year 2020-21, the company generated sales of Rs8 billion compared to Rs5 billion in 2019-20, registering an increase of 60%.

The gross profit for FY21 stood at Rs640 million, up 101% from Rs318 million, in FY20.

Operating profit for FY21 stood at Rs593 million compared to Rs277 million in FY20, posting an increase of 114%.

Profit-before-tax in FY21 stood at Rs441 million compared to Rs80 million in FY20, posting an increase of 450%.

Profit-after-tax for FY21 was Rs311 million as compared to Rs28 million in FY20, posting an increase of 988%.

The earnings per share (EPS) rose from lows of Rs3.67 in 2017 and Rs5.06 in 2020 to a high of Rs55.06 in 2021.

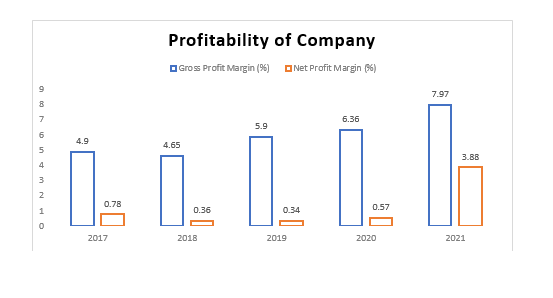

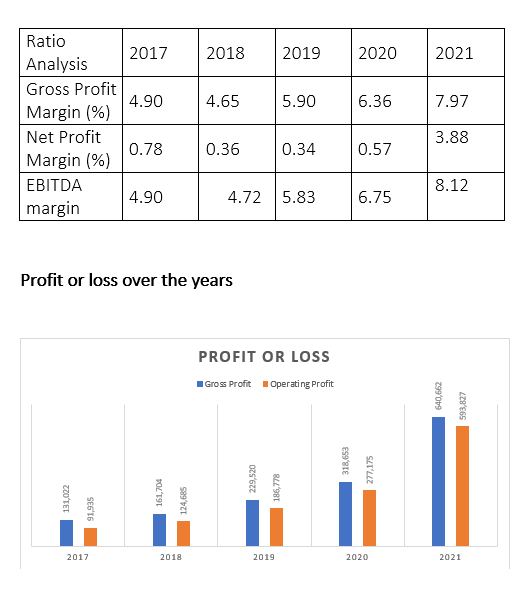

Ratio Analysis:

In 2017, the gross profit margin stood at 4.9%, but the net profit margin remained at just 0.78%.

Both the gross and net profit margins, however, peaked at 7.97% and 3.88%, respectively, in 2021.

The EBITDA (earnings before interest, taxes, depreciation and amortisation) margins remained high in 2020 and 2021.

Both the gross and operating profits remained high in 2020 and very high in 2021.

S.S. Oil Mills Limited was incorporated in Pakistan on August 21, 1990 as a public limited company. The company is engaged in solvent extraction (edible oil).

Credit : Independent News Pakistan-WealthPk