INP-WealthPk

Muhammad Mudassar

The international market is predicted to run short of gas this winter due to the Russia-Ukraine conflict. The standoff will also have its trickle-down effect on Pakistan needing practical steps at the government level to avoid braving a harsh winter, reports WealthPK. Muhammad Farrukh, Section Officer at the Ministry of Energy and Power Division, told WealthPK that there were two major reasons for the winter gas shortage. The first reason is that Pakistan avoided purchasing expensive gas from the global spot markets, while the second reason is the natural gas reserves which have been depleting at a rate of around 9% per year over the last few decades. According to the Federal Reserve Economic data, lack of gas in the international market has resulted in an almost three-time increase in the price of LNG (liquefied natural gas) from $14 per MMBtu in July 2021 to $41 per MMBtu in July 2022. Since the LNG price was too high at that time, Pakistan was unable to afford it. As a result, it did not make a spot purchase for July in June 2022. LNG price in the international market. Source: Federal Reserve Economic data In order to meet its energy needs, Pakistan imports some LNG under long-term contracts with Qatar, while some LNG is imported through spot purchasing.

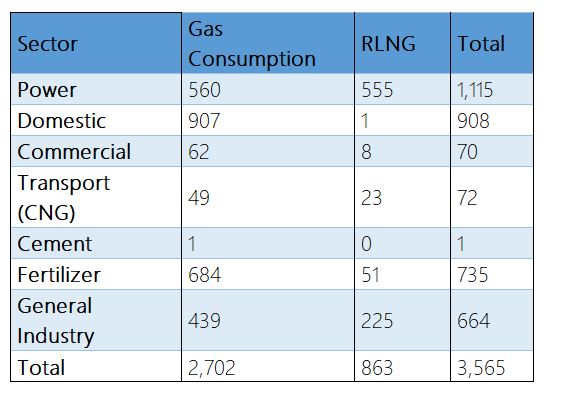

According to a document available with WealthPK, a 15-year agreement signed with Qatar in 2016 allowed Pakistan to import up to 3.75 million metric tons of LNG at a cost equivalent to 13.37 percent of Brent, which is a major step towards addressing the energy shortages. According to the Ministry of Energy and Power Division, Pakistan signed a contract in 2021 for 3 million metric tons of LNG at a price of 10.2 percent of Brent oil. Around 23 percent of natural gas consumption is met through LNG, showing how critical it is for the country. The LNG sector contributes significantly to power generation. From July to April 2022, according to the Pakistan Economic Survey 2021-22, the contribution of RLNG to the electricity installed capacity had increased to 23.8 percent (9,884 MW) of the total power installed capacity. Sector-wise natural gas consumption in million cubic feet per day (Mmcfd)

According to the survey, around 64.3 percent (555mmcfd) of the total imported LNG is consumed by the power sector. The general industry is the second largest consumer of LNG, with 225mmcfd (27 percent) of the total imported LNG consumed by this sector. The short-term solution for Pakistan is to negotiate with Qatar and sign a contract for a specified period of time. As a result, spot purchases of LNG will be avoided, and the cost of doing so will be much lower. The long-term solution is a shift toward renewable energy which will help reduce dependence on imported LNG.

Credit: Independent News Pakistan-WealthPk