INP-WealthPk

Uzair bin Farid

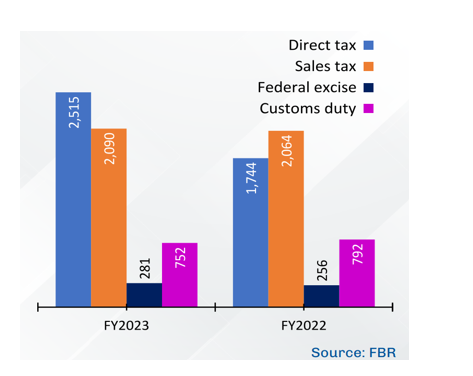

Direct taxes have surpassed sales tax and accounted for the highest share of total revenue during the July-April period of the fiscal year 2022-23. According to data available with WealthPK, the total amount of revenue generated through direct taxes reached Rs2.515 trillion followed by the revenue generated through sales tax at Rs2.090 trillion. Sales tax was followed by customs duty, which raised a revenue sum of Rs752 billion, and in the last place came the federal excise duty with a revenue generation of Rs281 billion. The total revenue collected by the Federal Board of Revenue (FBR) stood at Rs6.938 trillion during July-March FY23.

During the corresponding period of FY22, the total revenue of the government stood at Rs5.874 trillion, showing an increase of 18.1%. Increase in the revenue of the federal government was made possible due to increase in revenue from the non-tax sources. Over the previous year, a 25.5% increase in the non-tax revenue of the government was witnessed, while tax-collection by the FBR increased by 16.5%.

FBR Tax Collection (Rs. bn) (Jul-Apr)

Since tax collection and revenue generation witnessed considerable increase over the past year, fiscal deficit also shrank to 3.6% of gross domestic product (GDP) compared to 3.9% deficit last year. Over the past fiscal year (FY22), direct taxes increased by 44% from Rs1.744 trillion to Rs2.515 trillion during the current fiscal year. Although sales tax has also increased in absolute amount from Rs2.064 trillion to Rs2.090 trillion, but the increase (1.2%) in itself is very modest. Declining share of sales tax in total revenue is indicative of the harmful effects of inflation on the consumption patterns of end-consumers. When sales decline, consequently, the revenue generated from sales tax also declines.

Declining sales indicate that people are shunning spending their money, and overall demand in the economy is stagnating or even decreasing. This puts the production sector in a bad loop where their products are not being sold and they suffer losses. As a result, capital is wasted and investment behaviours take a turn for the worst. Declining investment and decreasing production activity result in layoffs. Therefore, it must be stressed that the government takes emergency measures to control inflationary pressures as they are hurting the economy beyond repair.

Credit : Independent News Pakistan-WealthPk