INP-WealthPk

Uzair bin Farid

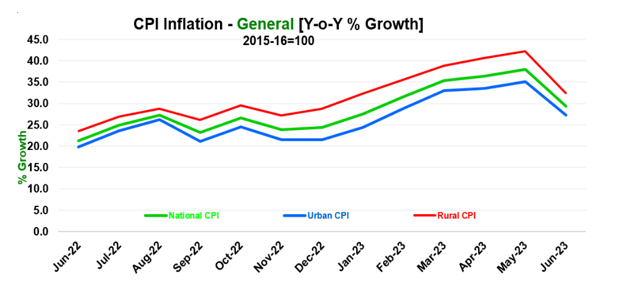

The gap between rural and urban inflation in Pakistan has widened to 5.1 percentage points, putting the poorest people in rural areas at greater risk of losing their social protection. According to data available with WealthPK, rural inflation as measured by the Rural Consumer Price Index (RCPI) on the general level for the month of June 2023 stood at 32.4% on a year-on-year (YoY) basis. The same statistic for urban inflation as measured by Urban CPI (UCPI) stood at 27.3% on a YoY basis.

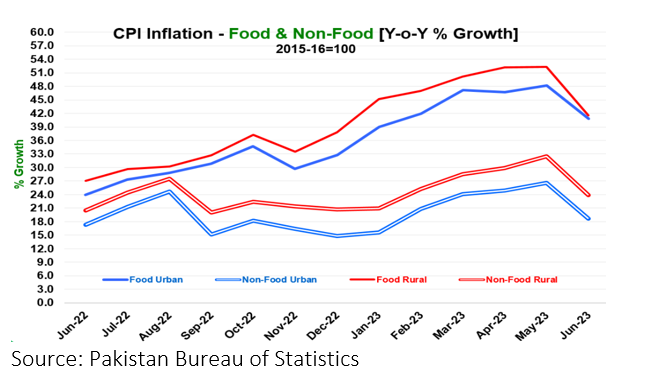

Food CPI for urban settings stood at 40.8% year-on-year, whereas for the rural settings it stood at 41.5% YoY. Similarly, the non-food CPI for the month of June-2023 stood at 18.7% YoY for urban areas and 23.8% for rural areas YoY. Core inflation rate, which is measured by excluding the price indices of food and energy items, also registered a stark difference between rural and urban settings. For urban areas core inflation rate stood at 18.5% YoY for the month of June 2023. On the other hand, the same statistic for rural areas reached to a high of 25.3% in the same month YoY.

Source: Pakistan Bureau of Statistics

High rural inflation can be attributed to various reasons, chief among which is the food inflation. Since in rural settings income levels are usually low people do not have enough liberty to expand their consumption basket. They, therefore, are more concerned about procuring food for their dependents than about higher forms of consumption. The index that calculates the rural and urban price differential used by the Pakistan Bureau of Statistics (PBS) gives more weight to food basket in the Rural Consumer Price Index (RCPI) as compared to the UCPI. In RCPI the weight of food and non-alcoholic beverages is 40.87% whereas in UCPI they have the weight of 30.42%.

According to the Pakistan Economic Survey 2022-23, rural inflation is higher than the urban inflation for various reasons, such as weak price regulation, low incomes, high demand for food items (hence the higher weight given in the index), transaction costs, and limited competition among suppliers. Similarly, over the past year the effects of floods and the continuing effects of the Covid-19 pandemic may well have contributed to the persistent gap between rural and urban inflation rates.

Since, in rural areas public services are already meagre with low penetration of communication and connectivity infrastructure, high prices of food and other commodities mean that people in rural areas are more vulnerable to lapses in their food and social security than those in urban areas. The government needs to take effective measures to bring down prices in rural areas.

Credit: INP-WealthPk