INP-WealthPk

Qudsia Bano

Roshan Packages Limited has released its financial results for the three months and nine-month periods ended March 31, 2023, posting a decline in profits due to challenges in the operating environment.

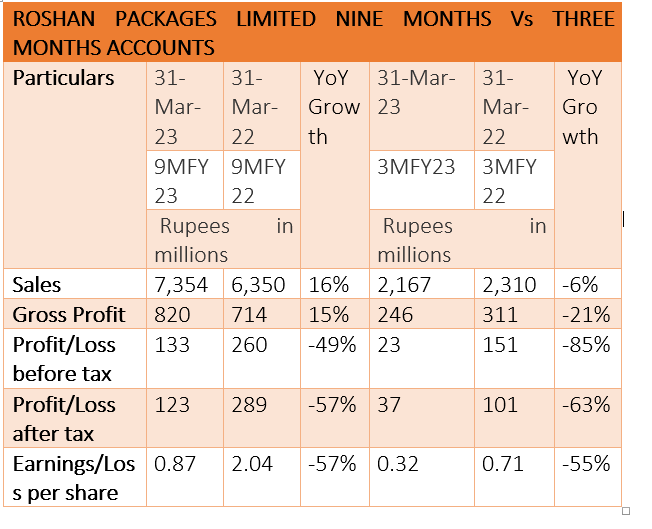

Nine-month accounts analysis

Roshan Packages recorded sales of Rs7.35 billion during the nine-month period of FY23, indicating a year-on-year (YoY) growth of 16%. This growth in sales demonstrates the company's ability to capture market opportunities and expand its customer base. The gross profit for the nine-month period amounted to Rs820 million, representing a 15% YoY growth. This growth in gross profit reflects Roshan Packages’ effective cost management and pricing strategies, enabling it to maintain healthy profit margins.

However, the company's profitability faced challenges during this period, as evidenced by a decline in profit-before-tax. Roshan Packages reported an after-tax profit of Rs133 million, reflecting a significant decrease of 49% compared to the same period of the previous year. This decline can be attributed to various factors, including increased operating expenses, potential supply chain disruptions, or changes in market dynamics.

The after-tax profit for the nine months amounted to Rs123 million, indicating a substantial YoY decline of 57%. This decrease in profitability further emphasises the challenges faced by the company during this period. Earnings per share (EPS) for the nine-month period stood at Rs0.87, down by 57% compared to Rs2.04 in the same period last year. The decline in EPS suggests a decrease in profitability per share, impacting the company's ability to create value for its shareholders.

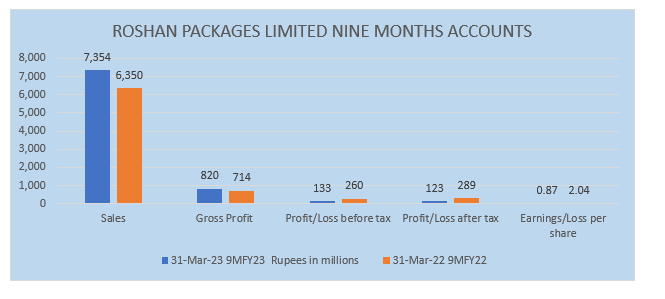

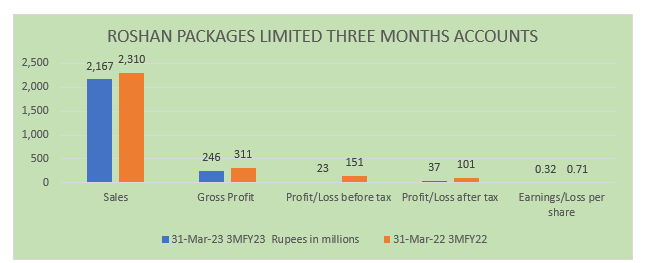

Three-month analysis

In the three months ended March 31, 2023, Roshan Packages encountered further difficulties, resulting in a more challenging financial performance. During this period, the company reported sales of Rs2.17 billion, representing a YoY decrease of 6%. This decline in sales may be attributed to various factors, including macroeconomic conditions, competitive pressures, or changes in customer demand. The gross profit for the quarter amounted to Rs246 million, reflecting a significant YoY decline of 21%. This decrease in gross profit suggests potential challenges in managing production costs and maintaining profit margins.

Profit-before-tax witnessed a substantial decline of 85%, with Roshan Packages reporting a pre-tax profit of Rs23 million. This decline in profitability highlights the impact of unfavourable market conditions or operational inefficiencies during this quarter. After-tax profit for the three-month period stood at Rs37 million, reflecting a YoY decline of 63%. This decrease in profitability further emphasises the challenging business environment faced by the company during this period. EPS for the quarter amounted to Rs0.32, down by 55% compared to Rs0.71 in the same period last year. The decline in EPS highlights the decreased profitability per share for the company during this quarter.

Historical ratio analysis

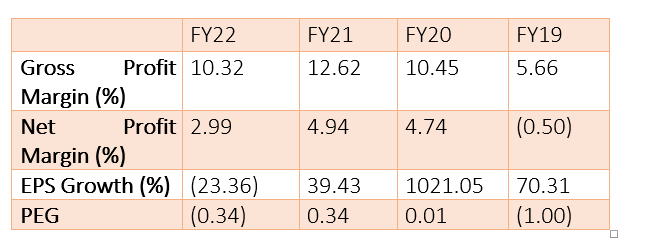

Roshan Packages Limited's historical ratios provide insights into the company's profitability, efficiency, and growth trends over the years.

Gross profit margin (%)

The gross profit margin measures the percentage of revenue retained after deducting the cost of goods sold. Roshan Packages experienced fluctuations in its gross profit margin over the years. In FY22, the gross profit margin was 10.32% compared to the previous year's margin of 12.62%. The decline may indicate challenges in managing production costs or potential pricing pressures.

Net profit margin (%)

The net profit margin indicates the percentage of revenue converted into net profit after deducting all expenses. Roshan Packages demonstrated a declining trend in the net profit margin over the years. In FY22, the net profit margin was 2.99%, down from 4.94% in FY21. The decrease may be attributed to various factors such as increased operating expenses, changes in market conditions, or reduced profitability.

EPS growth (%)

The EPS growth reflects the percentage change in earnings per share over time, indicating the company's ability to generate profits and distribute them among shareholders. Roshan Packages experienced significant fluctuations in EPS growth. In FY22, the EPS growth was negative at -23.36%, following a strong growth of 39.43% in the previous year. The negative growth may be due to challenges in maintaining profitability or unfavourable market conditions.

PEG (price/earnings to growth) ratio

The PEG ratio assesses the relationship between a company's price-to-earnings ratio and its EPS growth rate, providing insights into the company's valuation relative to its growth potential. Roshan Packages’ PEG ratio also showed fluctuations over the years. In FY22, the PEG ratio was -0.34, indicating a potentially undervalued stock relative to its EPS growth rate. However, it is important to note that negative PEG ratios may suggest caution or other factors influencing the valuation.

About the company

Roshan Packages was incorporated in Pakistan as a private company limited by shares on August 13, 2002 under the Companies Act, 2017. The company was converted into a public limited company on September 23, 2016 and got listed on Pakistan Stock Exchange on February 28, 2017. It is principally engaged in the manufacture and sale of corrugation and flexible packaging materials.

Credit: INP-WealthPk