INP-WealthPk

Ayesha Mudassar

A series of macroeconomic shocks, including multiple waves of Covid-19 pandemic, the outbreak of the Ukraine crisis and the resultant supply chain disruptions, have resulted in multi-decade high inflation around the world. In response to price hikes, central banks in advanced and emerging economies moved to shun the accommodative monetary policy. “This proactive policy approach was aimed at ensuring sustainable growth and keeping inflation expectations anchored,” said Dr Sajid Amin Javed, Deputy Executive Director at the Sustainable Development Policy Institute (SDPI). He said the removal of monetary accommodation meant raising interest rates and reducing the money supply.

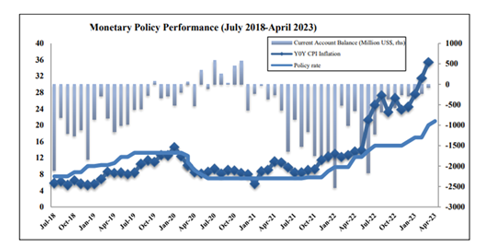

As per the Economic Survey of Pakistan 2022-23, the policy rate increased by 430 basis points (bps) in the US, 250 bps in Euro Area, 330 bps in the UK, 450 bps in Brazil, 300 bps in Australia, 230 bps in India, 200 bps in Indonesia, 350 bps in the Philippines and 630 bps in Pakistan. Amin Javed said that the State Bank of Pakistan (SBP) also started tightening monetary policy when these shocks appeared in major economic indicators. Cumulatively, the policy rate was raised by 675 bps to 13.75% in FY22. It was increased by 725 bps during the July-April period of FY23 to 21% on account of persistent inflationary pressures.

The situation further deteriorated after fiscal and external adjustments, which changed the inflation outlook for FY23 to 27-29% against the projection of 21-23%. Furthermore, the flash floods of 2022 worsened economic growth prospects. In response to this, the policy rate was increased by 300 bps to 20% in March 2023 and further by 100 bps to 21% in April 2023. Now, meeting the IMF condition for approval of a short-term loan, the central bank has further jacked up the policy rate to 22% to tame inflation.

Moreover, SBP also introduced other measures to combat demand-side pressures on import payments. These measures included increasing the commercial banks’ cash reserve requirement (CRR), tightening prudential regulations (PRs) for consumer and auto financing, and imposing cash margin requirements (CMRs) on additional imported items. In addition, it was decided to increase the frequency of monetary policy reviews from six to eight times a year to make the process of monetary policy formulation more responsive to the rapidly-changing situation.

Credit: INP-WealthPk