INP-WealthPk

Arooj Zulfiqar

Transformation of Pakistan's rural agricultural organisations into legal entities is an urgent necessity to transfer its benefits to people, said an expert. “A big part of Pakistan's economy is smallholder agriculture, and this transformation will help farmers become more productive,” said Faiz Rasool, Senior Policy Adviser, Global Alliance for Improved Nutrition (Gain). “Currently, many rural agricultural organisations in Pakistan operate informally, lacking legal recognition and structure. This informal setup poses numerous challenges, including limited access to credit, inadequate financial management, and a lack of accountability.

By formalising these organisations into legal entities, these issues can be effectively addressed, leading to a multitude of advantages,” he said. Faiz pointed out that a major reason behind the decline of the agriculture sector was the unavailability of financing to farmers. Bankers lack the institutional means to gather meaningful data about farms and rural businesses. “With non-existent formal financing, agricultural transformation is not possible. So, our population will continue to face food supply issues. Farmers are at the mercy of local money lenders, though they at least bring some liquidity to farm operations,” he mentioned. He said banks demand a lot of paperwork, making it hard to get a loan, and they also had to pledge their land to get the loan.

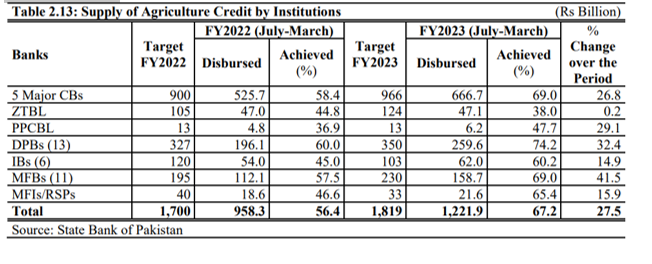

“It's therefore important to restructure the financing policy,” he emphasised. He said the government should make policies that let farmers borrow money without pledging their land, which is their only source of income. “This will empower farmers to invest in modern farming techniques, procure quality inputs, and expand their operations, thereby enhancing productivity and profitability,” he added. Land ownership in Pakistan is highly inequitable with 2% of farmers owning 45%, and 98% owning the rest. Pakistan's farm economy is dominated by 7.4 million small holders who cultivate less than 12.5 acres. Most of these small farmers use rudimentary technologies, face inefficient input and output markets, and rely on high-cost informal credit markets.According to Pakistan Economic Survey 2022-2023, banks distributed Rs1.2 trillion in agriculture credit during FY23, against the target of Rs1.8 trillion

Credit : Independent News Pakistan-WealthPk