INP-WealthPk

Amir Khan

Implementation of prudent strategies will promote legal remittance flows, increase transparency, and harness the economic potential for national development, Dr. Zahid Asghar, economic researcher at the Planning Commission of Pakistan, told WealthPK. The global remittance trade has experienced an alarming rise in illicit transactions, constituting a staggering 80% of all remittances, equivalent to an astounding $700 billion, he said. Despite witnessing substantial growth, with remittances increasing by over 35% from $23.1 billion in FY20 to a peak of $31.3 billion in FY22, the current fiscal year has witnessed a sharp decline. Over the first 11 months leading up to May, Pakistan suffered a loss of $3.7 billion in remittances, with inflows decreasing by approximately 13% to $24.8 billion compared to the previous year's $28.5 billion.

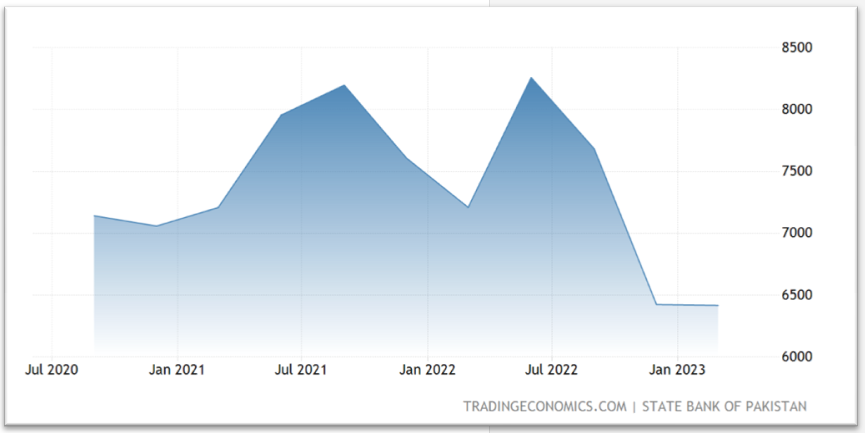

The data in the vertical line is in millions of USD This decline can be attributed to the increased use of the hawala/hundi system for remittances, he added. To address this issue and restore confidence in the legal remittance channels, Dr. Zahid suggested that the remittance process should be simplified and streamlined by reducing the bureaucratic procedures, paperwork, and transaction costs.

The establishment of efficient and user-friendly systems such as digital platforms or mobile money transfer services plays a crucial role in achieving this objective, said the Planning Commission researcher. Furthermore, the government aims to enhance financial inclusion by expanding access to formal financial services, including banking and mobile banking, in both urban and rural areas. This initiative ensures that the individuals have easier access to remittance services, thereby encouraging them to use formal channels for sending and receiving money.

In addition, policies and incentives are being introduced to promote the use of legal channels for remittances. Measures such as reducing transaction fees, offering tax incentives, and providing financial literacy programs are being implemented to raise awareness among migrants and their families about the benefits of formal remittance channels. Lastly, Dr Zaid said the regulatory framework governing remittances is being strengthened to ensure robust oversight and control.

Stricter regulations now require remittance providers to register and obtain licenses, and compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) measures are being enforced. Cumulatively, these strategies will also shift remittances from the hawala/hundi system to the official interbank channel, thereby safeguarding remittances and fostering economic growth. By taking these actions, the government hopes to improve the remittance landscape, allowing people to transfer money safely and legally and boosting the nation’s economic development.

Credit: INP-WealthPk