INP-WealthPk

Hifsa Raja

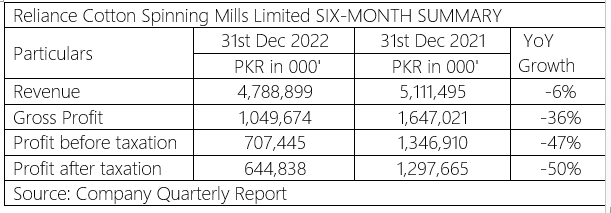

Reliance Cotton Spinning Mills Limited’s revenue decreased 6% to Rs4.7 billion in the first half (July-December) of the ongoing Fiscal Year 2022-23 from Rs5.1 billion in the corresponding period of the previous year, reports WealthPK. The company’s gross profit declined 36% to Rs1.04 billion in 1HFY23 from Rs1.64 billion in the corresponding period of FY22. This indicates that the company is facing challenges in maintaining profitability due to a decrease in revenue and increasing costs.

The profit-before-taxation in 1HFY23 also dropped to Rs707 million from a profit of Rs1.34 billion in 1HFY22, registering a negative growth of 47% year-on-year. Similarly, the profit-after-taxation shot down 50% to Rs644 million in 1HFY23 from Rs1.29 billion in 1HFY22. The results suggest that the company may need to evaluate its business strategies and implement corrective measures to improve its financial performance in future.

The global outlook remains tilted to the downside due to the lower growth projections and higher inflation, with the possibility of additional adverse shocks pushing the world economy into recession. Whereas in Pakistan, the deteriorating macroeconomic indicators pose significant challenges for growth during the remainder of the financial year and beyond. Despite these challenging circumstances, the company is taking every possible measure to maximize capacity utilization to maintain growth and profitability.

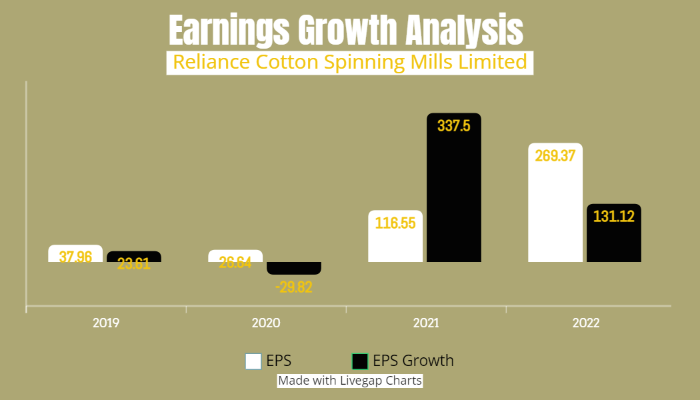

Earnings growth analysis:

In 2019, the EPS was at Rs37.96, which decreased to Rs26.64 in 2020. However, in 2021, the EPS increased significantly to Rs116.55, which was followed by another growth and stood at Rs269.37 in 2022. These figures suggest that the company has gone through some fluctuations in its earnings per share. However, the company has recovered and shown significant growth in the last two years.

The EPS growth has been quite volatile. In 2019, there was a growth of 23.61%, but in 2020, it decreased by 29.82%. However, in 2021, there was a significant increase in EPS growth of 337.5%, which further increased to 131.12% in 2022. This suggests that the company experienced a major improvement in its earnings performance during 2021, which continued into the next year. It could indicate good prospects for future growth and profitability.

Industry comparison

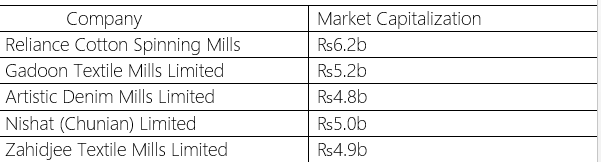

The company’s competitors include Gadoon Textile Mills Limited, Artistic Denim Mills Limited, Nishat (Chunian) Limited, and Zahidjee Textile Mills Limited.

The company has the highest market capitalization of ₨6.2 billion followed by Gadoon Textile Mills Limited with ₨5.2 billion, Nishat (Chunian) Limited with ₨5.0 billion, Zahidjee Textile Mills Limited with ₨4.9 billion, and Artistic Denim Mills Limited with ₨4.8 billion. The market capitalization provides an indication of the total value of a company as perceived by the stock market.

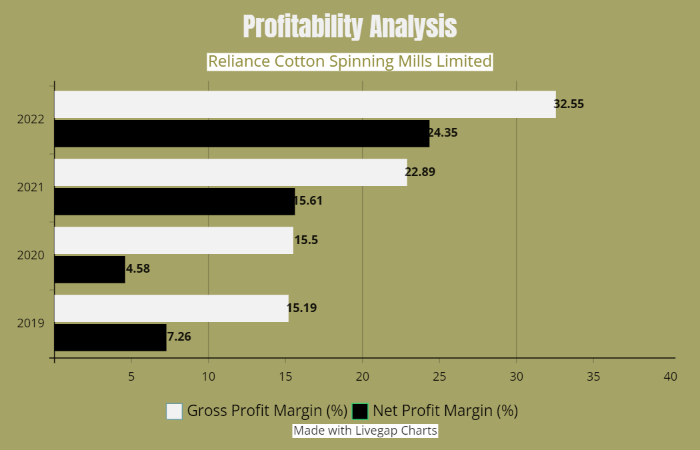

Profit or loss over the years:

The gross profit margin increased from 15.19% in 2019 to 32.55% in 2022, indicating that the company has been able to control its cost of sales and increase its pricing power. Similarly, the net profit margin increased from 7.26% in 2019 to 24.35% in 2022, indicating that the company has been able to effectively manage its operating expenses and generate higher profits from its operations. Overall, the increasing trend in both gross and net profit margins is a positive sign for the company’s financial performance and indicates its ability to generate higher profits over time.

Company profile

Reliance Cotton Spinning Mills Limited was incorporated in Pakistan on June 13, 1990, as a public limited company under the Companies Ordinance, 1984 (now the Companies Act, 2017). The principal activity of the company is manufacture and sale of yarn.

Credit : Independent News Pakistan-WealthPk