INP-WealthPk

Qudsia Bano

Rafhan Maize Products Company Limited, a leading player in the industrial and food ingredient sectors, has demonstrated remarkable resilience in the first three months of the ongoing calendar year 2023 despite various headwinds, including political instability, foreign exchange constraints, currency devaluation, and rising energy and commodity prices.

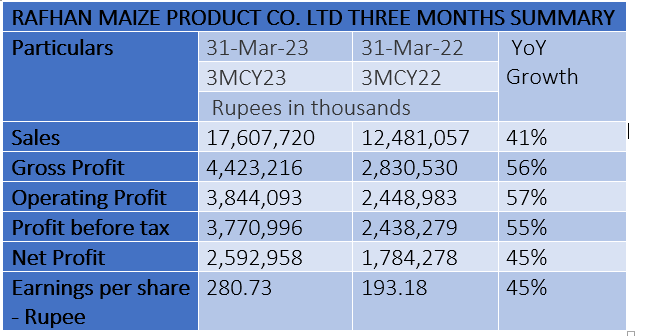

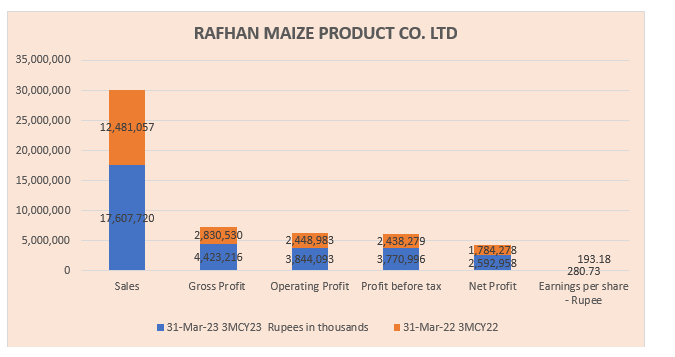

The company reported a significant increase in net sales with revenues reaching a staggering Rs17.6 billion during the first quarter of 2023, representing an impressive 41% growth compared to the same period last year. This growth is particularly notable considering the challenging economic conditions prevailing in the country.

The company's gross profit has also witnessed a commendable upswing, standing at Rs4.4 billion, denoting a 56% increase compared to the first quarter of 2022. Operating profit and profit-before-tax have both followed suit, registering growth rates of 57% and 55%. respectively. Notably, the net profit of Rafhan Maize Products has surged to Rs2.6 billion, representing an impressive 45% increase over the same period last year.

These exceptional financial results can be attributed to the company's strategic initiatives focused on improving operational efficiencies, implementing cost-cutting measures, optimising corn procurement, and rationalising prices. Despite the adverse market conditions, the company has effectively weathered the storm, reaffirming its position as a resilient and agile industry player. The food ingredients business encountered challenges due to soaring inflation, particularly in the food and related sectors, leading to changes in demand patterns.

Consequently, volumes remained lower, especially in confectionery and bakery products. However, the demand for animal nutrition ingredients remained steady, primarily driven by the poultry and dairy/livestock industries. This stability was fueled by a shortage of alternative feed ingredients and the competitive pricing offered by the company. Despite the prevailing economic headwinds, Rafhan Maize Products has demonstrated its ability to adapt and thrive. The company's strong financial performance, driven by improved operational efficiencies, cost-cutting measures, and strategic pricing, reinforces its position as a resilient market leader.

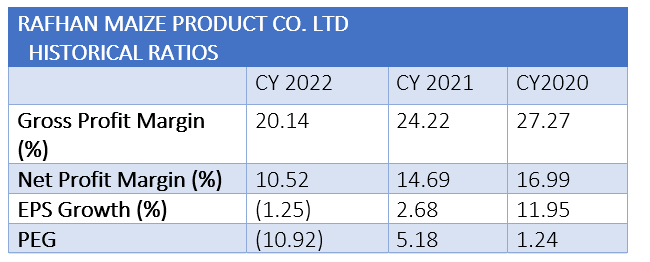

The gross profit margin measures the percentage of revenue that remains after deducting the cost of goods sold. A higher gross profit margin indicates better efficiency in managing production costs. Looking at the historical trend, the gross profit margin has been gradually declining over the past three years. In CY20, the margin stood at a healthy 27.27%, but it dropped to 24.22% in CY21 and further decreased to 20.14% in CY22. This declining trend suggests the company might be facing challenges in managing production costs and may need to address this aspect to maintain profitability.

The net profit margin represents the percentage of revenue that translates into net profit after deducting all expenses, including taxes and interest. Similar to the gross profit margin, the net profit margin has also shown a downward trend over the years. In CY20, the net profit margin was 16.99%, which declined to 14.69% in CY21 and further decreased to 10.52% in CY22. This decline indicates that the company's profitability has been adversely affected by various factors, such as rising expenses or a decrease in sales prices. It is crucial for Rafhan Maize Products to identify and address the factors affecting net profit margins to enhance overall financial performance.

The earnings per share (EPS) growth percentage represents the annual change in EPS of the company. Positive EPS growth indicates the company's earnings have increased year over year, while negative EPS growth suggests a decline in earnings. In the case of Rafhan Maize Products, the EPS growth has been fluctuating over the years. CY20 saw a healthy EPS growth of 11.95%, indicating a significant increase in earnings per share. However, in CY21, the EPS growth dropped to 2.68%, and in CY22, it turned negative at -1.25%. This fluctuating trend suggests the company's profitability and earnings have been facing volatility and could be affected by market conditions and other internal factors.

The PEG ratio assesses the relationship between the company's price-to-earnings (P/E) ratio and its EPS growth rate. A PEG ratio below 1 suggests the stock might be undervalued relative to its earnings growth, while a ratio above 1 indicates the stock might be overvalued. In the case of Rafhan Maize Products, the PEG ratio has been highly volatile over the years.

In CY20, the PEG ratio was at a reasonable 1.24, suggesting the stock was appropriately valued relative to its earnings growth. However, in CY21, the PEG ratio spiked to 5.18, indicating the stock has been overvalued given the relatively lower EPS growth during that period. In CY22, the PEG ratio plummeted to a negative value of -10.92, which could be due to the negative EPS growth. The significant fluctuations in the PEG ratio warrant attention, and investors should carefully assess the company's growth prospects and valuation.

About the company

Rafhan Maize Products Company Limited, a Pakistani company, is majority-owned by Ingredion Incorporated Chicago, US. The company uses maize as the basic raw material to manufacture and sell a number of industrial products, the principal ones being industrial starches, liquid glucose, dextrose, dextrin and gluten meals.

Credit: INP-WealthPk