INP-WealthPk

Hifsa Raja

An investor should consider some attractive opportunities in the form of dividend shares in the market as cash-rich companies are able to distribute dividends among their shareholders more frequently, said Muhammad Dilnawaz, manager of Yasir Mehmood Securities (Pvt) Limited. Investing in the market when it is low might benefit investors and increase their profits as it is the time when market starts to get back to normal, he added while talking to WealthPK during an interview.

WealthPK: What kind of shares a shareholder should purchase to maximise profits?

Muhammad Dilnawaz: There are two types of shares – capital gains shares and dividend shares. Dividends can be in the form of cash or in the form of stocks. Dividends may be a preferable option if you need a consistent source of income. On the other hand, capital gains might be a better choice if you're hoping to increase your fortune overtime.

WealthPK: What types of firms should an investor invest in?

Muhammad Dilnawaz: The investors should go for the company free of any bank debt or loans. It's crucial that the company should have its own capital. The second factor is that a corporation needs to be active in several different industries. Companies relying on different profits are more secure.

WealthPK: What particular company should the investor consider for investment for future growth?

Muhammad Dilnawaz: Orient has been a great investment opportunity since it is providing services to clients in Europe and America. The revenue of the company is intact.

WealthPK: Why should an investor choose your brokerage firm over others for investment?

Muhammad Dilnawaz: Our brokerage firm has a policy of not accepting fake entries. Some brokerage houses pass fake entries to show progress. Our strategy for pursuing the market is practical. An investor should choose our organisation for investing because we charge extremely low commission rates. We assist the investor with market analysis and investment.

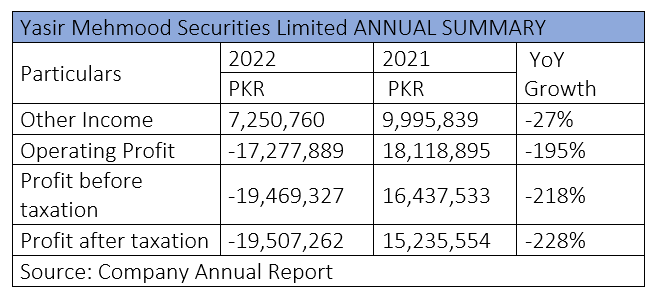

Annual Performance of Yasir Mehmood Securities

During the fiscal year 2021-22, the company’s income dipped 27% to Rs7.2 million compared to an income of Rs9.95 million in the fiscal year 2020-21. The company sustained an operating loss of Rs17 million in FY22 compared to the operating profit of Rs18 million in FY21, showing a decrease of 195% year-on-year.

The firm also suffered a loss-before-tax of Rs19.46 million in FY22 compared to the before-tax profit of Rs16.43 million in FY21. Similarly, the company’s loss-after-tax in FY22 stood at Rs19.5 million compared to the after-tax profit of Rs15.23 million in FY21, showing a loss of 228%.

Company profile

Yasir Mehmood Securities Private Limited is principally engaged in the business of brokerage. The office of the company is situated at Room No.205, 2nd Floor, Lahore Stock Exchange building, 19-Khayaban-e-Aiwan-e-Iqbal, Lahore. The company is the holder of Trading Right Entitlement Certificate (TREC) of the Pakistan Stock Exchange.

Credit : Independent News Pakistan-WealthPk