INP-WealthPk

Ayesha Mudassar

Public debt management is vital to meet the government's gross financing requirements at the lowest possible cost while ensuring a prudent degree of risk. Fiscal Responsibility and Debt Limitation (FRDL) Act 2005 defines "Total Public Debt" as the debt owed by the government serviced out of consolidated funds and debts owed to the International Monetary Fund (IMF).

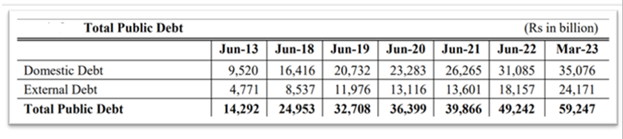

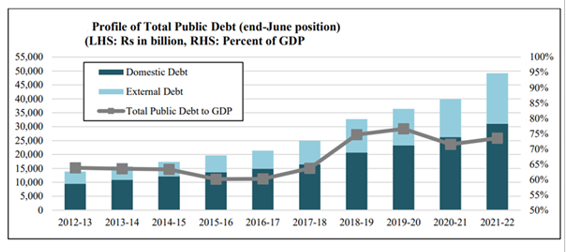

As per the Economic Survey of Pakistan 2022-23, the total public debt soared to Rs59,247 billion at end-March 2023. The domestic debt was Rs35,076 billion and external public debt was Rs24,171 billion or US$85.2 billion

Source: State Bank of Pakistan (SBP) and Ministry of Finance

Source: SBP and Debt Management Office

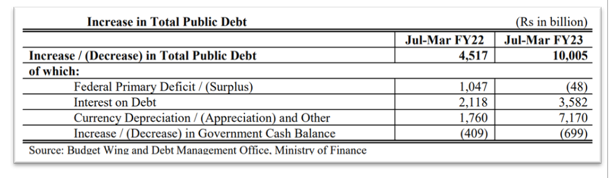

Dr Vaqar Ahmed, Joint Executive Director Sustainable Development Policy Institute (SDPI), has listed the factors that caused an increase in the public debt. These include fiscal deficit, high-interest rates, exchange rate movements, and changes in the government's cash balance.

“Apart from the financing of fiscal deficit, rupee depreciation against the dollar by around 39% led to a significant increase in the external public debt. Furthermore, interest expense was recorded at Rs3,582 billion during the first nine months of the current fiscal year. Besides, the conduct of monetary and fiscal policies also impacted the sustainability of public debt,” the SDPI joint executive director said. Mentioning the conduct of public debt management, Dr Vaqar told WealthPK that it varies from country to country due to different institutional setups, legal frameworks, economic fundamentals, and governance structures.

Nevertheless, the prime objective is to ensure that both the level and rate of growth in public debt are fundamentally sustainable while guaranteeing that the debt portfolio is efficiently structured in terms of currency composition, interest rates, and maturity profile. Moreover, it is important to acknowledge the role of macroeconomic policies in debt sustainability, considering that the overall net gains of macroeconomic policies should be positive.

Credit: INP-WealthPk