INP-WealthPk

Hifsa Raja

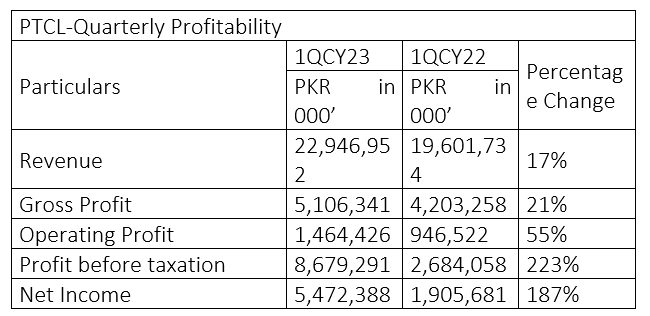

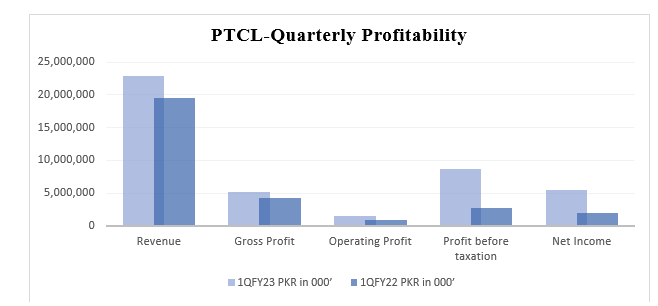

Pakistan Telecommunication Company Limited (PTCL) enjoyed comprehensive profits in the first quarter (January-March) of the ongoing calendar year 2023. The company’s gross revenue increased 17% to Rs22.9 billion in 1QCY23 from Rs19.6 billion in 1QCY22. This substantial growth in revenue was primarily attributable to strong performance in the fixed broadband, mobile data, business solutions, and banking services. PTCL’s gross profit grew 21% to Rs5.1 billion in 1QCY23 from Rs4.2 billion over the same period of last year. The company posted an operating profit of Rs1.46 billion with a 55% growth over last year.

The company posted a gigantic growth of 187% in net profit, which ballooned to Rs5.4 billion in 1QCY23 from Rs1.9 billion in 1QCY22. The growth was attributed to increase in non-operating income due to translation gain on the company’s forex denominated receivables, dividend income from a subsidiary and gain on disposal of obsolete assets due to upgrade and fiberisation of network.

PTCL- annual performance

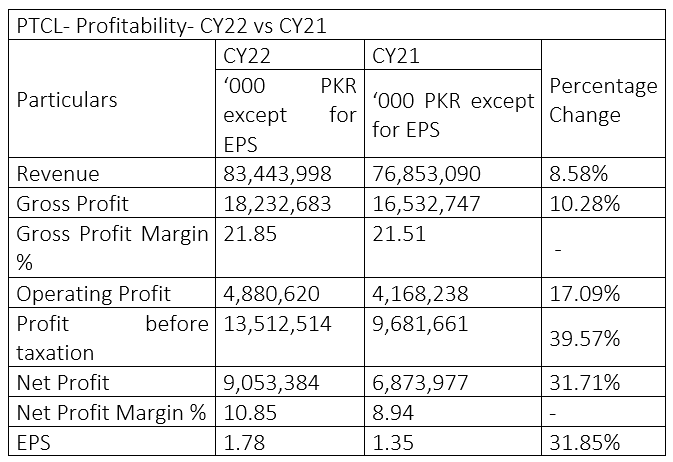

PTCL has also released its annual performance report, showcasing significant achievements in 2022. The company recorded a notable 8.5% increase in revenue, which jumped to Rs83 billion from Rs76 billion the previous year. Similarly, its gross profit increased 10% to Rs18.2 billion in CY22 from Rs16.5 billion in CY21.

The growth in revenue and gross profit was due to the company’s operational efficiency and effective strategies of cost management. In line with the gross profit, PTCL’s operating profit saw a substantial rise of 17% to Rs4.88 billion in CY22 from Rs4.16 billion the previous year. PTCL was able to drive its profitability through operational optimisation.

The company's profit-before-tax experienced a remarkable 39% growth, reaching Rs13.5 billion in CY22 compared to Rs9.68 billion in CY21. This exceptional performance indicates PTCL's success in expanding its market presence and effectively managing its financial position. The net profit increased 31.71% to Rs9.05 billion in CY22 from Rs6.87 billion in CY21.

The net profit margin increased to 10.85% in CY22 from 8.94% in CY21, displaying a positive trend. PTCL efficiently managed its costs, which contributed to the robust net profit margin. The earnings per share (EPS) also showed a strong growth of 31.8% and reached Rs1.78 in CY22 from Rs1.35 in CY21. The growth shows the company’s ability to generate value for its shareholders.

Price prediction using Artificial Intelligence (AI)

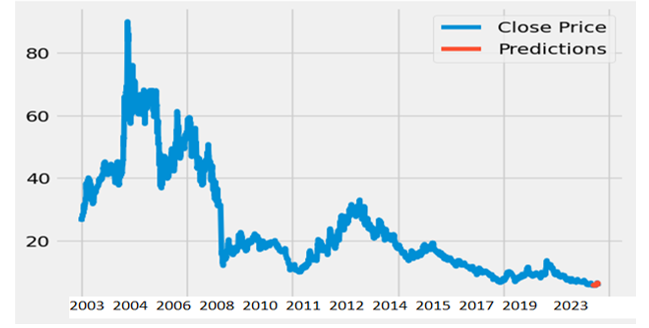

In a groundbreaking analysis, a cutting-edge AI technique was used to predict the future stock price of PTCL. By harnessing the power of a specialised recurrent neural network called Long Short-Term Memory (LSTM), the model leveraged two decades of historical data, spanning from 2003 to 2023, to generate highly accurate predictions. This opens a new era in financial forecasting, demonstrating the potential of machine learning to revolutionise investment strategies.

The analysis yielded fascinating results, as the AI-powered forecasts represented by the red line displayed an extraordinary level of accuracy in predicting the future stock price of PTCL. This is visually evident when comparing the red line to the blue line, which represents the actual close prices. The strong association between the projected and actual prices validates the effectiveness of the AI model. Notably, the forecasts consistently indicate that the PTCL stock price will remain in close proximity to Rs6 in the foreseeable future. These findings emphasise the immense potential of AI in predicting stock market trends.

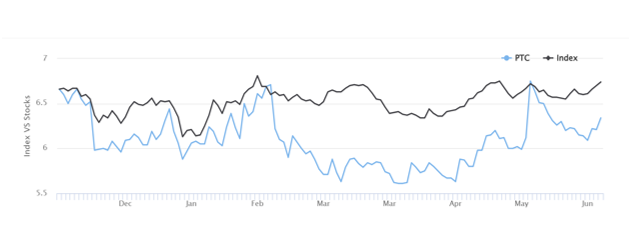

PTCL stock vs Index movement

The black line in the graph represents the Index value, while the blue line represents the share value of PTCL. During the months of December, January and February, the share price of PTCL closely followed the movement of the Index value. However, in March and April, there was a decline in the share price, dropping below Rs6 and deviating from the average Index value. This divergence suggests a deviation in the performance of PTCL compared to the overall market trend.

In May, a notable recovery occurred, with the share price experiencing a significant jump and aligning more closely with the average movement of the Index. This recovery indicated a potential stabilisation in the performance of PTCL. As we move into June, the PTCL share price continued to track the average movement of the Index, converging towards an average value of Rs6. Remarkably, this actual price movement closely aligns with the predicted price generated by the AI model, which also indicates Rs6.

These observations highlight the correlation between the PTCL share price and the Index value, with the AI model's predictions mirroring the actual price movement. This alignment suggests the efficacy of the company’s AI model in capturing and predicting the behaviour of PTCL's stock price.

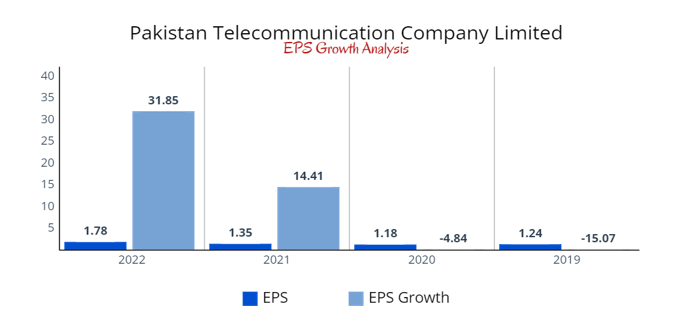

Earnings growth analysis

PTCL demonstrated notable progress in terms of its EPS growth over the past few years. In 2022, PTCL recorded an EPS of Rs1.78 with a growth of 31.85%. This growth was attributed to the significant improvement in the company’s profitability. This also indicates the positive momentum in the operations.

In 2021, the EPS stood at Rs1.35, indicating a growth rate of 14.41%. In contrast, 2020 experienced a negative EPS of Rs1.18 with a negative growth rate of -4.84%. In 2019, EPS further decreased to Rs1.24 with a negative growth rate of -15.07. This shows a setback in the profitability.

The substantial growth achieved in 2022 showcases PTCL's resilience and ability to adapt to changing market conditions, as well as effective strategies implemented by the company's management. Investors and stakeholders should closely monitor PTCL's EPS growth trajectory, as it provides valuable insights into the company's profitability and long-term sustainability. The positive EPS growth in 2022 and 2021 indicates a favourable outlook for PTCL, suggesting potential opportunities for investors seeking returns in the telecommunications sector.

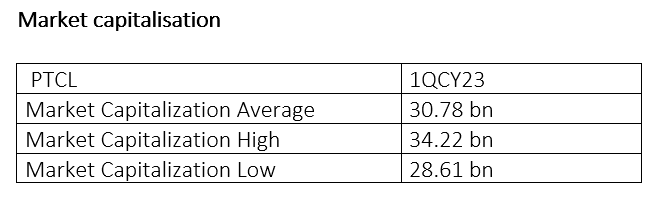

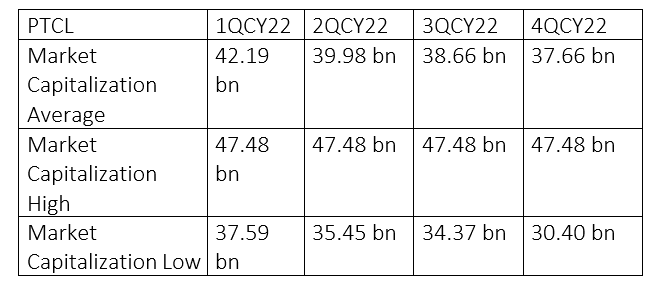

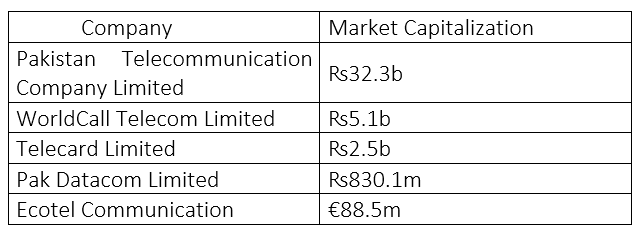

The table indicates the average market capitalisation of PTCL during the first quarter of CY23, which stood at Rs30.78 billion. This figure represents the average value that the market assigned to the company's shares during that period.

In 2022, the average market capitalisation of PTCL showed a gradual decline from Rs42.19 billion in 1QCY22 to Rs37.66 billion in 4QCY22. This suggests a decreasing trend in the market's valuation of PTCL over these quarters.

Industry comparison

PTCL’s competitors include WorldCall Telecom Limited, Telecard Limited, Pak Datacom Limited, and Ecotel Communication.

PTCL has the highest market capitalisation of ₨32.3 billion. WorldCall Telecom Limited has a market cap of ₨5.1 billion followed by Telecard Limited’s ₨2.5 billion.

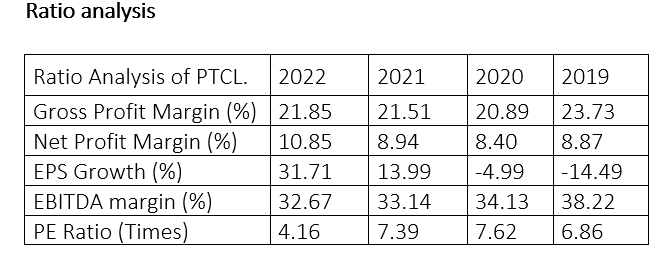

Ratio analysis

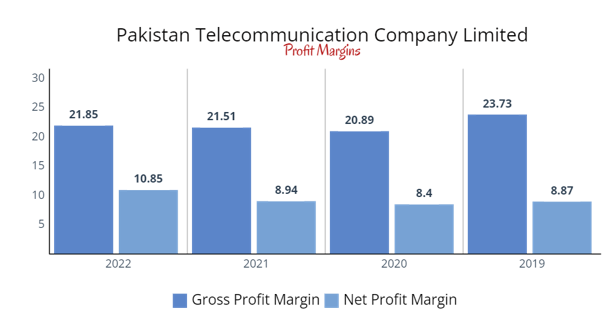

Profit or loss over the years

PTCL’s gross profit margin dropped from 23.73% in 2019 to 21.85% in 2022. The net profit margin, however, climbed from 8.87% in 2019 to 10.85% in 2022, demonstrating the company's progress in reducing operational expenses and raising operating earnings. The business's growing trend in net profit margins indicates it will eventually be able to generate higher profits.

Credit: Independent News Pakistan-WealthPk