INP-WealthPk

Qudsia Bano

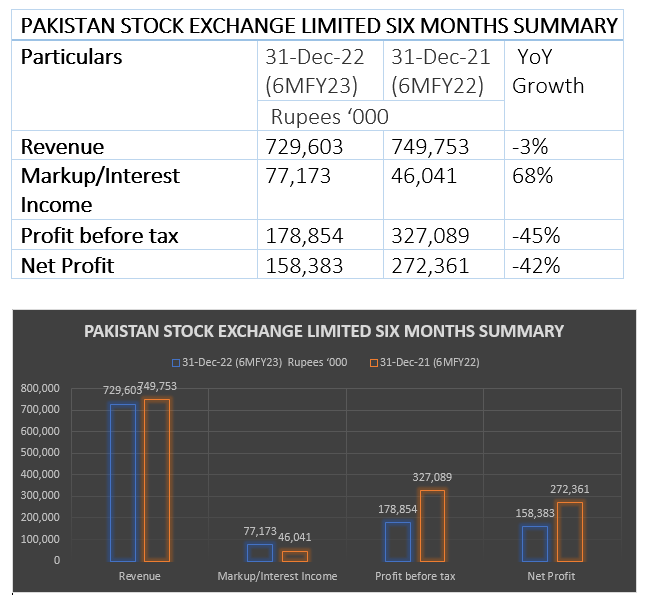

Pakistan Stock Exchange Limited’s (PSX) profit-before-tax decreased 45% to Rs179 million in the first half of the current fiscal year 2022-23 from Rs327 million over the same period of FY22. This decrease of 45% was primarily caused by the fact that the average daily traded value decreased to Rs10.7 billion in 1HFY23 from Rs18.6 billion in 1HFY22, which contributed to a Rs71 million decline in trading revenue.

The second reason behind the decline in profit was the declining performance of the associated businesses and the overall dismal state of the market and economy. The associates' share of profit was reduced by Rs42 million. The post-tax profit of PSX fell to Rs158 million in 1HFY23 from Rs272 million in 1HFY22, posting a negative growth of 42% year-on-year, reports WealthPK.

Performance in 2021-22

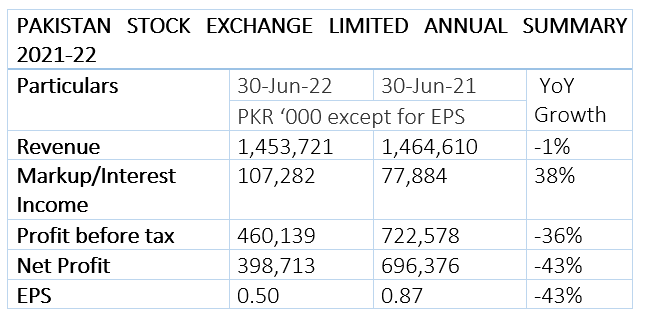

During the fiscal year 2021-22, the company’s gross sales almost remained the same as the previous year at Rs1.45 billion. However, the company’s pre-tax profit dropped to Rs460 million in FY22 from Rs722.5 million in FY21, posting a 36% decrease year-on-year. In contrast to the net profit figure of Rs696 million for FY21, this profit decreased to Rs398.7 million in FY22, posting negative growth of 43% on a year-on-year basis.

The company’s earnings per share stood at Rs0.50 for the fiscal year that ended on June 30, 2022 compared to the Rs0.87 EPS for the fiscal year that ended on June 30, 2021.

About company

Pakistan Stock Exchange Limited was incorporated under the Companies Act, 1913 (now Companies Act, 2017) on March 10, 1949, as a Company Limited by Guarantee. However, on August 27, 2012, the company was re-registered as a public company limited by shares.

PSX is engaged in conducting, regulating and controlling the trade or business of buying, selling, and dealing in shares, scripts, participation term certificates, modaraba certificates, stocks, bonds, debentures stock, government papers, loans and any other instruments and securities, including, but not limited to, special national fund bonds, bearer national fund bonds, foreign exchange bearer certificates and documents of similar nature, issued by the government of Pakistan or any other agency authorised by the government of Pakistan.

Credit: Independent News Pakistan-WealthPk