INP-WealthPk

Saba Javed

Pakistan’s stock market commenced on a negative note last week (April 10-13) mainly because of the uncertainty over the resumption of the IMF (International Monetary Fund) program. The Pakistani rupee (PKR) depreciated against the US dollar by PKR0.26/0.09% on week-on-week (WoW) basis, closing the week at 284.9/USD. The stock market closed at 40,206 points, (up by 155 points/0.4%) on Thursday, April 13.

Foreigners’ buying clocked in at $1.4 million compared to a net buying of $3.9 million the previous week. Major buying was witnessed in all other sectors ($1.4 million) and commercial banks ($0.6 million). On the local front, selling was reported by mutual funds ($1 million) followed by other sectors ($0.9 million). Average volumes reached 84 million shares, down by 24%, while the average value traded settled at $8 million, down by 28%, on WoW basis.

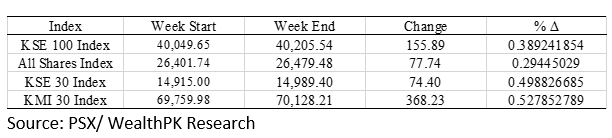

During the week under review, the market gained 155 points throughout the week, closing at 40,205.54 points, up by 0.4%. The All-Share Index increased by 77.74 points or 0.29%, the KSE 30 Index surged by 74.40 points or 0.5%, and the KMI 30 Index increased by 368.23 points or 0.53% on a WoW basis.

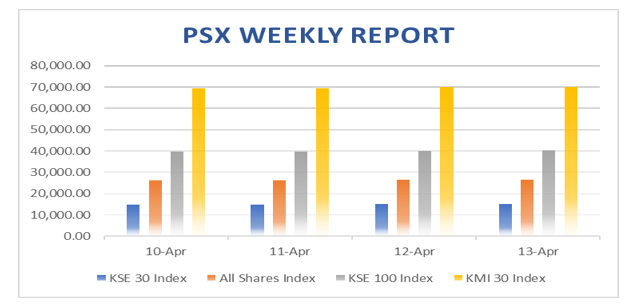

Pakistan Stock Exchange (PSX) remained under pressure on Monday, April 10, after the State Bank of Pakistan (SBP) hiked its policy rate, which raised the returns on savings certificates. The benchmark 100 Index of the PSX declined by 213.75 points, showing a negative change of 0.53%, closing at 39,835.90 points against 40,049.65 points the previous day.

On Tuesday, April 11, PSX witnessed a mixed trend and, after moving both ways, closed on a negative note with low volumes. The KSE 100 Index declined by 31.19 points, showing a negative change of 0.08%, closing at 39,804.71 points against 39,835.90 points the previous day.

On Wednesday, April 12, the stock exchange witnessed a bullish session, and the benchmark KSE 100 index crossed the 40,000 level once again after the reports that the United Arab Emirates (UAE) will provide financial assistance to Pakistan. By the end of the session, the KSE-100 Index rose 321.34 points or 0.81% to close at 40,126.05 level compared to 39,804.71 points the previous day.

On Thursday, April 13, the PSX saw a mixed session and the KSE-100 Index rose by 79.49 points or 0.2% to close at 40,205.54 points against 40,126.05 points the previous day. Trading began upward and the KSE-100 Index hit an intra-day high in the initial hour. At that point, selling pressure gripped the stock market and it fell steadily for the rest of the session.

According to Muhammad Irfan, a financial analyst at Arif Habib Limited, a leading securities brokerage, investment banking, and research firm, said key events to look out for the week after the central bank hiked its policy rate to a massive 21% include returns on savings certificates raised by big margins. So, the public cash holdings have decreased as the new rates were applied to deposits and investments.

Additionally, the UAE will confirm funding of $1 billion for Pakistan. The funding is vital to pave the way for the resumption of the IMF program for Pakistan. Renewed hopes of the signing of staff-level agreement between Pakistan and the IMF boosted investor interest before political and economic instability jumped to the fore.

Credit: Independent News Pakistan-WealthPk