INP-WealthPk

Fakiha Tariq

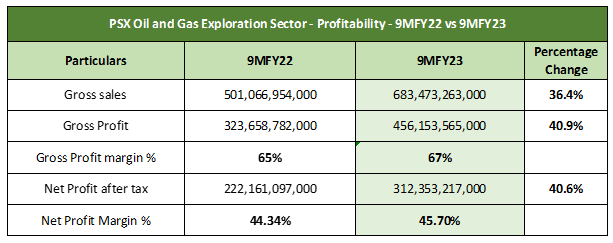

Pakistan’s oil and gas exploration sector reported an upsurge of 36.4% in revenue, 40.9% in gross profit and 40.6% in net profit over the nine-month period (July-March) of fiscal year 2022-23 compared to the same period of the last fiscal, WealthPK reports. The listed oil and gas firms collectively posted gross revenue of Rs683 billion, gross profit of Rs456 billion, and gross profit ratio of 67% in 9MFY23. The sector posted net profit of Rs312 billion and net profit ratio of 45.70%.

The oil and gas exploration sector’s revenues increased by 36.4% to Rs683 billion in 9MFY23 from Rs501 billion in the same period of FY22. Likewise, the gross profit increased 40.9% to Rs456 billion in 9MFY23 from Rs323 billion in 9MFY22. The net profit also increased by 40.6% to Rs312 billion in 9MFY23 from Rs222 billion in 9MFY22. Pakistan Stock Exchange (PSX) has four large-cap oil and gas exploration firms listed with a collective market capitalisation of Rs808.5 billion.

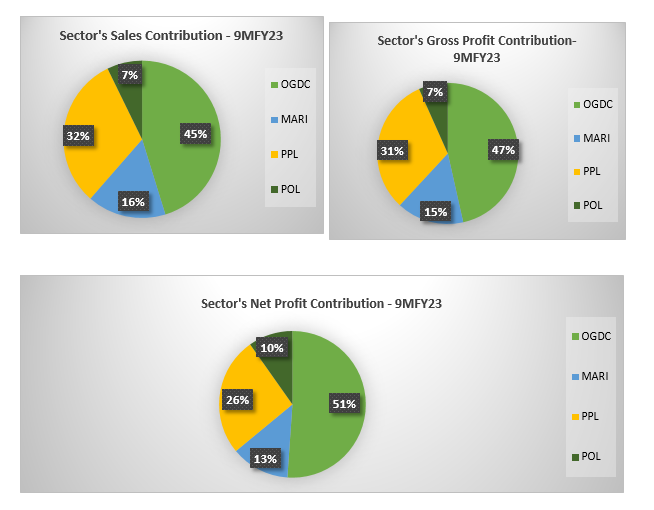

Oil and Gas Development Company Limited (OGDC) is the largest company of the sector with market capitalisation of Rs326.8 billion. All the four oil and gas exploration firms are among the top 15 companies listed on PSX. OGDC made the highest contribution of 45% in the total revenue secured by the sector followed by Pakistan Petroleum Limited (PPL) with the sales contribution of 32% in 9MFY23.

Mari Petroleum Company Limited (MARI) with a share of 16% and Pakistan Oilfields Limited (POL) with a share of 7% stood third and fourth in the sector’s total sales. OGDC led the sector by making 47% contribution to the sector’s gross profit followed by 31% contribution made by PPL. MARI added 15% and POL made the lowest contribution of 7% in the sector’s overall gross profit.

In terms of net profit, OGDC topped again by earning 51% of the sector’s net profit. PPL and MARI added 26% and 13%, respectively, to the sector’s aggregated net profit in 9MFY23. POL made the lowest contribution of 10% to the net profit.

Exploration sector – inter-firm comparison – 9MFY23

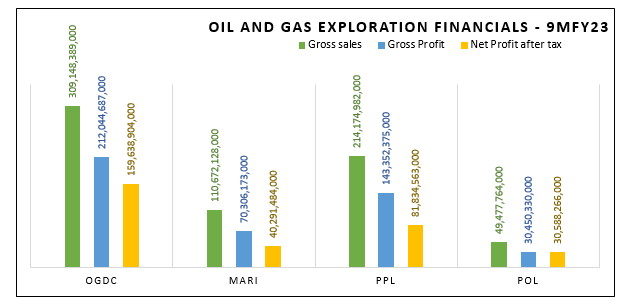

ODGC led the oil and gas exploration sector by making the highest sales, gross profit and net profit in 9MFY23. PPL stood second, MARI ranked third and POL took the fourth spot in terms of sales and profitability. OGDC secured gross profit of Rs212 billion and net profit of Rs159 billion on sales of Rs309 billion. PPL posted the sector’s second highest revenues, gross profit and net profit of Rs214 billion, Rs143 billion and Rs81 billion, respectively.

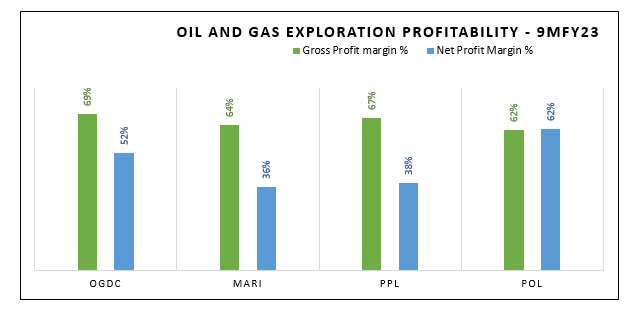

In 9MFY23, MARI recorded the third-highest sales of Rs110 billion and earned gross profit of Rs70 billion and net profit of Rs40 billion. Lastly, POL posted sales, gross profit and net profit of Rs49 billion, Rs30 billion and Rs30.5 billion, respectively. Profitability ratios analysis reveals that OGDC posted the highest gross profit ratio of 69% followed by PPL of 67%. MARI and POL came up with gross profit ratios of 64% and 62%, respectively.

However, on net level, POL beat the peers by posting the highest net profit ratio of 62%. OGDC remained second with a net profit ratio of 52%. PPL and MARI showed net profit ratios of 38% and 36%, respectively.

Credit: Independent News Pakistan-WealthPk