INP-WealthPk

Qudsia Bano

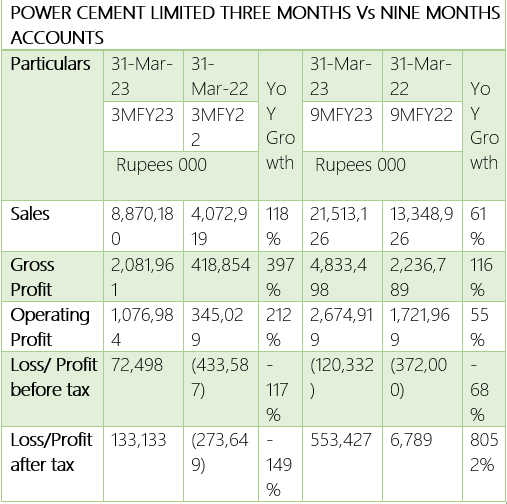

Power Cement Limited’s financial performance has improved significantly in the third quarter and the first nine months of this year, primarily driven by higher domestic retention prices and favorable exchange rates on exports, reports WealthPK. Despite facing challenges such as inflated production costs and higher borrowing costs, the company has managed to improve its gross margins through effective measures. In the third quarter of this year, the company witnessed a remarkable surge in its top lines. Sales for the quarter reached Rs8.87 billion, representing a substantial growth of 118% compared to the corresponding quarter of the previous year. This increase was attributed to higher domestic retention prices and favorable exchange rates on exports.

The company's gross profit margin for the third quarter stood at 23%, significantly higher than the 10% reported during the corresponding quarter of the previous year. This improvement in gross profit margin was the result of better management of production costs, including a more favorable mix of local and imported coal and improved plant efficiencies. The operating profit for the third quarter amounted to Rs1.08 billion, indicating a substantial growth of 212% compared to the corresponding quarter of the previous year. The company's efforts to optimize costs and improve operational efficiencies contributed to this impressive increase.

The company maintained its strong performance in the first nine months. Sales for the period amounted to Rs. 21.51 billion, a 61% increase from the same period last year. The company's gross margin for the nine-month period stood at 22%, higher than the 17% reported during the corresponding period of the previous year. The previous year's performance was impacted by the reliance on outsourced clinker.

The loss before tax for the nine-month period was reported at Rs120.33 million, a significant improvement compared to the loss of Rs372 million in the same period last year. Despite the challenges posed by higher borrowing costs in the country, the company managed to overcome them and reported a profit after tax of Rs133 million for the third quarter of the current year as against loss after tax of Rs273 million in the corresponding quarter of the previous year, showing a significant improvement. For the nine-month period, the company achieved a net profit of Rs553 million, compared to a profit of Rs7 million in the same period last year.

Operational Performance

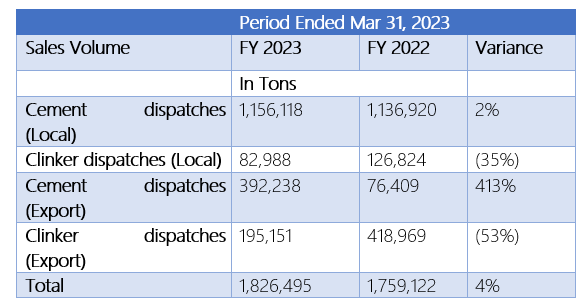

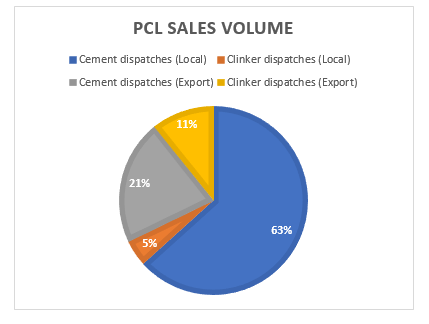

The sales volume analysis reveals interesting trends and variations in different segments. Firstly, local cement dispatches showed an increase of 2% in FY2023 compared to the previous fiscal year. Domestic dispatches increased by outperforming the South Zone which saw a decrease of 11% in the domestic market. However, local clinker dispatches experienced a significant decline of 35% in FY 2023.

This decline may indicate changes in production strategies or a shift in market demand for clinker. Power Cement Limited may need to evaluate and adapt its clinker production processes to align with market requirements.

On the other hand, the company achieved an exceptional growth of 413% in cement dispatches for export purposes. This surge in export sales is attributable to successful market penetration or increased demand for Power Cement's products in international markets.In contrast, clinker dispatches for export recorded a decline of 53% in FY2023. This decrease suggests a decrease in demand for Power Cement's clinker in overseas markets. The total sales volume witnessed a 4% increase in FY2023.

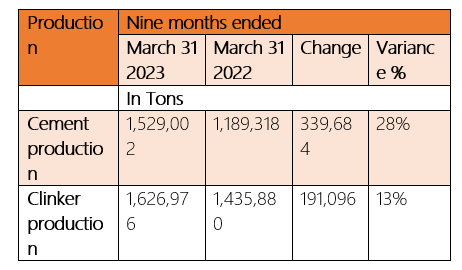

Cement production witnessed a substantial increase of 28% compared to the same period in the previous year. The company produced 1,529,002 tons of cement in 2023, representing an impressive increase of 339,684 tons. Similarly, clinker production also showed a positive trend, with a 13% increase in 2023 compared to the previous year. The company produced 1,626,976 tons of clinker, reflecting a rise of 191,096 tons.

About the company

Power Cement Limited was incorporated in Pakistan as a private limited company on December 1, 1981, and was converted into a public limited company on July 9, 1987. The company's principal activity is manufacturing, selling, and marketing of cement.

Credit: Independent News Pakistan-WealthPk