INP-WealthPk

Irfan Ahmed

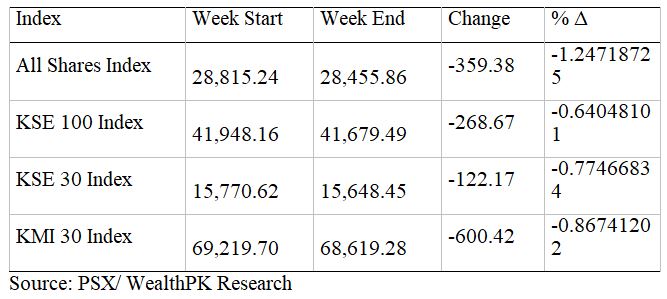

The Pakistan Stock Exchange (PSX) turned bearish last week owing to political uncertainty and weak economic indicators, WealthPK reports. The State Bank of Pakistan (SBP) reserves declined to $8.62 billion in the current month, putting further pressure on the Pakistani rupee, which continued to weaken against the greenback to settle at Rs236.84, down by 3.8% on a week-on-week basis. The remittances showed an increase of 8% and reached $2.7 billion from $2.5 billion in the previous month. The Financial Action Task Force also concluded its onsite visit to Pakistan on Wednesday. Overall the market remained lacklustre during the last week. According to WealthPK analysis, the market lost 268.67 points throughout the week, closing at 41,679.49 points, down by 0.64%. The All-Share Index also decreased by 1.25%, the KSE-30 index slipped dipped by 0.77% and the KMI-30 index decreased by 0.87% on a weekly basis.

The Pakistan Stock Exchange (PSX) was bearish on September 12 owing to inflation and the recent devastating floods. Bulls attempted to show some strength earlier in the session, however, they failed to muster enough traction and succumbed to nervousness. The KSE-100 index declined by 0.20% to close at 41,862.29 points against 41,948.16 points on the last working day. The KSE-100 index of the PSX turned around to witness a bullish trend on Tuesday due to speculations about the strengthening of the Pakistani rupee against the dollar. The KSE-100 index gained 139.05 points, a positive change of 0.33%, by closing at 42,001.34.

Another range-bound session was witnessed at PSX on September 14 owing to the concerns regarding political instability and continuous hammering of the Pakistani rupee against the dollar. At the end of the day, the KSE-100 index gained 10.48 points to close at 42,011.81 points. On September 15, the PSX ended a prolonged period of range-bound trading. However, the KSE-100 index declined by 0.57% as investors remained concerned about the depreciation of the rupee. The KSE-100 index finished with a drop of 239.73 points to close at 41,772.09 points. The KSE-100 index witnessed a bearish trend on September 16 owing to deteriorating macroeconomic conditions and lack of stability despite the resumption of the International Monetary Fund’s loan programme for Pakistan. As a result, the KSE-100 index witnessed a drop of 0.22% to close at 41,679.49 points.

Source: PSX/ WealthPK Research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $13.76 million. Insurance Companies made the most money by selling their shares for $ 8.54 million, followed by Mutual Funds with $3.61 million and individuals with $1.77 million. Foreign individuals purchased up to $11.79 million in shares, followed by overseas Pakistani, who purchased $1.97 million in stock. Banks purchased up to $1.29 million worth of stock. According to Muhammad Ahmed, a financial analyst with Arif Habib Limited, the market is expected to remain range-bound in the upcoming week amid concerns over the depreciation of the Pakistani rupee and inflation. He said that valuations across the board particularly in blue chips reached attractive levels.

“We advise investors to invest in blue chip scrips; our preferred stocks are OGDC, PPL, MARI, MCB, FABL, MEBL, BAFL, LUCK, MLCF, FCCL, ENGRO, FFC, HUBC, PSO, HUMNL and SNGP,” Ahmed told WealthPK.

Credit: Independent News Pakistan-WealthPk