INP-WealthPk

Irfan Ahmed

The stock market of Pakistan commenced on a green zone last week during the visit of Prime Minister Shehbaz Sharif to China, WealthPK reports.

The market momentum continued throughout the week. The country’s trade deficit also narrowed down by 26.59% and dipped to $11.469 billion during the first four months of the current fiscal as compared to $15.624 billion during the same period of the previous financial year.

The Pakistani rupee was slightly up against the greenback, closing at Rs221.95, up by 0.2% on a week-on-week basis. The reserves of the State Bank of Pakistan surged to $8.9 billion this week, up by $1.5 billion as compared to $7.44 billion on October 14, reflecting inflows from the Asian Development Bank.

However, towards the end of the week, the market went down due to an attempt on the life of former prime minister Imran Khan. The market closed at 41,856 points, gaining 716 points up by 1.7% on a week-on-week basis.

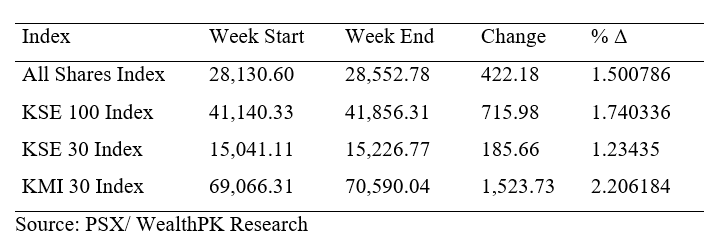

According to the information gathered by WealthPK, the market gained 715.98 points throughout the week, closing at 41,856.31 points up by 1.74% on a week-on-week basis. The All-Share index also increased by 422.18 points and the KSE-30 index rushed by 185.66 points while the KMI-30 index surged by 1,523.73 points on a weekly basis.

According to data, foreigners’ selling was witnessed during the week, clocking in at $1.58 million as compared to a net buy of $0.97 million last week.

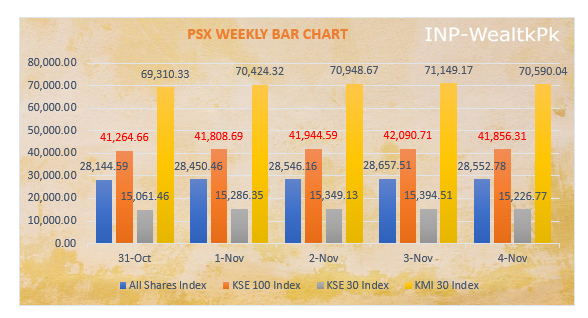

The stock exchange witnessed a bullish trend on October 31 owing to the visit of the prime minister to China and the stability of the Pakistani rupee. However, trading activity remained extremely low as investors stayed cautious due to prevailing political uncertainty in the country.

The KSE-100 index hit 41,376.09 points intraday high and closed slightly low at 41,264.66 points with a net gain of 124.32 points.

The stock market continued to witness a bullish trend on November 1 amid the expectation of positive outcomes of the visit of the prime minister to China. By the end of the session, the KSE-100 index rose 544.03 points to close at 41,808.69 points.

The 100-index of the PSX continued with a bullish trend on Wednesday as investors mainly focused on buying shares. The KSE-100 index gained 135.90 points, showing a positive change of 0.33%, and closed at 41,944.59 points.

Despite the political unrest, the KSE-100 index witnessed a slightly bullish trend on the fourth consecutive day on November 3, gaining 146.12 points, registering a positive change of 0.35%, and closing at 42,090.71 points.

The stock exchange remained under pressure on November 4 owing to political uncertainty and the expected long march on the federal capital. As a result of the unretained political situation, the KSE-100 index fell 234.40 points, showing a negative change of 0.56%, and closed at 41,856.31 points.

Source: PSX/ WealthPK Research

By selling its shares last week, the Foreign Investors Portfolio Investment (FIPI) made a profit of up to $1.58 million. Insurance companies made the most money by selling their shares for $2.91 million, followed by foreign corporates with $1.76 million and mutual funds with $1.72 million.

Individuals purchased up to $4.68 million in shares, followed by banks, which purchased $0.84 million in stock. Companies purchased up to $0.74 million worth of stock.

Muhammad Irfan Ahmed, a financial analyst with Arif Habib Limited, said that the market was expected to remain range-bound in the upcoming week as the participants would remain cautious due to the political uncertainty in the country. “Any positive outcome of IMF’s ninth review can aid the index,” he told WealthPK.

Credit : Independent News Pakistan-WealthPk