INP-WealthPk

Jawad Ahmed

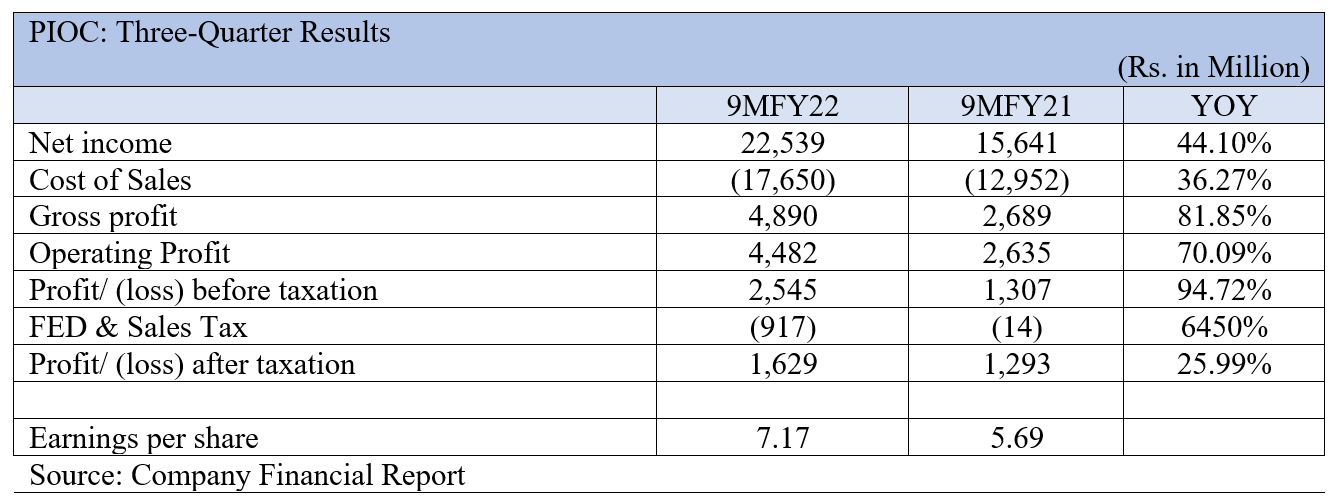

Pioneer Cement Limited’s revenue climbed 44% to Rs22.539 billion in the first nine months of the just-ended financial year 2021-22 (9MFY22) compared with Rs15.641 billion over the corresponding period of FY21, reports WealthPK. With the uptick in sales, the company’s gross profit, registering a growth of 81.8%, stood at Rs4.89 billion in 9MFY22, leaping from Rs2.69 billion in the corresponding period of FY21.

In the first three quarters of FY22, the company posted Rs2.545 billion in profit-before-tax compared to Rs1.307 billion in the preceding year. After statutory tax adjustments, the net profit came in at Rs1.629 billion, 26% higher than Rs1.293 billion in the same period of FY21. This increase in profit pushed the earning per share (EPS) to Rs7.17 from Rs5.69 the preceding year.

Company’s performance over the years

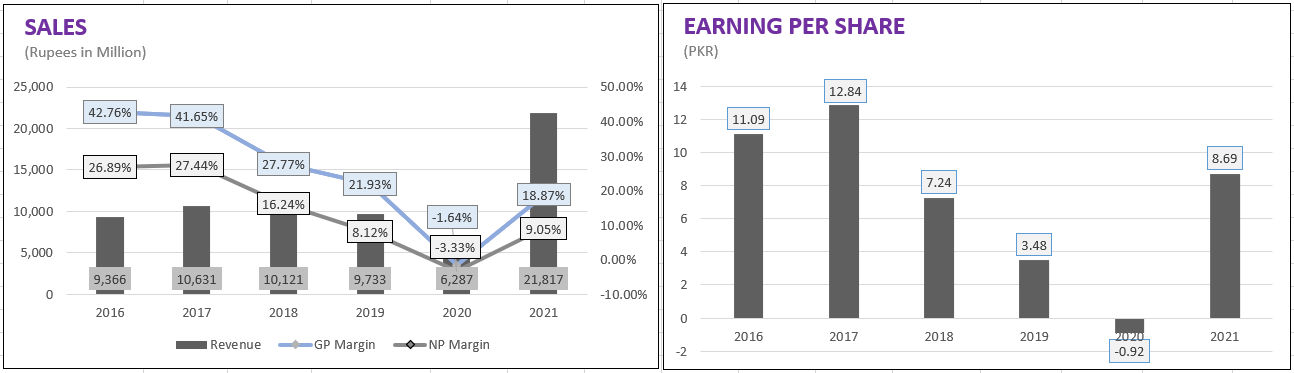

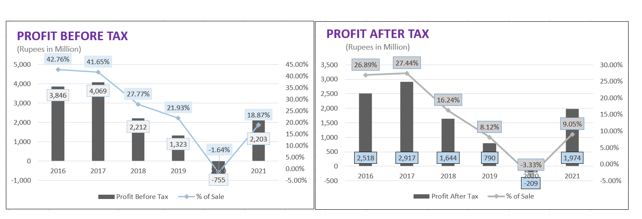

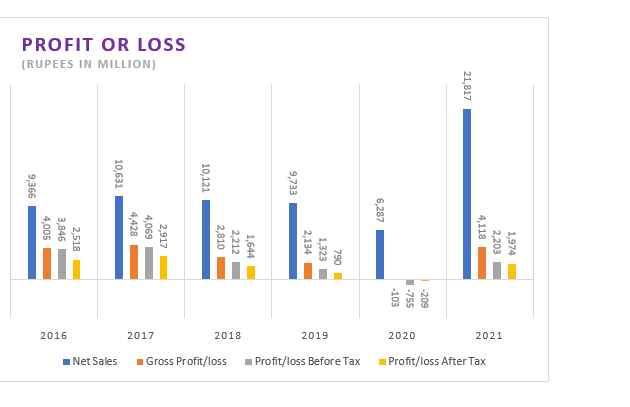

In 2018, the net sales of the company decreased to Rs10.12 billion from Rs10.63 billion the preceding year. Gross profit of the company fell from Rs4.428 billion to Rs2.81 billion. Net profitability also decreased to Rs1.64 billion from Rs2.91 billion in 2017, pulling the EPS down to Rs7.24 from Rs12.84.

The year 2019 also witnessed a decreasing trend in the company’s sales revenue, which declined to Rs9.733 billion from Rs10.12 billion the year before. The company’s gross profit fell to Rs2.134 billion from Rs2.810 billion the previous year, registering a 24% decline year-over-year.

Profit-before-tax for the year reduced to Rs1.32 billion, 40.2% lower than the previous year’s Rs2.21 billion. The EPS further declined to Rs3.48 due to a cut in after-tax profit, which fell to Rs709 million from Rs1.64 billion.

In 2020, sales further plunged by 55% to Rs6.287 billion from Rs9.73 billion in 2019. This impacted the company’s gross profit, which turned into a loss of Rs103 million from a profit of Rs2.13 billion a year earlier.

The company suffered a net loss of Rs209 million in 2020 from net profit of Rs790 million in 2019. This loss in profit translated into loss per share of Rs0.92. The company earned a profit per share of Rs3.48 in 2019.

The year 2021, however, saw the company’s fortunes change for the better, with the revenue collection almost quadrupling to Rs21.817 billion, up 247%, from the previous year’s Rs6 billion. The gross margins emerged from a Rs103-million loss to jump to Rs4.118 billion. Similarly, the company’s profit-after-tax jumped to Rs1.974 billion, recovering from the previous year’s loss of Rs209 million. EPS for the year shot up to Rs8.69 from a loss of Rs0.92 the previous year.

Credit : Independent News Pakistan-WealthPk