INP-WealthPk

Fakiha Tariq

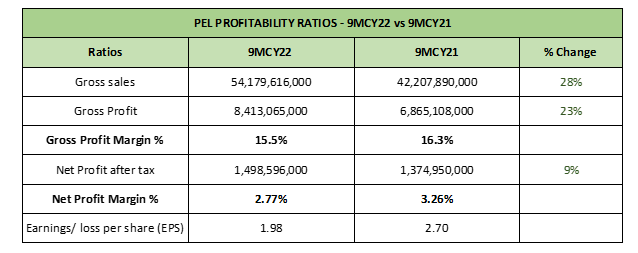

Pak Elektron Limited (PEL) reported an increase of 28% in its revenues in the first nine months (Jan-Sept) of the calendar year 2022 compared with the corresponding period of the previous year, shows a WealthPK analysis of the company’s financials. PEL, which has attained the status of a household name in Pakistan, was established in 1956 as a public limited company. It is an active member in the cable and electrical goods sector on the Pakistan Stock Exchange (PSX).

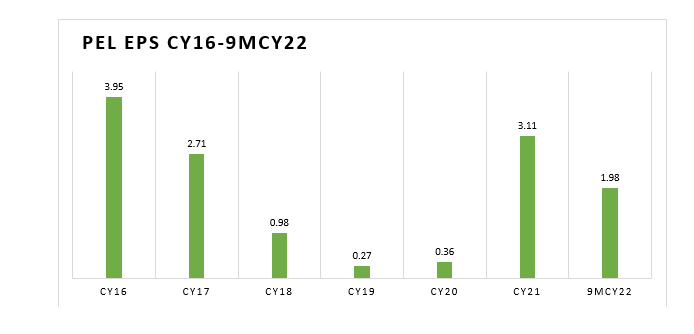

With a market cap of Rs12.8 billion, PEL is the largest company among its peers in the sector. In the first nine months of CY22, PEL reported a gross profit of Rs8.4 billion and a net profit of Rs1.4 billion, registering a year-on-year increase of 23% and 9%, respectively. The earnings per share value turned out to be Rs1.98 apiece.

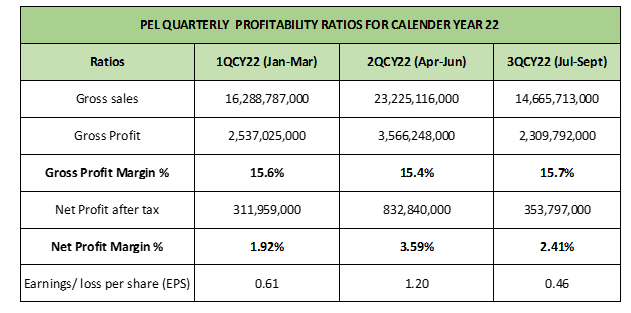

PEL quarterly profitability in CY22

PEL earned a gross profit of Rs3.5 billion from the sales of Rs23 billion in the second quarter (April-June) of CY22, which was also the leading quarter in terms of profit making.

The company also reported the highest net profit margin of 3.59% and EPS value of Rs1.20 in 2QCY22 compared to the first and third quarters of CY22.

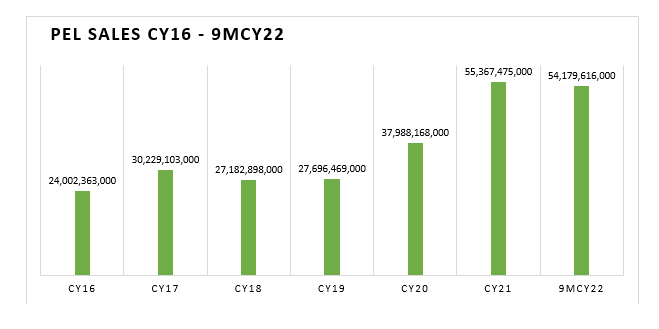

PEL about to set benchmark in CY22

The record revenues generated so far this year put PEL on track to hit the highest turnover by the close of CY22 when compared to the last six years as the WealthPK analysis shows that the company has already generated a whopping Rs54 billion revenue in the first nine months of the ongoing year, which is close to Rs55 billion generated in CY21.

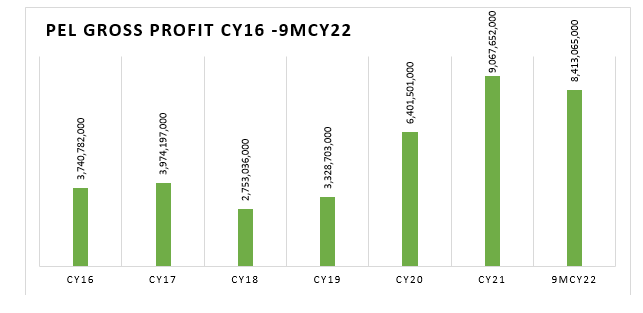

Likewise, the annual gross profit trends show that PEL achieved the highest gross profit of Rs9 billion in CY21. It was the highest reported gross profit since CY19. Whereas, the cumulative gross profit earned by PEL in 9MCY22 already stands at Rs8 billion.

The EPS trend shows that PEL achieved the highest EPS in 2016 at Rs3.95 apiece compared to the last five years. However, the company has already achieved half of that CY16 value in the first nine months of CY22.

In 9MCY22, PEL has already crossed the average amounts of sales, gross profit and earnings per share when compared to the last five years.

Credit : Independent News Pakistan-WealthPk