INP-WealthPk

Fakiha Tariq

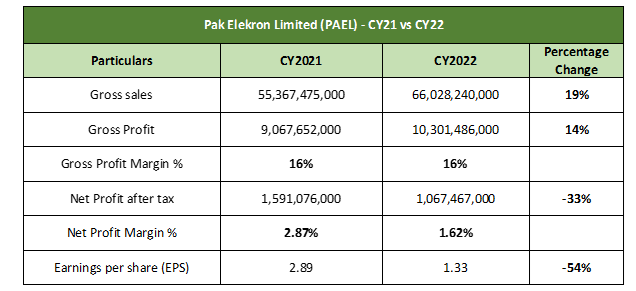

Pak Elektron Limited (PEL), a household name in Pakistan, ended the year 2022 with the highest revenues and profits in five years, WealthPK reports. And compared to the calendar year 2021, PEL’s sales and gross profit increased by 19% and 14%, respectively. PEL posted gross sales of Rs66 billion and gross profit of Rs10.3 billion, thus achieving the gross profit ratio of 16% in 2022. The company posted a net profit of Rs1.06 billion and a net profit ratio of 1.62% in 2022. PEL posted earnings per share of Rs1.33.

In comparison to 2021, the electrical goods firm’s revenues moved up by 19% from Rs55.3 billion to Rs66 billion in 2022. Likewise, the gross profit of Rs9.06 billion posted in 2021 increased by 14% in 2022. However, the net profit of Rs1.59 billion declared in 2021 dropped by 33% in 2022. PEL is the largest company in the cables and electrical goods sector with the market capitalisation of Rs9.4 billion. It is listed on the Pakistan Stock Exchange with the symbol of “PAEL”.

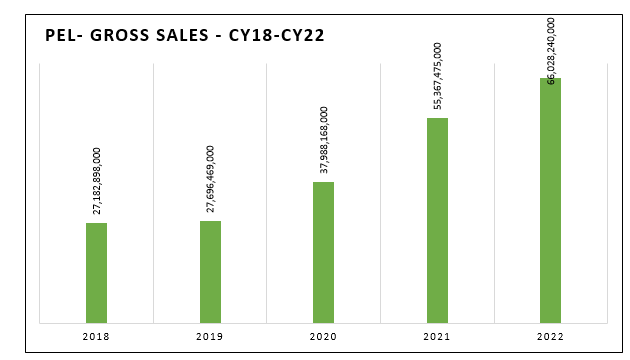

PEL sales – CY18 to CY22

The company posted the all-time high sales in 2022, showing an increasing trend over the past few years. The company posted Rs27.1 billion sales in 2018, followed by Rs27.6 billion in 2019 and Rs37 billion in 2020. The firm took a big leap in sales that clocked in at Rs55 billion in 2021.

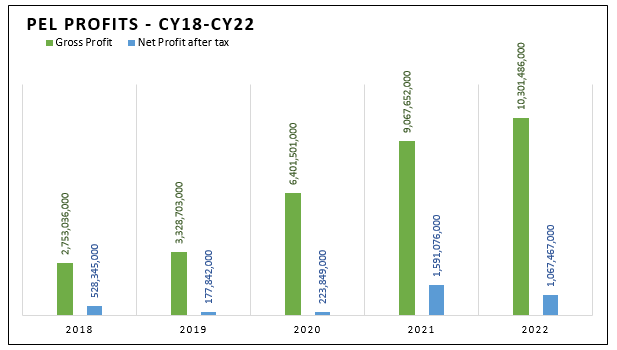

PEL profits – CY18 to CY22

On the back of increasing sales, PEL posted the highest gross and net profits in 2022. From CY18 to CY22, PEL raised its gross profit from Rs2.7 billion to Rs10.3 billion as a whole. The company posted Rs2.7 billion gross profit in 2018 followed by Rs3.3 billion in 2019, Rs6.4 billion in 2020 and Rs9 billion in 2021.

From CY18 to CY22, PEL raised its net profit from Rs528 million to Rs1.06 billion as a whole. The company posted Rs528 million net profit in 2018, followed by Rs177 million in 2019, Rs223 million in 2020 and Rs1.5 billion in 2021.

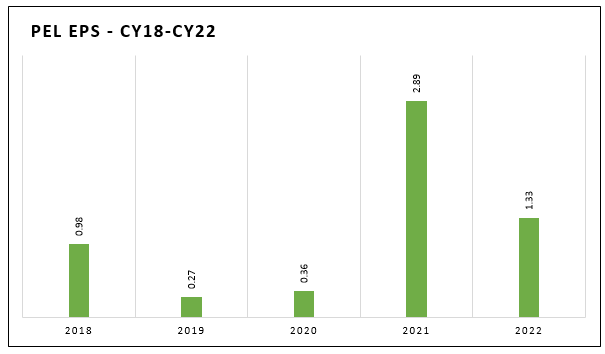

PEL EPS – CY18 to CY22

Of the last five years, PEL posted the highest earnings per share of Rs2.89 in 2021. However, the EPS value dropped by 54% to Rs1.33 in 2022.

Credit: Independent News Pakistan-WealthPk