INP-WealthPk

Muhammad Asad Tahir Bhawana

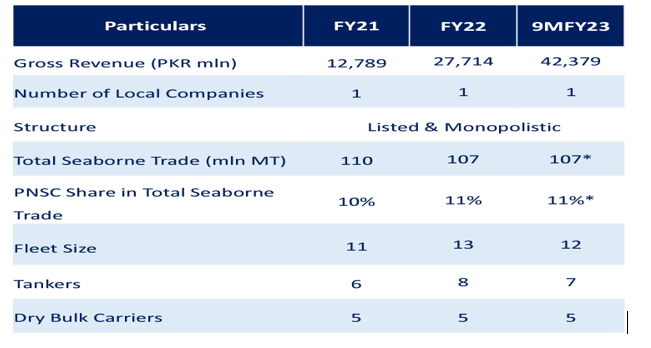

Pakistan's seaborne trade in FY22 declined by 2.7% to 107 million deadweight tonnage (DWT) from 110 million DWT in FY21. However, gross revenue in the industry increased significantly by 117%, reaching Rs28 billion in FY22 from Rs13 billion in FY21. Additionally, in the first nine months of FY23, revenue soared by 53% year-on-year to Rs43 billion, compared to Rs16 billion in 9MFY22 and Rs10 billion in 9MFY21.

Pakistan's economy heavily relies on the shipping industry, which accounts for 95% of its international trade. With a coastline spanning over 1,000 kilometres, Pakistan's strategic location dominates sea traffic to and from the Suez Canal, Arabian Sea, Persian Gulf, and India to the Far East. Gwadar Port, part of the China-Pakistan Economic Corridor, offers a shorter trade route connecting China, the Middle East, Africa, and Europe, facilitating the transportation of oil and goods to and from Pakistan. According to a report published by the Pakistan Credit Rating Agency (PACRA), as of 9MFY23, the Pakistan National Shipping Corporation (PNSC) is primarily owned by the government of Pakistan through the Ministry of Maritime Affairs, holding 87.3% of the shares.

The PNSC Employees Empowerment Trust owns an additional 1.83%, bringing the total government’s holding to 89.13%. PNSC is unique as the sole national flag carrier with a 100% Pakistani fleet, including both dry bulk and liquid bulk carriers. PNSC transports an impressive 80% of Pakistan's imported oil. As of December 2022, the company's fleet consisted of 13 ships (eight tankers and five dry bulk carriers), with a combined deadweight capacity of 1,046,020 DWT. The fleet owned by PNSC is relatively young, with an average age of around 16 years, compared to the global fleet's average age of 22 years. Pakistan currently spends approximately $6 billion on freight expenses for its seaborne trade.

In FY22, Pakistan experienced a 3% decline in total seaborne trade, with volumes decreasing from approximately 110.3 million metric tonnes in FY21 to 106.8 million metric tonnes. Pakistan's shipping sector experienced a significant boost in FY22, with local revenue reaching Rs24 billion, marking a remarkable 96.5% YoY growth from Rs12 billion in FY21. Revenue from oil tankers accounted for the largest share at 45% (Rs11 billion), while chartered ships and bulk carriers contributed 33% (Rs8 billion) and 22% (Rs5 billion), respectively. Gross and operating margins also improved, with FY22 recording 29% and 20%, respectively. In 9MFY23, the gross margin rose by 24% to 48%, and the net margin surged by 42% to 57%.

During 9MFY23, the shipping sector achieved a historic revenue milestone of Rs42 billion (compared to Rs16 billion in 9MFY22). This remarkable increase can be attributed to expanded shipping operations, revenue generated from two new vessels (MT Mardan and MT Sargodha), and the sale of the tanker vessel MT Karachi. Additionally, the revenue was affected by a significant rise in the exchange rate as it is earned in US dollars. The shipping sector offers promising prospects, including capitalising on Pakistan's advantageous coastal position to enhance global shipping services, forging strategic alliances and joint ventures, implementing logistics operations enabled by web technology, establishing bilateral agreements to foster development, and adhering to regulations regarding the decarbonisation of fuel.

Credit: INP-WealthPk