INP-WealthPk

Muhammad Soban

Remittances from overseas Pakistanis rose by 7.9% in August 2022 compared to July, reaching $2.7 billion, according to the State Bank of Pakistan (SBP).

Pakistan is heavily dependent on workers’ remittances to meet the requirement of foreign reserves. Workers’ remittances help Pakistan’s economy to narrow the current account deficit. In July, remittances fell by 8.59% from the previous month and stayed at $2.5 billion.

August’s increase of over $200 million in remittances will bring positive impact on the economy. Pakistan’s workers from the Gulf countries are the top contributors to overall remittances, showed the SBP data.

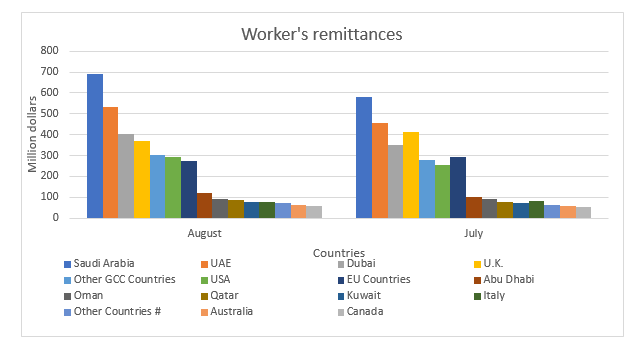

In August 2022, Pakistan received 19.15% increased remittances from Saudi Arabia at $691.8 million as compared to July when it was $580.58 million. It was the largest amount received among all the countries.

The United Arab Emirates (UAE) is the second destination of Pakistani workers who sent $531.4 million in August, 16% more as compared to the previous month when they sent $456.17 million to their homeland, as shown in the following graph.

Data shows that remittances from the United Kingdom decreased in August by 10%. In August, Pakistan received $369.7 million from the UK as compared to $411.7 million in July.

Pakistan's economy is experiencing challenges despite the revival of the IMF program. Pakistan's need for foreign reserves has been growing over the years due to a massive gap between exports and imports. Overseas remittances are a major source to bridge this gap. In the last fiscal year which ended on June 30, 2022, remittances sent by overseas Pakistani workers reached an all-time high.

The government of Pakistan and the State Bank provide incentives and investment opportunities to overseas Pakistanis in different ways. Roshan Digital Account (RDA) is a prime example. The RDA is the SBP's mega project that is growing rapidly as its deposits reached over $5 billion last week.

To attract further investment, the SBP is increasing the menu of services under the RDA program. The SBP aims to introduce insurance products, pension plans, and services for non-resident Pakistanis to open their accounts in local and foreign currencies who have more than 50% ownership of local entities. These initiatives of the SBP further help to increase the inflow of capital in the country.

Credit : Independent News Pakistan-WealthPk