INP-WealthPk

Fakiha Tariq

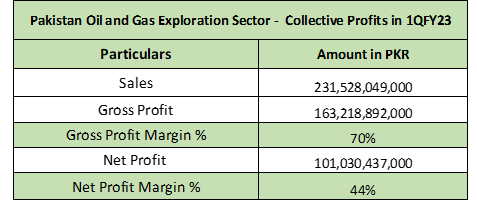

Pakistan’s oil and gas exploration sector posted a healthy gross profit of Rs163 billion and net profit of Rs101 billion during the first quarter of the fiscal year 2022-23 (1QFY23), a study conducted by WealthPK shows.

Overall gross profit margin for oil and gas exploration sector was reported to be 70%, whereas the net profit margin stood at 44% in 1QFY23. The sector achieved a gross sales value of Rs231 billion as a whole from July 2022 to September 22.

Pakistan’s oil and gas exploration sector is dominated by four giants, including Oil and Gas Development Company Limited (OGDC), Mari Petroleum Limited (MARI), Pakistan Petroleum Limited (PPL) and Pakistan Oilfields Limited (POL).

With the market capitalisation of Rs311.6 billion, OGDC is the largest company listed on Pakistan Stock Exchange (PSX). MARI comes second with a market cap of Rs223.4 billion. PPL and POL, with market capitalisation of Rs152.4 billion and 118.8 billion, rank third and fourth, respectively, in the oil and gas exploration sector.

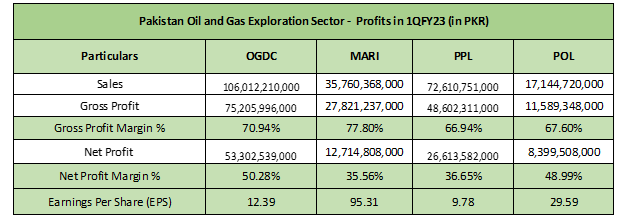

Oil, gas exploration sector – profitability analysis 1QFY23

Mari Petroleum, with a reported gross profit of 77.80%, ranked the most profitable company in the sector during 1QFY23. However, with a net profit of Rs12 billion over the sales of Rs35 billion, the net profit margin stood at 35.56%. MARI also earned the highest earnings per share of Rs95.31 among its three peers.

OGDC hit the highest sales worth Rs106 billion in the first quarter of FY23. With a gross profit of 70.94% over the sales, OGDC was the second highest profit earner from July 22 to September 22. Net profit of Rs53 billion earned the company a net profit ratio of 50.28%. OGDC’s EPS value remained at Rs12.39.

POL marked its name as third in the list and reported gross profit and net profit of 67.60% and 48.99% during the period under review. POL sales value was the lowest among its peers. POL managed Rs29.59 EPS in 1QFY23. PPL reported the lowest profits in the oil and gas exploration sector during the period under review. It earned gross profit of 66.94% and net profit of 36.65% from July 22 to September 22. PPL’s earnings per share value for 1QFY23 was Rs9.78.

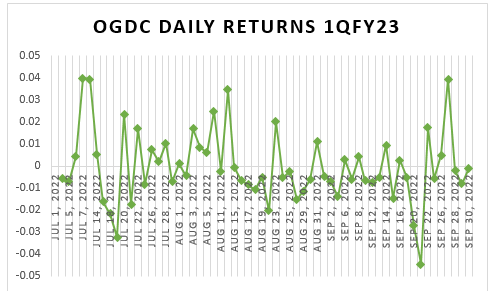

Oil, gas exploration sector – stock returns analysis 1QFY23

Overall, the oil and gas exploration sector experienced a favourable stock returns pattern. However, the stock return patterns of all four participant companies seemed quite correlated during 1QFY23. OGDC stock returns showed multiple peaks of positive returns for its investors during 1QFY23. During the whole quarter, only a single deep dip was observed in the mid of September 22.

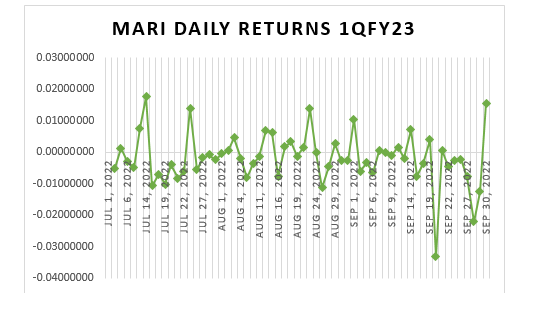

MARI stock returns patterns remained stable and experienced no significant gains or losses for its investors.

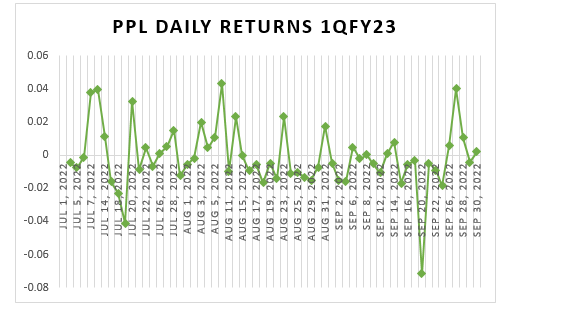

PPL daily stock returns almost duplicated the pattern of OGDC stocks. Multiple high spikes made money to PPL investors.

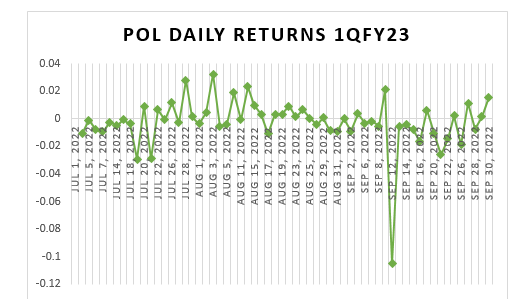

Lastly, POL stocks fetched positive returns towards the end of July 22 and mid of August 22. The stock returns experienced only a single deep dip in September 22.

Credit : Independent News Pakistan-WealthPk