INP-WealthPk

Azeem Ahmed Khan

More than 80% of Pakistan’s large-scale manufacturing (LSM) sector witnessed a broad-based contraction during the first half (July-December) of the current fiscal year (2022-23) as its output fell in 18 out of 22 fields. The LSM setcor contracted by 3.7% during H1FY23, down from an expansion of 7.7% during the corresponding period of last fiscal year, according to the State Bank of Pakistan (SBP). This reflects the impact of tight monetary conditions, lower Public Sector Development Programme (PSDP) spending, imports compression measures, and increase in power tariffs and fuel prices along with lower demand in the domestic and global markets.

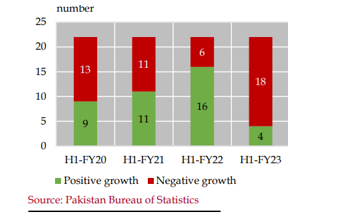

The textile sector, the largest component, followed by automobile, pharmaceutical, non-metallic minerals, petroleum, and construction-allied sectors majorly contributed to the decline in the LSM industry. The worsening macroeconomic environment led some businesses to partially suspend operations during the period under review, the SBP said in its half year report for FY23 on the State of Pakistan’s Economy. Wearing apparel and furniture sectors lessened the magnitude of overall LSM contraction during H1FY23 by showing steady growth. The following table shows that the growth momentum of the last two years was disrupted during H1FY23.

Positive and negative growth sectors in LSM

The SBP report, whose analysis is prepared on data outturns for the July-December FY23, notes the policy measures introduced since last year had succeeded in constraining domestic demand. However, the fallout of flash floods, adverse global economic conditions, uncertainty surrounding the completion of IMF (International Monetary Fund) programme’s 9th review, the foreign exchange constraints, and political instability exacerbated the underlying domestic structural issues, posing challenges to macroeconomic stability.

Specifically, both agriculture production and LSM contracted substantially, whereas headline inflation rose to a multi-decade high level. Slowdown in external demand and the persistence of domestic structural issues pulled exports below last year’s level. Moreover, the below-target growth in the Federal Board of Revenue (FBR) taxes also indicate the need to speed up structural reforms. Continuing with its contractionary stance, the SBP raised the policy rate by a further 225 basis points (bps) during H1FY23, on top of the 675 bps increase during FY22. On the fiscal side, the government resorted to curtailing federal expenditures on grants, subsidies and development. Furthermore, to contain pressures on external account, the government and the SBP introduced various regulatory measures to restrict imports.

Despite visible contraction in domestic demand, the report said the inflation outturns remained stubbornly persistent since the second half of fiscal year 2021-22. High global commodity prices along with elevated inflation expectations and a range of domestic factors pushed the National Consumer Price Index (NCPI) inflation to 25% during H1FY23 compared to 9.8% during the same period last year. Higher food prices, on account of flood induced supply shortages, mainly drove overall inflation followed by non-food and non-energy and energy groups, the report said.

The floods submerged a substantial area of the country’s land, and inflicted heavy losses to lives, livelihood and infrastructure. In agriculture, Kharif crops sustained considerable production losses due to floods. In addition, the rupee’s depreciation along with the increase in power tariffs and energy prices provided further impetus to inflationary pressures. In line with the overall downturn in economic activity, the labour markets also showed contraction in employment generation. The general sales tax (GST) collection also slowed down in line with weakening economic activity. The deterioration in the macroeconomic environment affected business confidence during H1FY23, which also contributed to sluggish offtake in credit to private businesses.

On the revenue side, tax administration efforts, inflation and higher return on deposits led to an expansion in the FBR taxes. However, a sharp contraction in imports and an overall dip in economic activity constrained tax collection below the target during the period under review. In the absence of sufficient external inflows, the government mainly relied on domestic bank and nonbank sources to meet its borrowing requirements, mostly through medium term floating rate instruments. Private sector credit (PSC) decelerated during H1FY23 amid an economic slowdown.

The external sector, in general, and external financing, in particular, remained under significant pressure during H1FY23 due to uncertainty regarding the resumption of the IMF programme, along with tight global financial conditions. Similarly, workers’ remittances also declined during H1FY23. In addition to the global economic slowdown, increase in the use of informal channels also affected remittances flows to the country. However, the decline in exports and remittances was more than offset by a much larger fall in imports during H1-FY23, leading to a notable decline in current account deficit (CAD). Despite this improvement in CAD, the report notes that the dearth of financial inflows led to decline in foreign exchange reserves during H1FY23.

Credit: Independent News Pakistan-WealthPk