INP-WealthPk

Ayesha Mudassar

Financial experts believe that economic growth in a modern economy hinges on efficient capital markets that mobilise domestic savings and foster an investment-friendly climate. A robust capital market helps to achieve socioeconomic growth and development. In Pakistan, the capital markets consist of the Pakistan Stock Exchange Limited (PSX), the Central Depository Company (CDC), the National Clearing Company of Pakistan Limited (NCCPL), and the Pakistan Mercantile Exchange Limited (PMEX).

The Securities and Exchange Commission of Pakistan (SECP) serves as a regulatory body for the smooth functioning of these capital markets. Badiuddin Akber, Managing Director of CDC, said a sophisticated capital market financed new ideas, supported government and corporate initiatives, and facilitated the management of financial risk.

“A strengthened capital market could play a significant role in tackling the country's structural imbalances that have plagued the economy over the years. These structural imbalances include the lack of documentation, a small tax base, and low savings and investment rates. CDC is fulfilling its commitments towards innovation, service quality, investor facilitation, and improving ease of doing business,” Badiuddin Akber added.

Farrukh H. Khan, Chief Executive Officer of PSX, said a broad-based capital market would help to achieve economic and social objectives, including expanding the number of taxpayers, increasing savings and investment rates, and reducing wealth inequality. “Furthermore, it is necessary to create a favourable environment through regionally competitive and long-term tax policies for the capital market,” Khan emphasised.

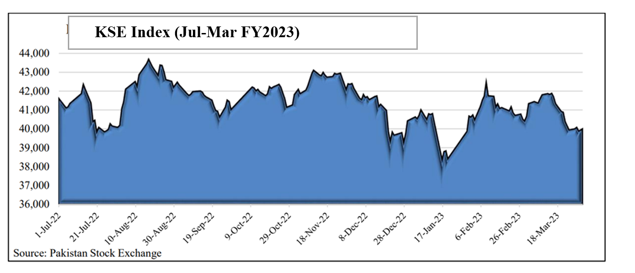

Presenting the performance of the Pakistan’s stock market, he said it remained volatile during the outgoing fiscal year, mainly due to ongoing political and economic uncertainty. As per the Economic Survey 2022-23, the benchmark index of Pakistan Stock Exchange Limited, the KSE-100 index, declined from 41,540.8 points to 40,000.8 points from June 30, 2022, to March 31, 2023. The index closed at its highest point of 43,676.6 on August 17, 2022, whereas its lowest closing point was 38,342.2 on January 17, 2023.

The market capitalisation of the PSX was recorded at Rs6,956 billion on June 30, 2022, and closed at Rs6,108 billion on March 31, 2023, reflecting a decline of 12.2% during the period. Month-wise performance of KSE-100 index shows the turnover in shares reached its peak in August 2022, indicating that investors were actively investing and participating in trading activities.

During July-March FY23, corporations raised Rs99.0 billion by issuing 20 debt securities. Moreover, during the period under review, 2.96 million lots of various commodities futures contracts, including gold, crude oil, and US equity indices worth Rs3.49 trillion, were traded on Pakistan Mercantile Exchange Limited – 28.1% higher than the same period last year.

Over the past few decades, there has been an upsurge in capital market activity globally, which suggests its growing recognition as a tool for fast-tracking economic progress. Following the trend, SECP must take initiatives to strengthen the market and facilitate investors.

Credit : Independent News Pakistan-WealthPk