INP-WealthPk

Ayesha Mudassar

Pakistan's economy is experiencing an array of challenges requiring prudent measures to be on a strong footing. This is the general feeling among economic experts and people alike, reports WealthPK. Low growth, falling investment, skyrocketing inflation, precariously low foreign reserves, and external imbalance are the current economic issues. As per the Economic Survey 2022-23, the real GDP grew by 0.29% in the outgoing fiscal year, missing the target of 5%. Dr. Abid Q. Suleri, Executive Director Sustainable Development Policy Institute (SDPI), attributed this low growth to the global economic slowdown, flood damages, and the State Bank's restrictive policies.

Furthermore, he said the economy is facing multiple headwinds mainly due to the inconsistent economic policies. Numerous economic policies have been implemented since the country’s inception, including Hoover’s trickle-down model, nationalization, aid-based economy, reliance on short-term and long-term loans, a capitalistic system, and a welfare economy. The SDPI executive director believes that policy continuity is a prerequisite for macroeconomic stability and development in the country. The economic survey also illustrates that the total investment-to-GDP ratio has hit a record low of 13.5% in the outgoing fiscal year.

Talking to WealthPK, Additional Secretary Board of Investment (BOI) Ambreen Iftikhar related this decline to the concerns about sovereign default, uncertain taxation policies, and restrictions on the outbound repatriation of profits. In 2021, South Asia received foreign investment of $175 billion, out of which only $2 billion were invested in our country, she said. Improving sovereign credit rating, ensuring external sector liquidity, and incentivizing firms with high-growth potential are necessary to attract investment, she added.

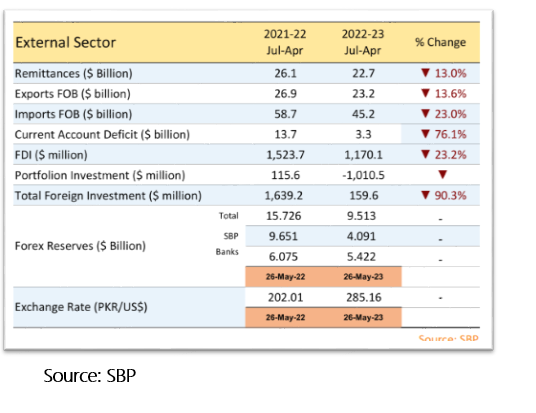

The BOI additional secretary believes that the board’s “Invest Pakistan Initiative” has the potential to transform Pakistan’s investment landscape. The country’s foreign exchange reserves witnessed a decline mainly on the account of amortization of official loans and liabilities during Jul-Apr FY2023 and reached a level of $4.5 billion by the end of April 2023. Higher loan repayments have kept the foreign exchange reserves under pressure. The external sector position remains under stress mainly due to reduced inflows of remittances and investment.

In addition, the CPI inflation was recorded at 36.4% on a year-on-year basis in April 2023, compared to an increase of 35.4% in the previous month, according to the monthly economic update and outlook for May 2023. On average, the CPI inflation stood at 28.2% during July-April FY2023 as against 11.0% in the same period last year.

World Bank senior economist Adnan Ashraf Ghumman said Pakistan’s record high inflation reflects global commodity shock, currency depreciation, tight monetary policy stance, flood-related disruptions to supply, and reversal of unsustainable fuel and energy subsidies. Experts believe that the country’s economic framework is not working well and requires a serious appraisal.

Credit: INP-WealthPk