INP-WealthPk

By Qudsia Bano

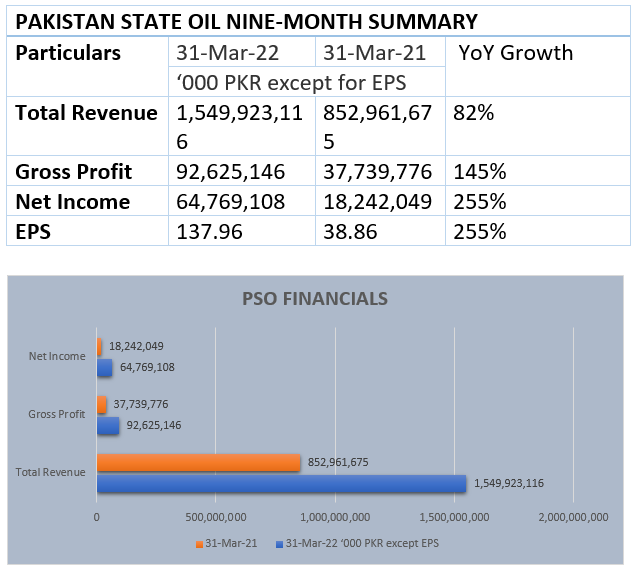

ISLAMABAD, Aug 02 (INP-WealthPK): Pakistan State Oil’s revenue climbed 82% to Rs1,545 billion in the first nine months of the financial year 2021-22 compared with Rs852 billion in the corresponding period of the previous fiscal year.

Similarly, the gross profit of the company registered a growth of 145% during the nine months of FY22 and stood at Rs92.6 billion, coming up from R37.7 billion in the corresponding period of FY21.

The net income increased 255% to R64.8 billion in the nine months of FY22 compared with a profit of Rs18.2 billion in the corresponding period of FY21. Higher sales revenue was primarily attributable to an increase in the average realised price of crude oil to $68.84 per barrel from $43.28 per barrel.

The state-owned company outperformed the industry in all petroleum products, which led to an increase in its market share by 3.4%, reports WealthPK.

Annual Results 2020-21

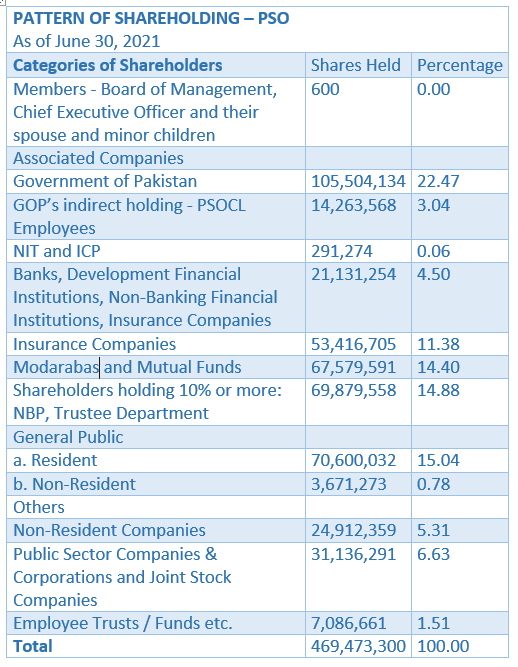

As of June 30, 2021, the government of Pakistan owned 22.47% shares of the company. The government’s indirect holding – PSOCL employees held 3.04% shares. Banks, development financial institutions and non-banking financial institutions owned 4.50% of the total shares of the company. Insurance companies held 11.38% shares and modarabas and mutual funds owned 14.40% shares. National Bank of Pakistan and Trustee Department held 14.88 of the PSO shares, while general public (resident) owned 15.04 % of the total shares. Non-resident companies held 5.31% shares and public sector companies, corporations and joint stock companies held 6.63% shares.

Financial Performance

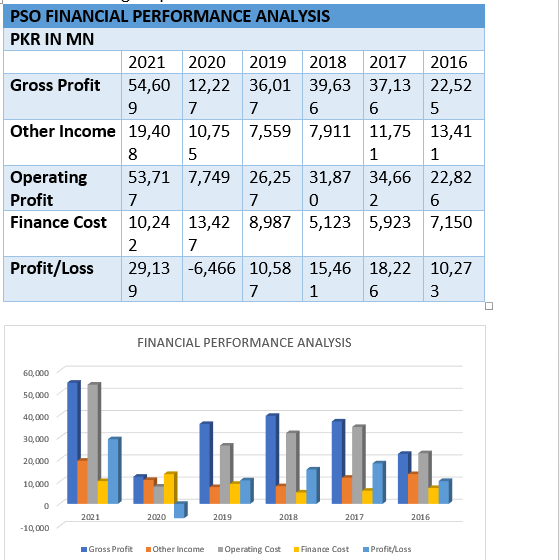

The company reported an after-tax profit of Rs29.14 billion in FY21. Gross profit increased by 346.6% as a result of PSO's targeted sales methods and increased industry demand, which led to larger sales volumes of white and black oil products. Gross profit also climbed due to favorable pricing conditions brought on by the rise in global oil prices.

An increase of 80.5% in other revenues came about as a result of greater LPS income and an exchange profit due to strengthening of dollar against the rupee.

Finance costs decreased by 23.7%, mostly as a result of lower borrowing levels brought on by the power sector's recovery, higher sales of white oil, and lower average markup rates for the period.

Profit-after-tax increased by massive 494.8%, thus exceeding the objective. Higher gross margins, an increase in other revenues, and a decrease in finance costs were the major causes of the higher profits.

Earnings per Share

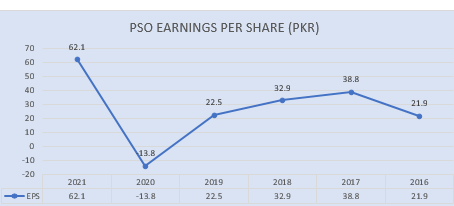

The earnings per share (EPS) of the company witnessed mixed trends during recent years. From 2016-17, the EPS showed remarkable growth and reached Rs38.8, but then it continued decreasing and reached Rs13.8 in 2020. However, EPS shot up to Rs62.1 in 2021.

Petroleum and related goods are bought, stored and sold by Pakistan State Oil Company Limited. Additionally, the company blends and sells a variety of lubricating oils. Retail fuels, gaseous fuels, alternative fuels, lubricants, cards, non-fuel retail, aviation and marine, consumer business and product prices are among the company's goods and services.

Motor gasoline, high speed diesel, furnace oil, jet fuel, kerosene, compressed natural gas, liquefied petroleum gas, petrochemicals and lubricants are some of the petroleum products it produces. Premier XL, Green XL, and E-10 are a few of its retail fuel brands. Jet fuels, diesel and kerosene are also sold there. The company operates a network of about 3,546 retail stores. General trade, defense, Pakistan Railways and power projects are among its core consumer business functions.

Credit:

Independent News Pakistan-WealthPak