INP-WealthPk

By Qudsia Bano

Pakistan direly needs to fix structural imbalances inherent in its economy to boost productivity and generate employment, stresses Farrukh Muqeem, Finance Manager of Pakistan State Oil Limited.

He stated this during an interview with WealthPK.

Q: How is your firm impacted by depressed economic and political landscape?

A: The political polarisation the country is roiled in has extracted a heavy toll on the economy, which was recovering from the pandemic. The devastation caused by recent floods has further fueled inflationary pressures, eroding the profits of the companies. All these factors have contributed to an increased uncertainty for businesses. The ongoing geopolitical tensions have also marred economic growth in Pakistan due to bottlenecks in supply chain and rising commodity prices internationally. However, despite these challenges, our company persists with robust measures to face these headwinds robustly. Our strong fiscal 2021-22 outcome reflects our ability to expand our outreach in the months to come.

Q: What steps does your company take to promote innovation?

A: PSO is investing in its network while developing value-added services and goods in the retail market to better serve its customers as it embraces the competition. Customers' trust and loyalty are demonstrated by the company's rising market share and profitability over time. Employees are encouraged to offer comments and identify areas for innovation and improvement because the corporation values open communication throughout the organisation.

Q: How do you aim to protect the value of your investment portfolio from possible market risks?

A: The PSO’s board of finance and risk management committee are in charge of managing investments and risk management operations, authorising suitable risk management protocols and measurement methodologies across the organisation, and reviewing the company's financial and operating strategies from time to time. PSO has a generally low-risk appetite for carrying out its commercial activities because it is the nation's top oil marketeer and a public sector organisation. Effective and timely risk management across the company is ensured by PSO's well-established governance framework. The company's risk profile is evolving over time along with the underlying risk factors, mostly as a result of rising receivables, shifting regulatory requirements, and market-driven forces.

Q: What are the major causes hampering economic growth?

A: Pakistan faces structural issues like disproportionately high government involvement in economic activities; a sizable informal economy; a focus on cotton-related production activities; policy bias toward import-substitution; neglect of the services sector in policies; a low rate of savings and insufficient investment to develop human resources and infrastructure. In order to promote efficiency, improve competitiveness, encourage entrepreneurship, and advance technology, deep-rooted economic reforms are required. It should be highlighted that when procyclical macroeconomic policies stop having an effect, economic managers are left with no choice but to implement fundamental structural adjustments to turn around the economy.

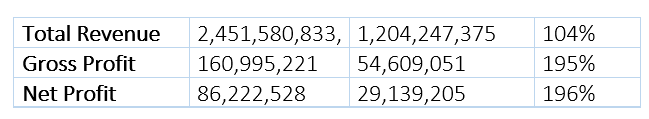

Performance in 2021-22

During the financial year 2021-22, the company generated a revenue of Rs2.45 trillion over Rs1.2 trillion in FY21, posting an increase of 104% year-on-year.

The gross profit for FY22 stood at Rs160 billion, 195% up from a profit of Rs54 billion in FY21.

The after-tax profit for the year jumped to Rs86 billion from Rs29 billion in FY21 at a growth rate of 196% .

About the company

Pakistan State Oil Company Limited was established in 1976. The company's primary activities include purchasing, storing, and marketing petroleum and related products. Additionally, it blends and sells a variety of lubricating oils.

Credit : Independent News Pakistan-WealthPk