INP-WealthPk

Arsalan Ali

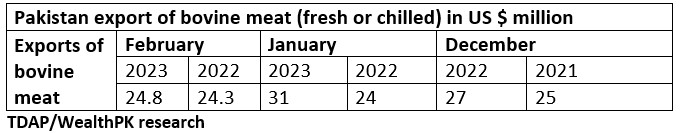

Pakistan has the potential to massively enhance its meat exports with diversification into the boneless and frozen category with a particular focus on gaining access to the Chinese market, WealthPK reported. Data from the Trade Development Authority of Pakistan (TDAP) shows that the exports of bovine meat reached $24.8 million during February 2023 against $24.3 million during the same period of 2022, showing a growth of 2%.

According to a report published by TDAP, Pakistan's export-oriented meat processors have a significant opportunity to tap into the Chinese market, which is the largest importer of frozen beef. To capitalise on this thriving market, Pakistani meat processors need to diversify into other meat segments, particularly frozen, boneless beef.

The TDAP report stated that diversifying away from fresh carcasses is essential to gain a foothold in the Chinese market, as the China-Pakistan Free Trade Agreement-II (CPFTA-II) does not grant concessions for fresh or chilled bovine carcasses, which are subject to a prohibitive 20% tariff.

The report said Pakistani bovine meat processors enjoy duty-free access to all other market segments, including frozen bovine meat products, fresh boneless meat, and fresh bovine cuts with bone in. This provides Pakistan with a significant advantage over other major beef exporters, it added.

The report pointed out that to penetrate the promising Chinese market, meat processors must devote significant efforts and resources to comply with the strict phytosanitary standards imposed by Chinese authorities. Furthermore, the need to shift towards the frozen beef market segment is also crucial to expand to other major markets in Asia, including Malaysia, Indonesia, and Vietnam, where similar consumption patterns are observed, the report said. Meat exports from Pakistan are largely concentrated in the fresh or chilled market segment, specifically in the carcasses and half carcasses category, with most exports going to Gulf Cooperation Council (GCC) countries.

Pakistan Business Council (PBC) has explored the potential of Pakistan's bovine meat sector for the export market, highlighting that the industry presents an opportunity for growth, but is currently hindered by a lack of traceability of cattle stock, the presence of foot and mouth diseases (FMD), outdated methods and technologies used in aggregating, transporting, and slaughtering animals, and the lack of capacity to produce frozen de-boned beef cuts for international markets.

The PBC highlighted that Pakistan has a significant opportunity to diversify its exports and improve its economy, given its existing agrarian base and the involvement of around 12.5 million families in cattle-rearing activities. However, there is limited focus by livestock farmers to rear animals exclusively for meat production, with older animals that no longer produce sufficient milk typically sold for meat. According to the PBC, yield gap for buffalo meat produced in Pakistan, when compared to the top three best meat-producing countries (Australia, US, and Brazil), is around 35%, with the low yield being driven by the unattractive domestic market for beef.

The PBC mentioned that the three largest meat exporting countries, including Australia, Brazil, and India, export frozen beef, which is considered lower quality and cheaper, but has a longer shelf life and can be transported by sea to far markets, improving marketability and providing better returns. To compete in the international market for frozen beef, Pakistan must comply with the quality and phytosanitary standards of importing countries. The FMD in Pakistan currently limits access to most global markets, but the government is undertaking vaccination programs and making an animal quarantine zone in Cholistan to address the issue.

Credit: Independent News Pakistan-WealthPk