INP-WealthPk

Uzair bin Farid

Pakistan needs to increase its tax-to-GDP ratio up to 18% to achieve and sustain growth of 7%-8%.

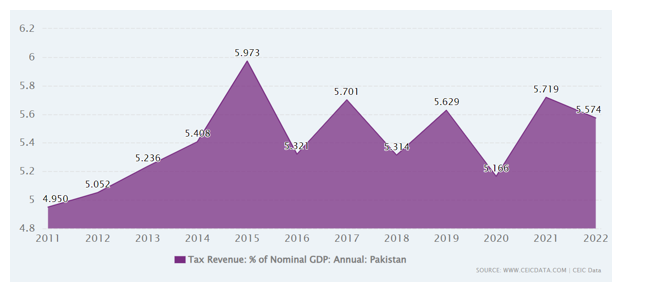

According to data available with WealthPK, Pakistan’s tax-to-GDP ratio averaged around 4.6% from December 2000 to December 2022, which is way lower than the Organisation for Economic Co-operation and Development (OECD) average.

In December 2022, Pakistan’s tax-to-GDP ratio was reported to be 5.6%, which is not enough to support the expansionary policies of the government to spur growth. The country’s tax burden needs to be shared by all the sectors of the economy so that no one sector is overburdened. It is only through a concerted effort to share the burden of taxation that the government can hope to achieve additional 3%-4% increase in tax-to-GDP ratio in the short-run and 6% in the long-run. However, if Pakistan wants to achieve growth of 7%-8%, and wishes to sustain them till 2035 to achieve the saturation of capital, it will have to increase its tax-to-GDP ratio up to 18%.

Pakistan’s tax revenue: % of GDP from 2011 to 2022

Similarly, to continue the process of return-benefits, Pakistan will have to keep the investment levels in the range of 22-25% of GDP. The main thrust for such a level of investment will come from domestic savings which need to be mobilised to levels that promise healthy returns in competitive sectors of the global economy. Additionally, Pakistan needs to bring down the inflation level in single digit as high prices eat away the savings capacity of the people. This prevents them from investing in high-value, high-risk and high-return ventures and consequently the growth slows down. A high level of exports-to-GDP ratio is also needed to achieve GDP growth. Investment is also financed using the inflow of foreign savings. Over the past four years, the average inflow of foreign savings in the country stood at around 1.3% of GDP.

To sustain the 8% growth level, however, the country needs to increase the level of incoming foreign savings to 2.7% of GDP until the year 2035. Individual and domestic savings are not enough to support mega projects that have national level significance. These projects are supported using big money from multilateral sources like the World Bank, Asian Development Bank, or the China International Capital Corporation. An all-encompassing, concerted effort by the government and the private sectors of the country will be required to bring the necessary reforms in the structure of incentives and returns and to expand the net of taxation. It is only through mobilisation of all the resources and policies that the government can hope to achieve high levels of growth.

Credit: INP-WealthPk