INP-WealthPk

Azeem Ahmed Khan

The Pakistan Footwear Manufacturers Association (PFMA) is determined to achieve the $1 billion export target by increasing production and gaining greater market share over the next four years, reports WealthPK. Currently, high-quality footwear is exported to over 60 countries, with Europe and the United States being the primary destinations. “Pakistan’s footwear industry has experienced increasing exports over the past five years, generating $160 million during the first 11 months of the Fiscal Year 2022-23,” Secretary General PFMA Ahmad Fawad Farooq told WealthPK. The footwear industry has been actively engaged in the export sector for over three decades, and many international brands have chosen Pakistan as their manufacturing base, he said.

When asked about the strategy to achieve the $1 billion export target by 2027, Fawad mentioned a shift in the global footwear manufacturing sector away from China and Vietnam to other countries. He also highlighted that many international brands had visited Pakistan for potential collaborations. Pakistan’s advantages include low labour cost, abundant supply of quality leather, and supportive government that offers attractive rebates and incentives to exporters. The government has also eliminated import duties on the basic raw materials. Although China will remain the world’s leading footwear supplier in the coming years, it has been experiencing a steady decline in footwear exports since 2010 due to higher labour costs.

Pakistan aims to capture a portion of China’s lost market share and increase its global footprint. Additionally, the Special Economic Zones (SEZs) in Pakistan established under the CPEC project have attracted international investors and joint venture partners. These SEZs offer a 10-year tax holiday, thus further incentivizing the industry setup and optimizing production. The local footwear industry is growing rapidly, with exporters operating at full production capacity. Fawad noted that many companies were already booked with international orders, and both existing and new players were expanding their industry lines. With the serious commitment of the government and the industry’s growth potential, Fawad believes Pakistan can surpass the $1 billion export target by 2027. In terms of the industry’s growth trend over the past four years, Fawad highlighted a reduction in reliance on international products, resulting in a significant decrease in footwear imports.

Previously, Pakistan imported 30 million pairs of footwear, whereas now it imports only around 7 million pairs, as the remaining 23 million pairs are being manufactured domestically. Pakistan boasts the best processed leather globally, and its tanneries meet the standards set by the International Organisation for Standardisation (ISOs), European countries, and the Leather Working Group (LWG). The country has gold- and platinum-rated leather manufacturers, bringing it on par with the tanners worldwide. The Pakistani footwear manufacturers have hired technicians from Italy, Brazil, and China, thus further enhancing the quality of their products. As a result, Pakistan’s footwear is considered among the best in the world. Regarding the footwear design, Fawad said the industry had its own design departments.

He said the PFMA had established the Pakistan Shoe Design Hub (PSDH) in collaboration with the Punjab government, the World Bank, and the United Nations Industrial Development Organisation (UNIDO). The PSDH conducts regular courses on computer-aided footwear design, utilising the advanced technology such as 3D scanners, printers, digitizers, oscillating knife cutters, and plotters. Additionally, institutions like the Pakistan Institute of Fashion and Design, Lahore, offer a bachelor of design degree in leather accessories and footwear. Since its inception in 1985, the PFMA has been dedicated to promoting and enhancing the growth and development of the footwear industry. Currently, the Association has around 170 footwear factory owners as members.

Fawad was also a keynote speaker recently at an International Summit on Consumer Trends in Italy, where he interacted with the international companies expressing interest in manufacturing in Pakistan. Currently, approximately 80 percent of the documented footwear industry is concentrated in and around Lahore due to the availability of skilled labour and other necessary resources. The supporting institutes required for skill development are also located in close proximity to Lahore. Leading multinational footwear companies like Bata Shoes and Servis Industries Limited have established factories in Lahore. The footwear sector in Pakistan is predominantly an unorganized sector, with cobblers representing the majority of footwear manufacturers.

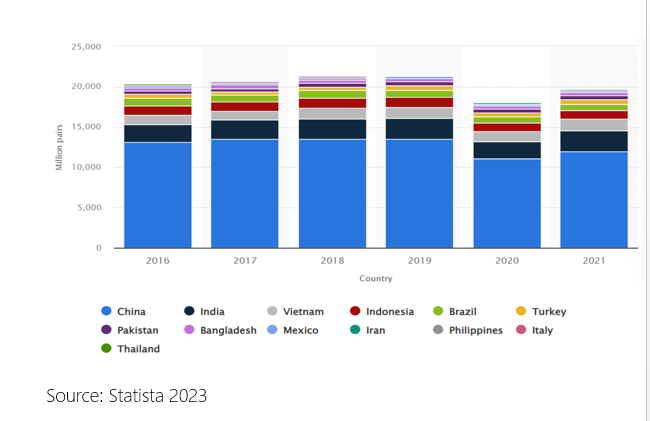

The cottage industry primarily caters to the domestic demand, while the organised industry has the potential to explore the global markets. Nevertheless, the PFMA extends support to the cottage industry as well. Pakistan ranks as the seventh-largest producer of footwear globally, contributing over two percent to the worldwide production. However, footwear exports currently account for less than one percent of Pakistan’s total exports. The following table shows the top 10 global footwear producers (in million pairs) from 2016 to 2021.

According to Statista, China, India, Vietnam, and Indonesia are leaders in footwear production, collectively representing over 75 percent of global production as of 2021. China produced 12,016 million pairs, India 2,600 million, Vietnam 1,360 million, Indonesia 1,083 million, Brazil 806 million, Turkey 547 million, Pakistan 513 million, Bangladesh 401 million, Mexico 191 million and the Philippines 188 million pairs. So, if Pakistan aims to increase its market share and make a significant contribution to its total exports, it will have to compete with these footwear manufacturing countries.

Credit: INP-WealthPk