INP-WealthPk

Uzair bin Farid

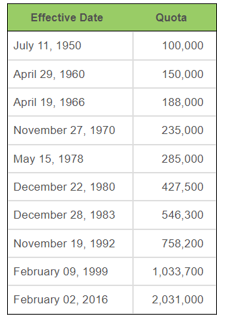

Pakistan has exceeded its Special Drawing Rights (SDR) quota with the International Monetary Fund (IMF) in the new Stand-by Agreement (SBA) at the staff level. Pakistan’s current level of SDR quota with the IMF stands at SDR 2,031 million. The new SBA with the IMF will provide Pakistan with financial assistance worth SDR 2,250 million, which is equivalent to $3 billion and amounts to 111% of Pakistan’s IMF drawing quota.

SDRs are an international reserve asset created by the IMF to provide liquidity to the global economic system in times of economic crunch. They are not a currency, but rather part of a process through which the IMF member countries have access to unconditional liquidity. They are distributed to the member countries through a process called ‘General Allocation,’ which is decided by the IMF Board of Governors with 85% of the total voting power in favour of the decision.

Member countries of the IMF can exchange their SDRs with other member countries and prescribed holders to get access to ‘freely usable currencies.’ The payment on SDRs is made through interest determination and if a country loses its SDR holdings below the allocated amount, it incurs interest payment to the country that provides it with additional SDRs.

In Pakistan’s case, the allocated amount of SDRs by the IMF is 2,031 million whereas its current rate of borrowing has increased its SDR allocation to 2,250 million. This means that Pakistan will have to pay interest rate on its SDRs to the countries who will contribute to easing the liquidity stress on Pakistan’s external sector.

Pakistan’s SDR quota in thousands

In its press release announcing the SBA with Pakistan, the IMF said that Pakistan needs to remain ‘steadfast’ in its policy implementation of the reforms needed to bring the economy around from the brink of collapse.

The reforms and policy interventions needed by Pakistan to turn around its economy include stringent fiscal discipline to save resources, market determination of the exchange rate to be able to absorb external shocks, deregulation of the import regime to make it market competitive in the global markets, efforts to increase government revenue, and the plugging of holes in the loss-making entities of government to prevent the drainage of resources, especially in the power sector.

Nathan Porter, who led the IMF staff team to negotiate the terms of the new SBA with the government of Pakistan, said that the 2022 catastrophic floods impacted the lives of millions of Pakistanis.

He further referred to a hike in the prices of commodities in the international market, and said that because of the foregoing reasons, inflation in Pakistan continued to climb despite measures by the government to tame it. Similarly, policy decisions by the Government of Pakistan led to deterioration of the market outcomes as forex reserves continued to dwindle despite efforts by the State Bank of Pakistan (SBP) to curb imports and reduce the trade deficit.

Circular debt or arrears in different sectors of the economy also remain a concerning issue for the IMF as these and other loss-making entities are a continual drain on the already limited revenue of the federal government. The IMF has agreed to provide Pakistan with the needed funds in foreign exchange to avoid a sovereign default, which has become a distinct possibility over the past few weeks.

Credit: INP-WealthPk