INP-WealthPk

Jawad Ahmed

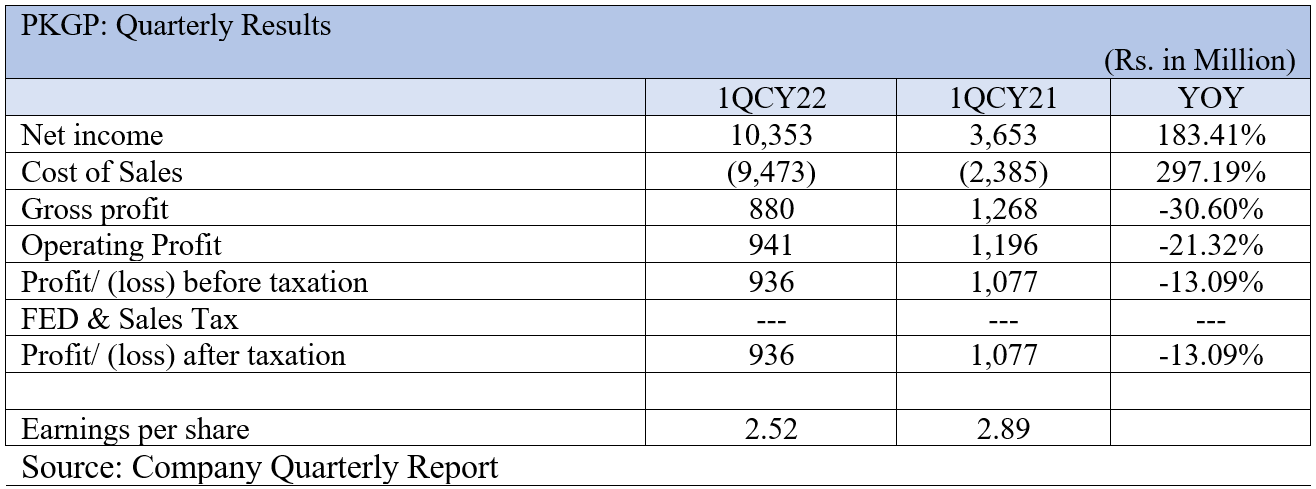

The revenues of Pakgen Power Limited – the electricity generation and distribution company – increased by 183% in the first quarter of the calendar year (January-March) 2022 to Rs10.353 billion from Rs3.653 million in the same period last year, according to the latest financials filed with the stock exchange.

Despite healthy growth in the top-line, skyrocketing prices of raw materials and increasing cost of sale continued to reduce margins.

This caused the profit-after-tax to fall 13.09% to Rs936 million from Rs1.077 billion in the same period of last year, reports WealthPK, quoting the company’s financial stats.

Historical Performance

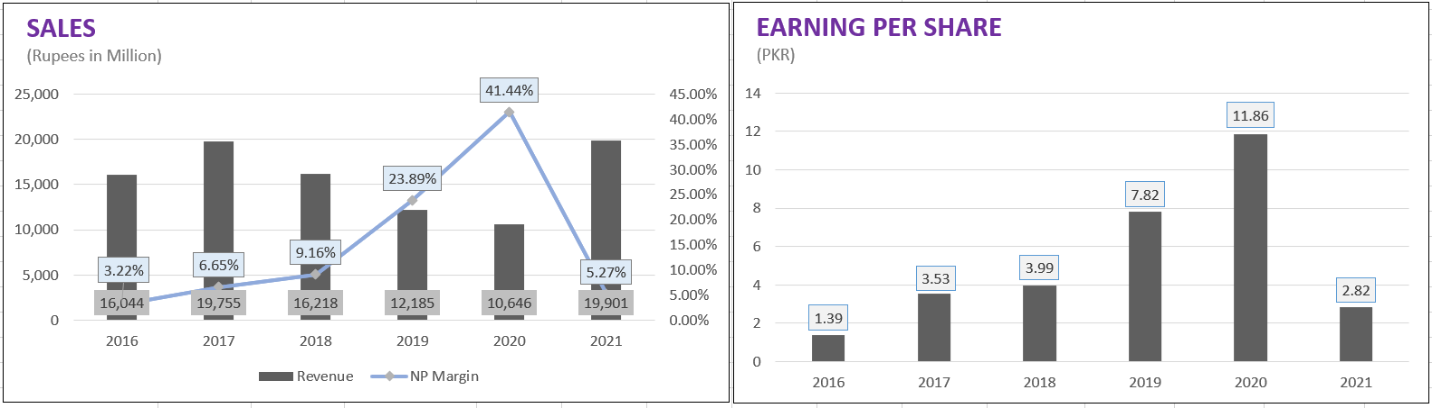

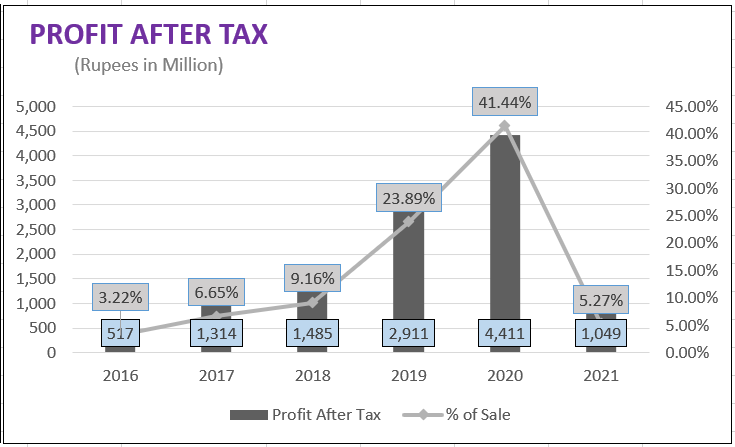

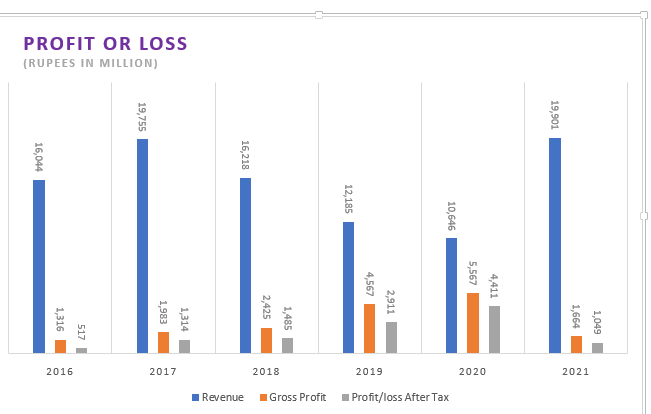

In 2018, the company achieved sales of Rs16.218 billion, which was 17.9% lower than the previous year’s sales of Rs19.755 billion.

Gross profit grew by 22.3% to Rs2.426 billion compared to Rs1.983 billion last year, and profit-after-tax registered a growth of 13% to Rs1.485 billion compared to Rs1.314 billion in 2017.

The earnings per share (EPS) was recorded at Rs3.99 in 2018 compared to Rs3.53 in 2017

In 2019, the total sales revenue of the company decreased to Rs12.185 billion from Rs16.218 billion the previous year.

The gross profit, however, increased by 88.2% to Rs4.567 billion from Rs2.426 billion in 2018.

The company also earned a net profit of Rs2.911 billion compared to a net profit of Rs1.485 billion the previous year. This growth in profit jacked up the EPS to Rs7.82.

The major reason for the increase in net profit was the decrease in delta loss by Rs420 million and higher revenue of capacity payment price by Rs1.058 billion due to devaluation of the rupee against the US dollar.

During the year 2020, the total sales revenue of the company further pushed down to Rs10.646 billion from Rs12.185 billion a year ago. However, the operating cost dropped to Rs5.078 billion, which resulted in 22% increase in gross profit, taking it to Rs5.567 billion from the last year’s Rs4.567 billion.

The company earned a net profit of Rs4.411 billion compared to a net profit of Rs2.911 billion last year. EPS further cranked up to Rs11.86 in 2020 from Rs7.82 in 2019.

However, in 2021, the company saw sales revenue grow by 87% to Rs19.901 billion from Rs10.646 billion a year ago. Despite the topline growth, the year remained extremely challenging with respect to financial performance.

Gross profit declined to Rs1.664 billion as compared to last year’s Rs5.567 billion. The company’s net profit also dropped to Rs1.049 billion from Rs4.411 billion the previous year.

The major reason for the decrease in profit was non-issuance of Capacity Purchase Price (PPA) invoices amounting to Rs2.429 billion from May 2021 to October 2021, pursuant to PPA Amendment Agreement with Central Power Purchasing Agency.

Moreover, the company had started giving tariff discounts, which reduced its net profit.

Credit: Independent News Pakistan-WealthPak